Over the last several weeks, Hedera’s (HBAR) price has been holding steady, registering a slight 3.8% gain in the past week. The token is working hard to keep its market value above $11.5 billion as the overall market trend appears to be slowing down.

As HBAR continues its upward trajectory, ambiguous signs from various technical markers hint at the possibility of further gains or a possible downturn. Investors are keeping a close eye on whether HBAR manages to surpass crucial resistance points or instead approaches critical support thresholds.

Hedera Remains in an Uptrend, but a Shift May Be Near

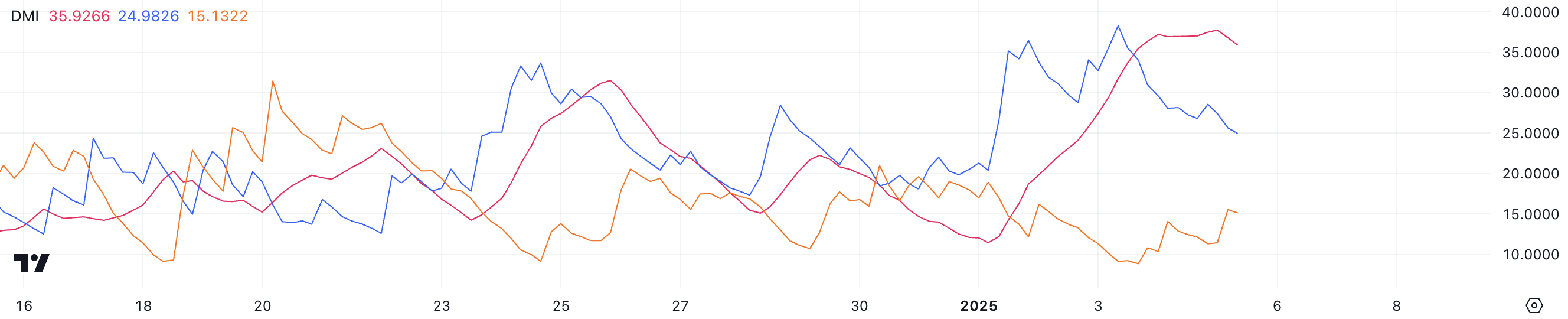

Currently, the Average Directional Index (ADX) for Hedera stands at 35.9, demonstrating a robust trend strength. However, it has slightly decreased from its previous reading of 37.7 just a few hours ago. The ADX gauges the intensity of a trend’s direction, ranging from 0 to 100. A value above 25 signifies a strong trend, while values below 20 suggest weak or non-existent momentum.

Based on the current trend, it appears that the HBAR price is continuing its robust upward trajectory. However, a decrease in ADX indicates that the momentum might be starting to slow down slightly, suggesting a possible relaxation in the strength of this uptrend.

The directional indicators offer extra information. Currently, the +DI stands at 24.9, which is lower than its value of 38.2 two days back, suggesting a decrease in buying pressure. Conversely, the -DI has risen from 9.1 to 15.1 over the same period, implying an increase in selling pressure. This suggests that although buying pressure still holds dominance, it has noticeably weakened, and selling pressure is starting to pick up.

If the current pattern persists, the upward momentum might weaken. It’s possible that HBAR will move into a period of little to no price change (consolidation), or potentially even experience a decline, unless increased purchasing interest significantly boosts the Positive Directional Indicator (+DI) and reinforces the Average Directional Index (ADX).

HBAR Ichimoku Cloud Shows Mixed Signs

As a crypto investor, I’m closely watching the Ichimoku Cloud chart for Hedera, and it’s showing a somewhat ambiguous picture right now. At the moment, the price is hovering close to the red cloud, which indicates a phase of uncertainty as the market grapples with finding a clear direction.

Looking at the green mass in front, it appears there could be an increase in buying pressure (bullish momentum). However, since the price is hovering close to the red mass, we need more evidence to firmly establish an upward trend.

As the Tenkan-sen, represented by a blue line, is sloping downwards and getting nearer to the Kijun-sen, or orange line, it suggests that the short-term price movement is becoming less strong.

To rebound and resume its upward trend, HBAR should convincingly rise above the cloud and hold its ground. On the flip side, if the price falls beneath the cloud, it might indicate a change in market sentiment towards bears, possibly resulting in additional drops.

HBAR Price Prediction: Will Hedera Fall Back to $0.23 In January?

Right now, the price of HBAR is holding steady within a range that spans from a significant support at roughly $0.274 to a strong resistance at approximately $0.311. A golden cross occurred a few days back, but so far, the HBAR price has failed to surpass the resistance near $0.32.

Should the current upward trend grow stronger and manage to surpass the $0.311 barrier as a hurdle, Hedera might experience additional upward push, possibly challenging the next resistance level at $0.338.

If the support at $0.274 doesn’t maintain its strength, there’s a possibility that the current upward trend could flip into a downward one. In this case, the HBAR price might encounter increased selling, potentially causing it to drop and challenge the next support level at $0.233.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-06 01:34