Hedera, the darling of the crypto world, has been hemorrhaging funds like a Victorian aristocrat after a bad investment in railroads. Over the past week, the spot market has seen a steady exodus of capital, as if the investors had suddenly remembered they had better things to do with their money.

The selling pressure has been relentless, like a pack of hungry wolves circling a wounded deer. The once-mighty altcoin now clings precariously to the $0.20 support level, a figure that seems more like a cruel joke than a lifeline.

Hedera Outflows: A Comedy of Errors

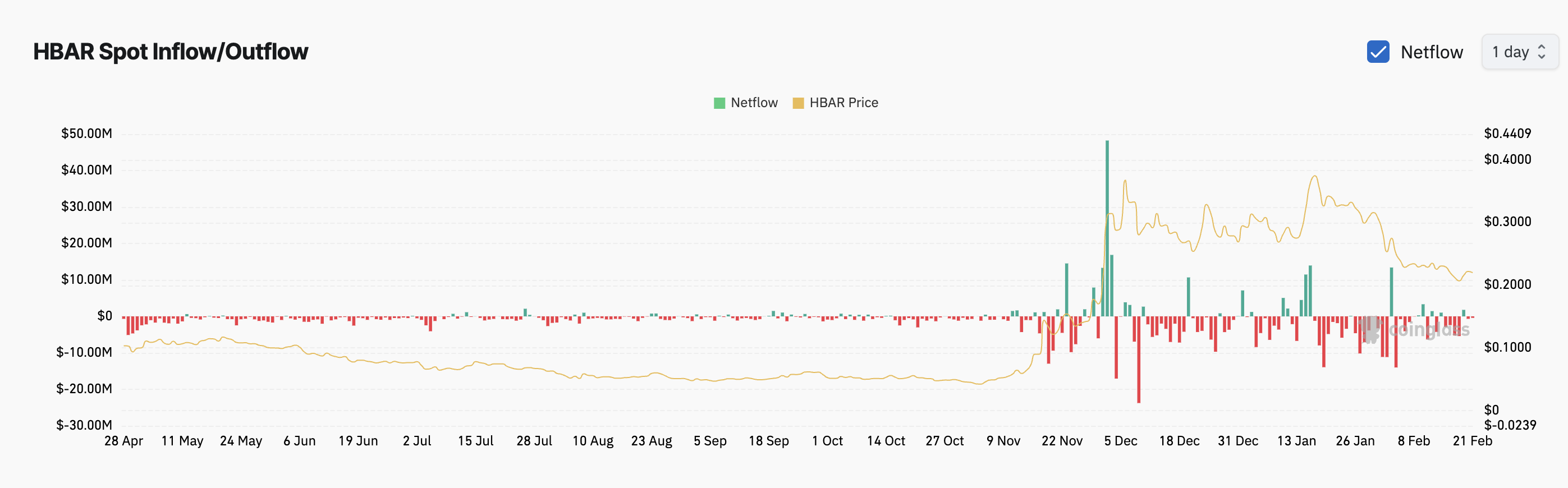

In the last seven days, HBAR spot markets have seen over $17 million vanish into thin air, as if the investors had collectively decided to take up magic. The only inflow during this period was a paltry $1.78 million on January 19, a sum so insignificant it might as well have been a rounding error.

Spot outflows, for the uninitiated, occur when investors decide to pull their capital from the spot markets, usually by selling their holdings and fleeing to greener pastures. This is a clear sign of weakening demand and increased selling pressure, which can send the asset’s price tumbling faster than a drunkard down a flight of stairs.

HBAR’s consistent outflows suggest a bearish market sentiment, as if the traders had all simultaneously decided to take up knitting instead. The token’s negative weighted sentiment, as measured by Santiment, only confirms this grim outlook. The on-chain metric, which analyzes social media and online platforms to gauge the overall tone surrounding a cryptocurrency, has returned only negative values all week. It’s as if the entire internet had collectively decided to throw a pity party for HBAR.

As of this writing, the token’s weighted sentiment is -0.61, a figure so dismal it might as well be written in Comic Sans. When this metric’s value is negative, it indicates that the overall market sentiment regarding the asset is bearish, with more negative discussions and outlooks outweighing positive ones. It’s like the entire crypto community has decided to give HBAR the cold shoulder, leaving it to shiver in the corner.

HBAR Bears: Masters of the Universe

BeInCrypto’s assessment of HBAR’s performance on the daily chart reveals a tale of woe and despair. Since reaching a four-year high of $0.40 on January 17, the token has been trending below a descending trend line, like a ship slowly sinking into the abyss. Exchanging hands at $0.21 at press time, the token’s value has since plummeted by 48%, a figure so staggering it might as well be accompanied by a sad trombone sound effect.

When an asset trades below a descending trend line, it indicates a sustained downtrend, where selling pressure consistently exceeds buying activity. It’s as if the bears have taken control of the market, gleefully pushing the price lower with each passing day. If this struggle continues, HBAR’s price could drop below the $0.20 price zone to trade at $0.17, a figure so low it might as well be written in invisible ink.

On the other hand, a resurgence in demand could invalidate this bearish projection. If that happens, HBAR’s price could break above the descending trend line and climb to $0.26, a figure so optimistic it might as well be accompanied by a choir of angels. But let’s not hold our breath, shall we? 😏

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-21 12:20