As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of price surges and market trends. The recent 41% spike in HBAR, the native cryptocurrency of the Hedera Hashgraph network, has piqued my interest. This is especially true given that it’s been two years since HBAR last traded above the $0.20 psychological barrier.

The digital currency called HBAR, which is used on the Hedera Hashgraph platform, has experienced a surge of approximately 41% within the last day. At present, it is being traded at around $0.24, marking the first time in two years that it has surpassed the significant price level of $0.20.

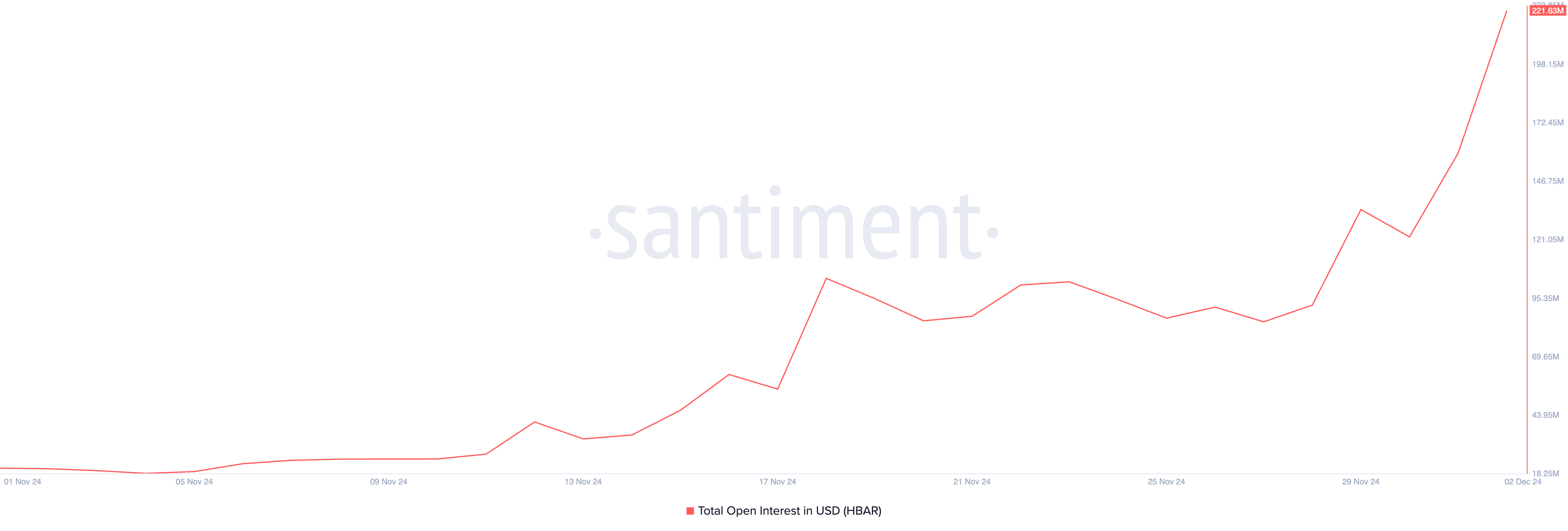

The significant increase in this product’s price beyond the teen range has triggered a rise in trading in its related markets, as indicated by the skyrocketing number of active contracts (open interest), currently reaching a record peak.

Hedera Is the Talk of the Town

Recently, there’s been a lot of excitement surrounding Hedera, with its token gaining attention. The recent rise in the price of HBAR tokens can largely be explained by increasing whispers about a possible partnership between Ripple and Hedera, focusing on establishing a global settlement standard. Ripple intends to extend its RLUSD stablecoin to their network as part of its growth strategy.

Furthermore, Canary Capital, a company specializing in cryptocurrency investments, has put forward a plan to the Securities and Exchange Commission (SEC) for establishing the first Hedera HBAR spot exchange-traded fund (ETF). If accepted, this ETF would grant institutional investors the opportunity to invest directly in the HBAR token.

The recent advancements have sparked intrigue in the market, evident in the significant increase in HBAR’s open interest. Currently, it stands at approximately $222 million, marking a rise of more than 1000% over the last 30 days.

In simpler terms, “Open Interest” is the sum of all unresolved contracts or positions for a specific asset like futures or options. An increase in Open Interest during a price surge implies that more people are entering into fresh contracts, demonstrating high levels of market involvement and faith in the ongoing price trend.

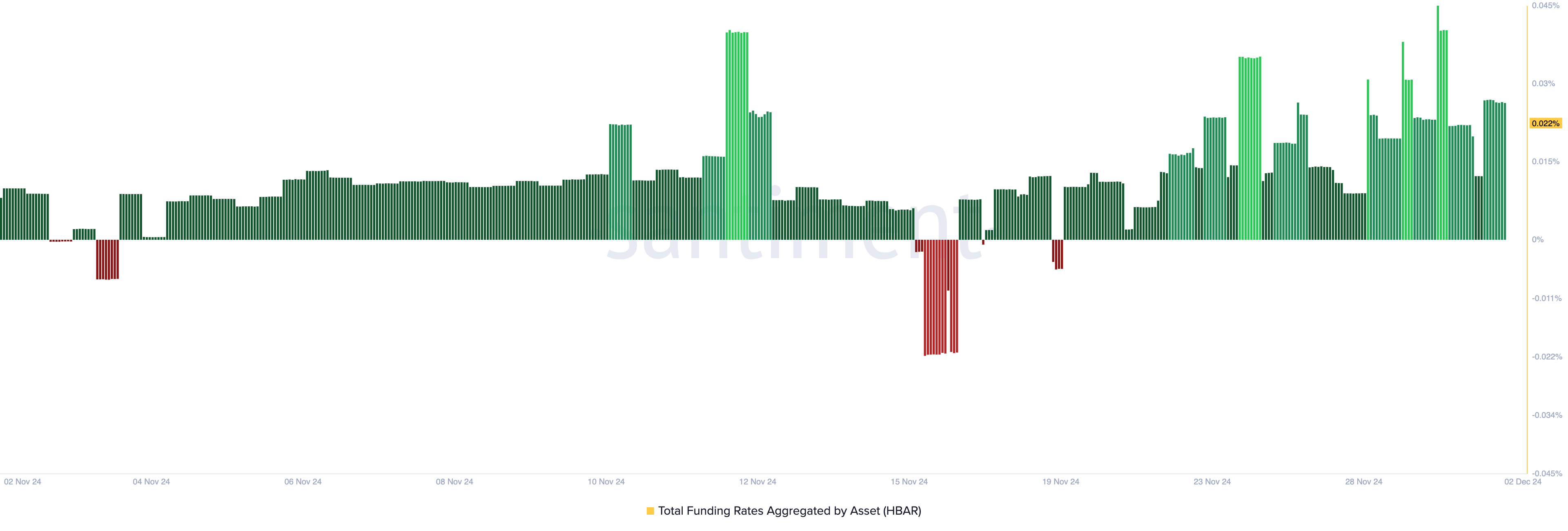

HBAR’s positive funding rate further supports its bullish outlook, currently standing at 0.022%.

In simpler terms, the funding rate is a periodic payment made between parties holding long (expecting price to rise) and short (expecting price to fall) positions in perpetual contracts. This fee helps ensure that the contract’s price stays close to the asset’s current market value (spot price). When the funding rate is positive, it means long positions are paying out to short positions, signaling a bullish attitude among traders because more of them anticipate the price will go up.

HBAR Price Prediction: There Is Room for More Growth

On a daily scale, the Super Trend indicator for HBAR suggests a possible prolonged upward trend might be in progress. At this moment, the price is positioned above the green line of the indicator, indicating increasing buying strength.

The Super Trend indicator tracks the direction and strength of a price trend, appearing as a line on the chart. Green denotes an uptrend, while red indicates a downtrend. If the uptrend continues, HBAR’s price could reach $0.30.

On the other hand, if the positive trend weakens, it could lead to a drop down to $0.15, contradicting this optimistic forecast.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-12-02 14:07