Recent price action signals a shift in sentiment, supported by technical confirmation and consistent network engagement. With growing volume and momentum, HBAR appears to be positioning for a potential move toward the $0.35 level. Market data and analyst insights suggest a bullish structure may be taking shape.

HBAR Gains Traction Amid Breakout From Key Technical Structure

HBAR’s daily chart presents a decisive breakout from a multi-month falling wedge formation. This pattern, historically known for signaling bullish reversals, has unfolded with increasing volume, a metric closely watched to validate price direction.

The breakout occurred above the $0.23 mark and has propelled price movement into a new range. According to analyst Dalin Anderson (@HighAltitudeInv), this structure was confirmed with strong market conviction, and the rally appears to be gaining traction.

Additional momentum stems from the presence of a bullish divergence on the MACD indicator. While price action was forming lower lows in previous sessions, the MACD line and histogram were trending upward, indicating diminishing bearish pressure.

Following this signal, HBAR’s MACD line has crossed above the signal line, while histogram bars have turned positive, reflecting accelerating bullish momentum. These indicators suggest that price is entering a new phase, possibly setting the stage for a broader trend reversal above the $0.30 mark.

HBAR Market Fundamentals Show Strength Amid Growing Trading Volume

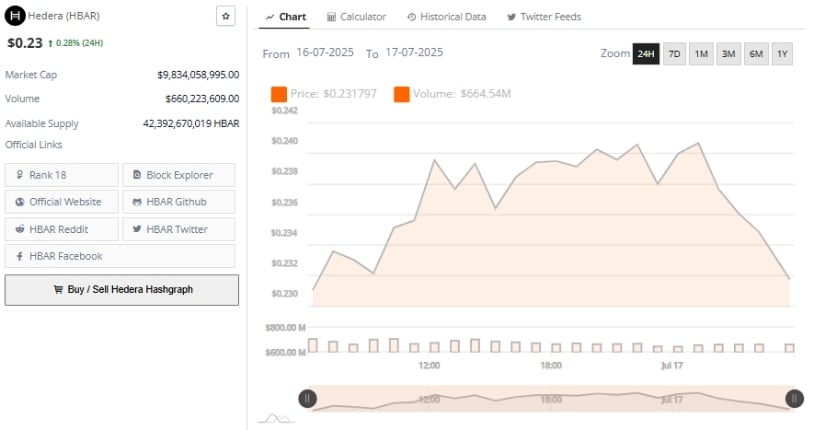

At the time of writing, HBAR is trading at $0.23, registering a minor 0.28% daily gain. The token currently ranks #18 by market capitalization, with a total cap of $9.83 billion. It maintains a circulating supply of 42.39 billion tokens, contributing to its deep liquidity and accessibility across major exchanges.

While short-term price movement has been moderate, the underlying fundamentals reflect sustained confidence from both retail and institutional participants.

Trading volume over the last 24 hours stands at approximately $660 million, suggesting active market participation. This volume equates to roughly 7% of the token’s market cap, pointing to possible accumulation during this consolidation phase.

If volume remains elevated in the coming sessions, this could strengthen the breakout structure and support HBAR’s approach toward higher resistance zones, particularly around the $0.28 to $0.35 levels. Market observers continue to monitor whether this momentum can extend further.

Technical Indicators Signal Shift as Bollinger Band Expansion Supports Momentum

The daily chart from TradingView highlights that HBAR recently broke above the basis line of the Bollinger Bands in early July, a key signal of momentum acceleration. This breakout occurred as the price surged above both the middle and upper bands, pushing volatility higher.

The move peaked around $0.35 before a minor retracement brought the price to $0.231. Despite the pullback, the price remains well above the 20-day simple moving average, suggesting the broader uptrend is intact.

At the time of writing, the Bollinger Band Power (BBP) indicator is reading 0.05728, reflecting a significant increase in price volatility. BBP had been negative during prior weeks, indicating subdued price activity.

The current shift into positive territory aligns with the breakout and signals a change in momentum strength. However, as price now tests the upper band, near-term consolidation may occur before a renewed push. Provided support between $0.20 and $0.22 holds, HBAR may continue its upward trajectory, with $0.35 as a primary upside target.

So, will HBAR hit $0.35 or fizzle out? Only time will tell, but one thing’s for sure: the crypto world is watching with bated breath! 🤑🚀

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-17 22:34