As a seasoned analyst with years of market observation under my belt, I must admit that HBAR‘s recent performance has left me scratching my head. The struggles this asset has faced over the past month are reminiscent of a rollercoaster ride without the thrill – just the stomach-churning drops.

The declining Open Interest and reduced trader activity are red flags that cannot be ignored, suggesting a bearish trend that’s as relentless as a winter storm in the Midwest. The prolonged consolidation period is like a stale popcorn bag at a movie theater – empty promises with no satisfying end.

Looking at the technical indicators, the MACD’s renewed bearish momentum is as comforting as a cold shower on a frosty morning. It’s clear that HBAR needs a hot cup of coffee, or perhaps a strong catalyst, to shake off this chill.

However, all hope is not lost. If HBAR can manage to break above the consolidation range, it might just have a shot at posting a new ATH and restoring market confidence. But that’s like asking Santa for world peace – possible, but highly unlikely without some serious effort.

In the immortal words of Yogi Berra, “It’s tough to make predictions, especially about the future.” And as we look forward to January 2025, I can only hope that HBAR will surprise us all with a performance worthy of a standing ovation. Until then, we’ll just have to keep our popcorn bags crossed!

Hedera Hashgraph’s (HBAR) progress has been sluggish lately, showing a mostly bearish-neutral trajectory in the last month. Although HBAR holds great promise, it has struggled to gather momentum because of waning investor excitement in the market.

It seems that even long-term HBAR supporters are showing signs of decreased commitment, perhaps due to the influence of current market conditions on investors’ optimism.

HBAR Traders Are Disappointed

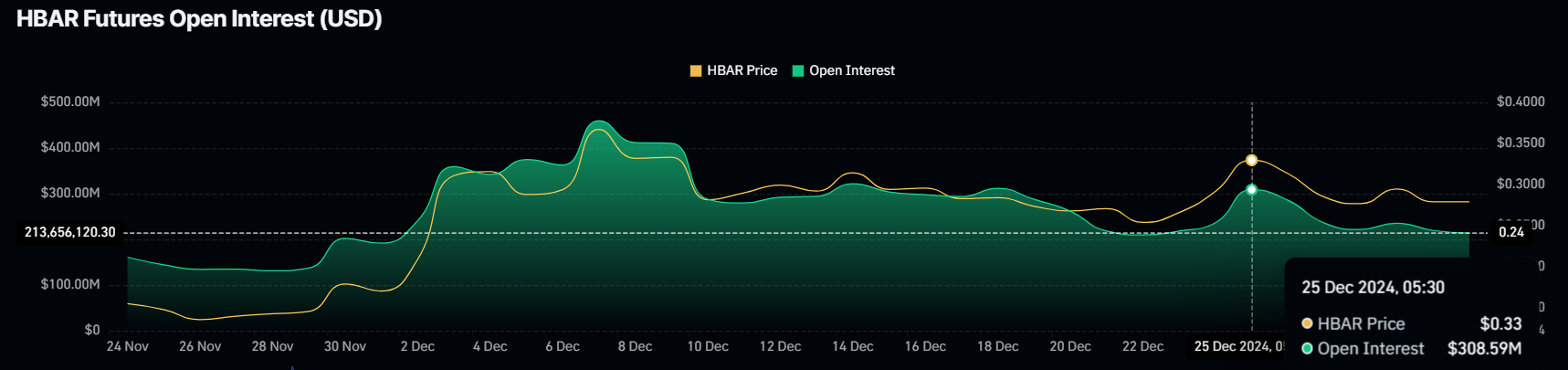

As someone who has been actively trading cryptocurrencies for several years now, I have noticed that the recent drop of $95 million in HBAR’s Open Interest over just six days is quite significant and concerning. In my experience, such a notable decline in trader activity often indicates that traders are withdrawing their funds from the asset, which can lead to reduced liquidity and lower trading volumes. This prolonged consolidation period has left me feeling uneasy, as it seems to be eroding confidence within the HBAR market. The bearish sentiment across the market is hard to ignore, and I am starting to question whether this could be a sign of a larger downward trend for HBAR. However, I always remind myself to stay patient and cautious when making investment decisions in the volatile world of cryptocurrencies.

Due to a prolonged period with no significant price changes, traders are scaling back their involvement because the hope for quick profits is fading. This change in opinion is adding more downward pressure, making it difficult for HBAR to gather the momentum required for a rebound. The asset continues to be trapped in a loop of doubt and instability.

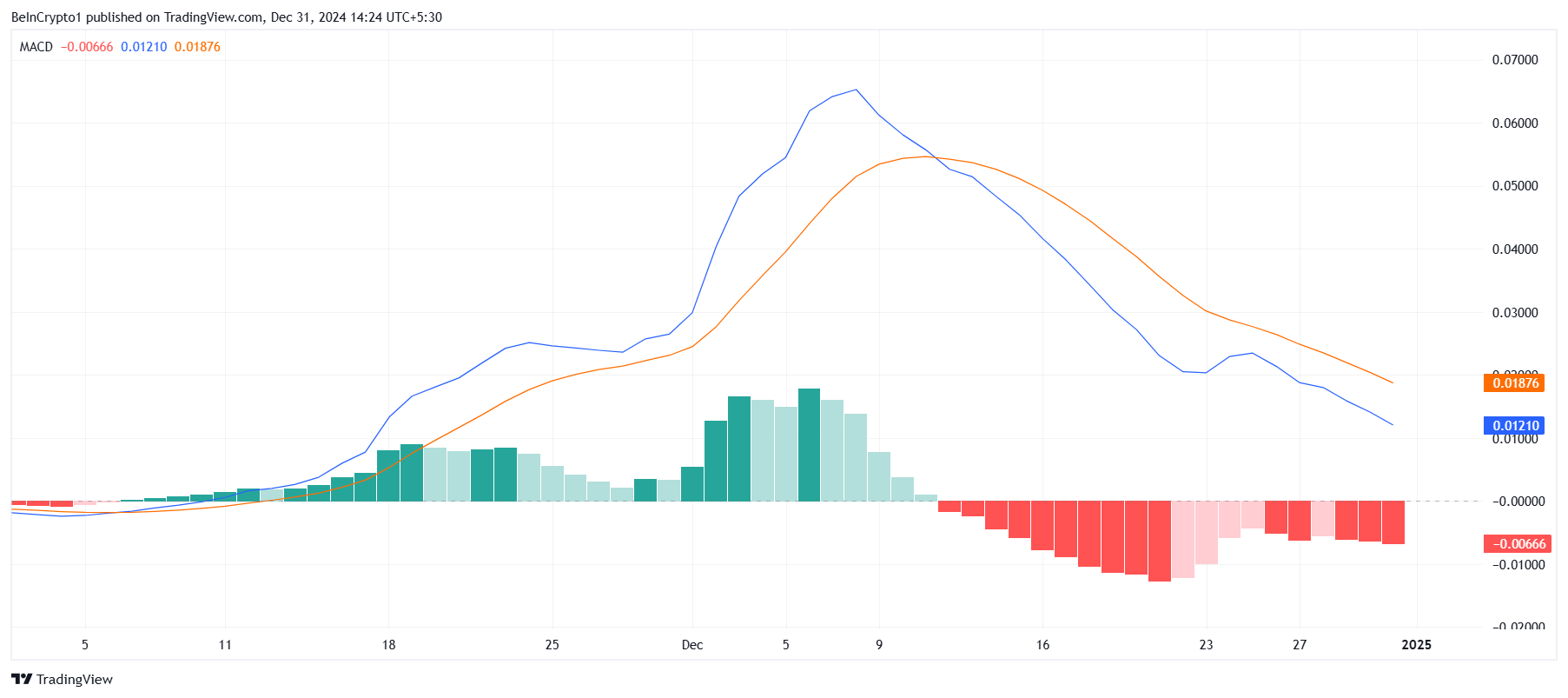

In simpler terms, the technical charts suggest a concerning trend for HBAR’s overall market movement. The Moving Average Convergence Divergence (MACD) indicator is hinting at a build-up of bearish momentum following a short pause, which typically means increased selling activity. This development might lead to a faster downward trend, making it harder for HBAR to break free from its current price range.

The bearish divergence is troubling because it should have slowed down, but instead, it’s picking up speed. This increased momentum implies that HBAR’s price might continue to struggle unless strong positive factors (bullish catalysts) appear soon. If there isn’t a change in the broader market conditions, the cryptocurrency could encounter more challenges in the upcoming months.

HBAR Price Prediction: Arranging A Breakout

As a researcher, I’ve observed that HBAR has been trapped within the narrow band of $0.39 to $0.25 for over a month now, striving to break free from this confined range. Currently, the price is hovering around $0.27, with the all-time high of $0.57 still 109% above it. To achieve $0.57 and potentially establish a new all-time high, HBAR would necessitate a prolonged bullish surge reminiscent of its staggering 637% surge in November.

In January 2025, a rally of such scale seems improbable, but a decent push could still elevate HBAR. Yet, if HBAR fails to surpass $0.39, it may prolong the period of stability or even dip below $0.25, potentially reaching as low as $0.18.

Consequently, moving beyond the current price range between $0.25 and $0.39 is essential to start an upward trend and boost market trust. If HBAR performs as it did in November and sets a new all-time high, this would require favorable market circumstances and increased investor enthusiasm, which are currently unclear.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-31 13:50