As a seasoned crypto investor with a knack for spotting promising opportunities and a portfolio that has weathered numerous market cycles, I find myself intrigued by the recent surge in HBAR prices. With over a decade of experience under my belt, I’ve learned to read between the lines and interpret technical indicators effectively.

In the last 24 hours, the native cryptocurrency of Hedera Hashgraph, named HBAR, has experienced an 11% increase in value. This recent spike in price is due to a growing interest and demand for the token over the past few days.

As a crypto investor, I’ve noticed some promising signs pointing towards potential growth in HBAR. The technical analysis indicates that this cryptocurrency might see further upward momentum, making it crucial for token holders like myself to keep an eye on specific price points.

Hedera Token Holders Intensify Accumulation

Looking at HBAR’s day-to-day price movements, it’s clear that while there’s been a dip, the price line consistently hovers over the Super Trend line, serving as a robust, moving barrier at approximately $0.23, providing ongoing support.

The Super Trend tool monitors the movement and intensity of an asset’s price fluctuations. This information is presented visually on a graph by a line that adapts its color – green representing an upward trend, while red signifies a downward trend.

When an asset’s cost surpasses its Super Trend line, it suggests a strong upward trend or bullish movement in the market. In such situations, the Super Trend line functions as a flexible support level. As the asset’s price remains above this line, it indicates that the bullish momentum is likely to persist.

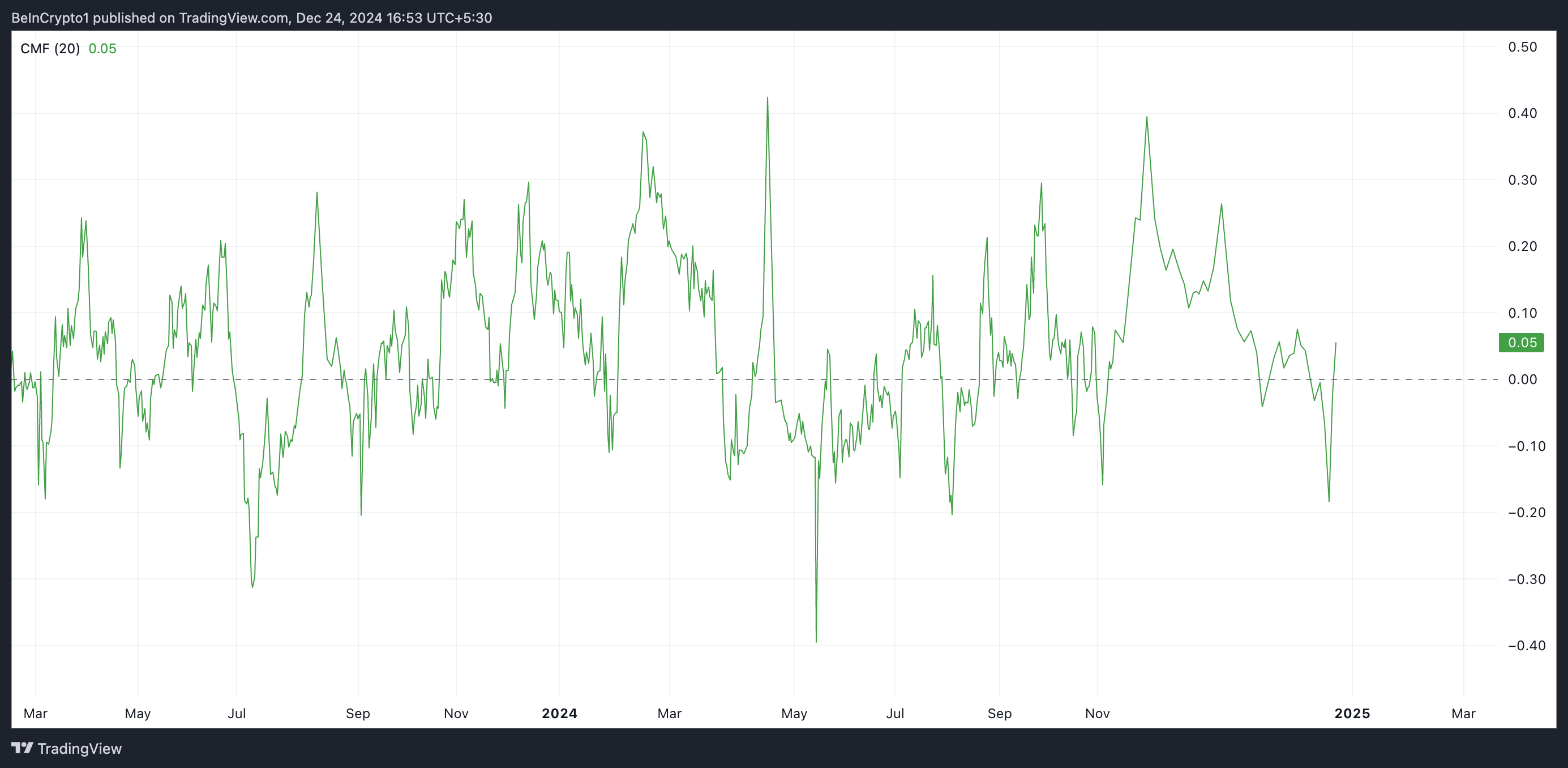

Additionally, the increasing Chaikin Money Flow (CMF) of HBAR suggests it could maintain an ongoing upward trend. Presently, its CMF stands at 0.05.

This metric tracks the movement of funds entering and leaving an asset’s market, such as HBAR. A positive value for HBAR during a price surge signifies robust buying interest, since more money is flowing into the asset than out. This implies that the upward trend may be backed by genuine accumulation, boosting the probability of a prolonged bull run.

HBAR Price Prediction: Bulls Eye $0.39 While Bears Target $0.24

Based on the prediction from its Fibonacci Retracement tool, if the accumulation continues, HBAR’s price could return to its three-year high of $0.39 and potentially exceed it. However, for this to occur, the previous high must be transformed into a strong support level.

Conversely, if there’s another wave of selling, the value of HBAR might lose some of its recent increases and move towards approximately $0.24. Dropping below this point could trigger a further drop, reaching the Super Trend’s dynamic support at around $0.23. If even that level can’t prevent it, the price of the HBAR token may slide down to around $0.16.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-25 01:23