As a seasoned crypto investor with a decade of experience navigating the volatile and unpredictable world of digital assets, I’ve seen my fair share of bull markets and bearish slumps. The current situation with HBAR leaves me cautiously optimistic, despite the stagnant price action and outflows that have been dominating the asset in recent times.

I remember the days when XRP was stuck in a similar range-bound behavior, only to skyrocket once broader market cues shifted favorably. HBAR’s current position above the neutral line on the RSI is reminiscent of those early days with XRP, offering a glimmer of hope that the same pattern could repeat itself.

However, I can’t help but feel a sense of deja vu when I see the Chaikin Money Flow (CMF) indicator signaling outflows. This trend reflects growing investor skepticism and has been a precursor to declines in other assets that I have followed closely over the years. It’s a reminder that complacency can be costly, and the ongoing outflows exhibit the need for stronger market participation to reverse the current sentiment and support a potential recovery.

That being said, I’ve learned to never underestimate the power of external factors in shaping the trajectory of an asset. A shift in broader macroeconomic conditions could provide the catalyst needed for HBAR to breach its resistance and regain upward momentum. As they say, hope springs eternal in the crypto world!

Jokingly, I can’t help but wonder if HBAR is just waiting for the right mix of market cues, investor sentiment, and a dash of luck to spark a “hashgraphic” rise. Time will tell whether this digital asset has what it takes to join the ranks of crypto’s biggest winners!

Over the past month, HBAR’s price movement has been sluggish, causing uncertainty among investors regarding its capacity for future growth.

Regardless of the current stagnation, broader indicators in the market still lean towards an optimistic perspective, potentially signaling a rise in prices soon.

Hedera Hashgraph Faces Outflows

Currently, the Chaikin Money Flow (CMF) for HBAR is located below the zero line, indicating that withdrawals are more frequent than deposits in this asset, which suggests increasing investor doubt. This pattern arises as many investors are withdrawing their funds because they see a lack of momentum that could trigger an increase in price. Such withdrawals typically decrease bullish enthusiasm and raise the possibility of a price decline.

Despite efforts by HBAR, investor uncertainty remains a substantial challenge. Should trust wane even more, there might be increased selling which could exacerbate downward trends. The consistent outflow of funds suggests a need for robust market involvement to change the current opinion and foster a potential resurgence.

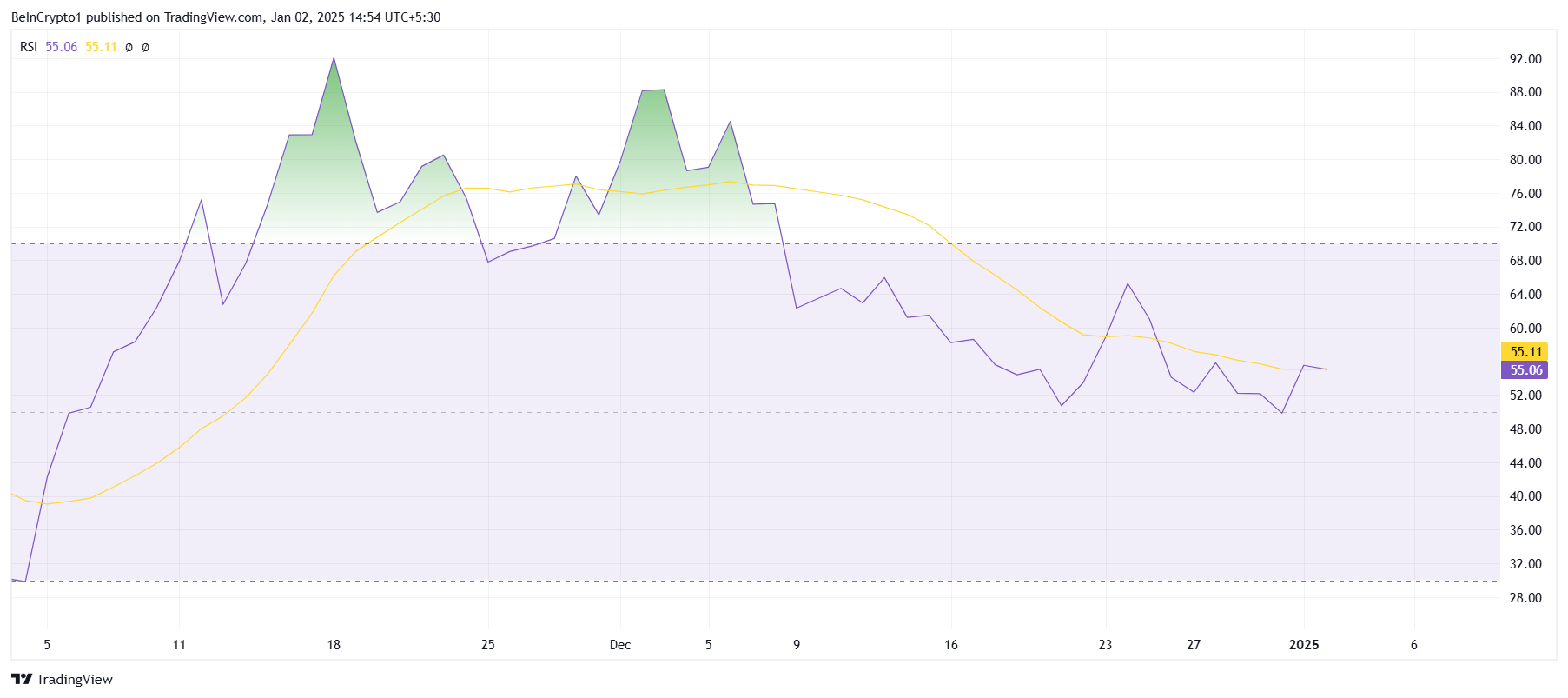

Even though there are difficulties, HBAR’s Relative Strength Index (RSI) continues to stay above the 50.0 neutral mark, implying that the overall market is offering some positive momentum for HBAR. This consistency in the RSI suggests that while HBAR encounters resistance, a total collapse might be prevented if market signals continue to be favorable.

The stance taken by RSI suggests that it’s plausible to keep up with the existing price ranges. However, broader economic factors might significantly influence if HBAR can continue its position and possibly rebound. Any changes in external circumstances could serve as the spark leading to a significant move.

HBAR Price Prediction: Breaking Resistances

As a seasoned cryptocurrency investor with years of experience under my belt, I’ve noticed that HBAR has been stuck in a narrow trading range between $0.39 and $0.25 for quite some time now. Throughout December, this altcoin has only managed to test the $0.39 resistance once, indicating that it lacks the sustained momentum required for a significant breakout. This sideways movement highlights the challenges HBAR faces in mounting a recovery. Based on my observations and market analysis, I believe that HBAR needs more bullish sentiment and positive developments to push its price beyond this range and potentially trigger a bull run. However, until then, I would advise caution for investors looking to invest in HBAR as the current market conditions do not seem favorable for a substantial price increase.

Based on my years of experience analyzing cryptocurrency markets, I believe HBAR is likely to stay in a holding pattern for now due to its current sentiment and technical factors. However, if bearish sentiments grow stronger, we might see a drop below the $0.25 support level. This could trigger further declines and dampen investor enthusiasm, which could potentially impact my own portfolio as well. It’s essential to keep a close eye on market trends and adjust investment strategies accordingly.

Instead of remaining stagnant, a significant increase in optimism (bullishness) due to overall financial market trends might enable HBAR to surpass the resistance at $0.39. This potential breakthrough would contradict the current bearish-neutral forecast and rekindle investor trust, paving the way for continued upward momentum. The upcoming weeks will play a crucial role in defining HBAR’s direction.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2025-01-02 18:16