As a seasoned crypto investor with over a decade of market experience under my belt, I’ve seen my fair share of ups and downs in this wild world of digital assets. With that said, I’m cautiously optimistic about Hedera Hashgraph (HBAR).

I remember the days when HBAR was all the rage, promising to revolutionize the blockchain industry with its innovative hashgraph technology. I invested heavily in it back then, and while I took a hit during the subsequent bear market, I’ve been patiently holding onto my HBARs, waiting for the right moment to strike.

Now, as I look at the current market conditions, I see a coin that is stuck in consolidation but shows signs of potential. The declining investor interest and reduced market activity are concerning, but I’ve learned not to let short-term turbulence deter me from long-term gains.

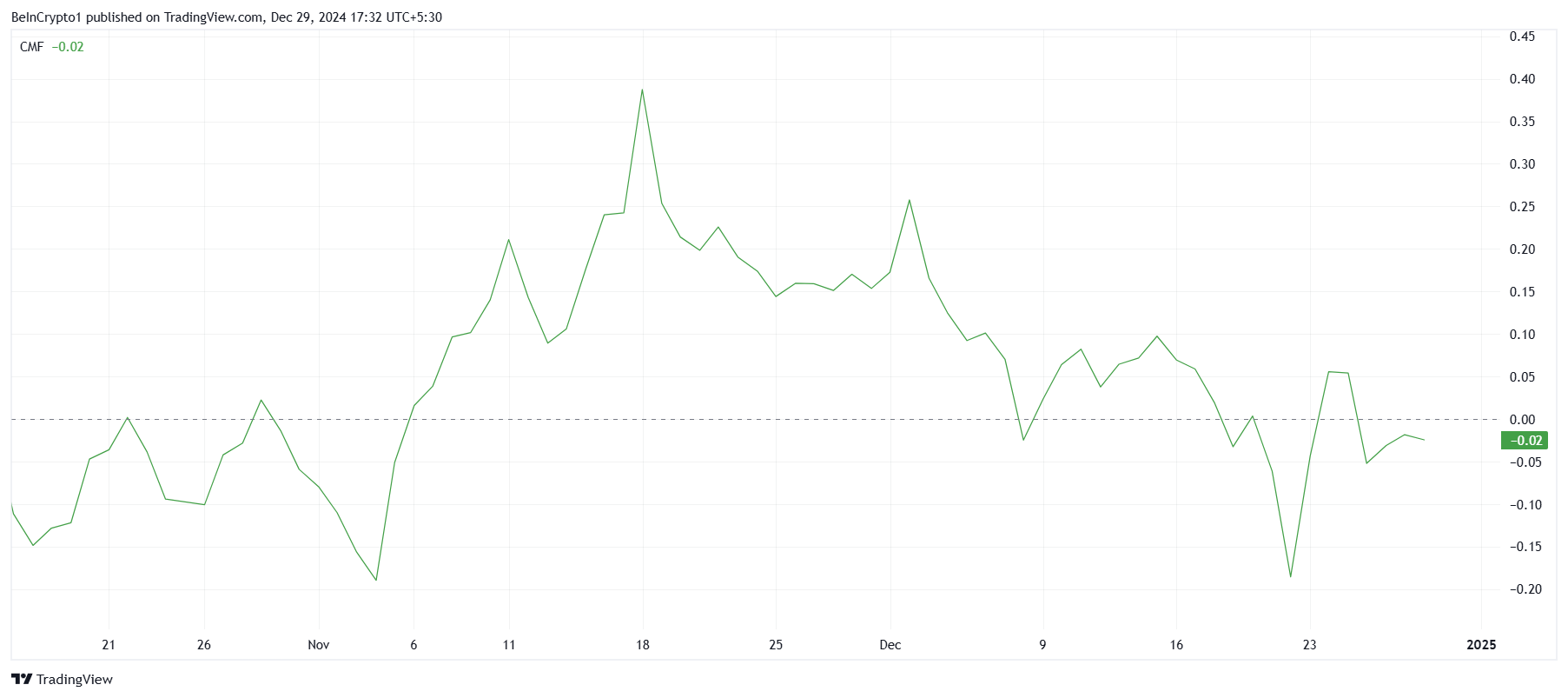

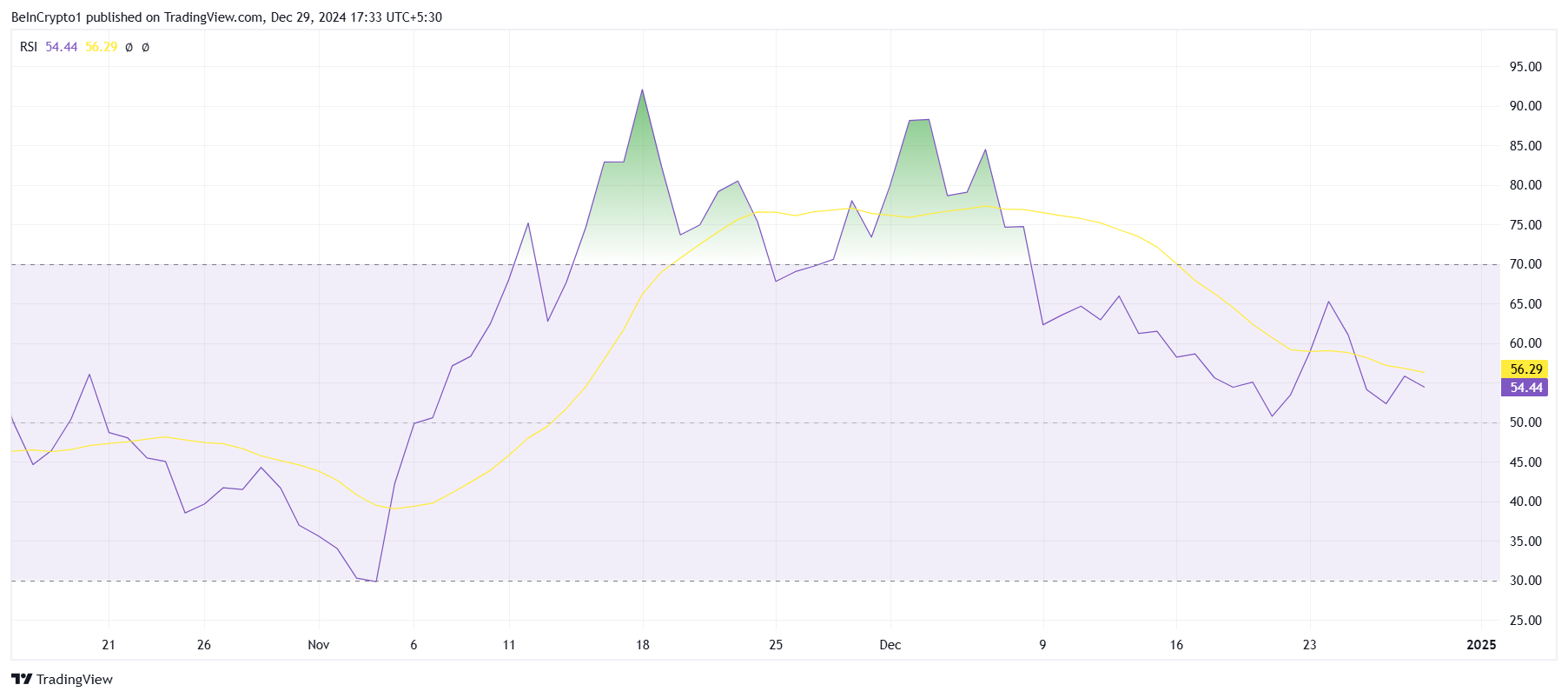

The Chaikin Money Flow (CMF) indicator suggests that we’re experiencing a significant shift in outflows, which could stall any near-term rally. However, the Relative Strength Index (RSI) indicates that bearish pressure is rising but not yet overwhelming, leaving room for HBAR to attempt another rise if market conditions improve.

I’ve learned from past experiences that the crypto market can be unpredictable, so I’m not counting on a breakout just yet. But I’m keeping my eyes peeled and my fingers crossed, as I believe in the potential of Hedera Hashgraph to deliver long-term value.

As for my investment strategy, I plan to continue holding onto my HBARs and adding to my position if the price dips further. After all, every bear market is an opportunity to accumulate more at lower prices. And who knows? Maybe this could be the bottom we’ve been waiting for.

Finally, as a wise man once said: “The secret to success in crypto investing is not to have the best crystal ball, but to stay calm and keep buying when others are selling.” So, I’ll keep my cool and hold on tight, hoping that HBAR will break out and take me to new heights. Fingers crossed!

Oh, and just a little joke to lighten the mood: Why did the crypto investor go broke? Because he thought he could outsmart the market and sell at the top every time!

For the last month, Hedera Hashgraph (HBAR) has found itself in a period of consolidation, making it difficult to break free and reach increased profits.

As long as it maintains a positive upward trend, the potential issues for HBAR’s future direction could be waning investor enthusiasm and decreased trading activity.

Hedera Hashgraph Has A Shot

The Chaikin Money Flow (CMF) shows a noticeable decrease in inflows towards HBAR, as outflows currently overshadow the asset. This change indicates that investors are withdrawing funds, probably due to apprehension about HBAR’s price movements and its capacity to maintain bullish trends.

The outgoing funds indicate increasing wariness among investors, possibly pausing any immediate market surge. If there aren’t more investments coming in and confidence from investors doesn’t rebound, the value of HBAR may remain stable within its current limits, postponing chances for a significant rise.

Hedera’s overall trend appears to be growing more bearish, as indicated by the decreasing Relative Strength Index (RSI). This downward movement suggests a gradual buildup of selling pressure. Yet, it’s important to note that the RSI is still above 50.0, implying that while bears have some control, they haven’t completely dominated the market yet.

This arrangement opens up an opportunity for HBAR to potentially surge again if the market improves. The absence of a clear bearish trend suggests that the altcoin may recover its vigor, as long as it gets enough backing from investors in the form of purchases.

HBAR Price Prediction: Consolidation Continues

For about a month now, HBAR has been holding steady, and it’s currently being traded at around $0.28. Trapped between the resistance at $0.40 and support at $0.25, this cryptocurrency doesn’t seem to be making any significant moves yet, which suggests a lack of clear direction in the market as a whole.

As a crypto investor, I’m closely watching HBAR, and the market indicators I’ve been following seem to be sending mixed messages. It appears that HBAR might continue its consolidation phase for quite some time, possibly stretching into 2025. This extended period of stagnation could require some strong bullish signals to ignite a breakout and rekindle investor faith in the altcoin’s promising upward trajectory.

From my perspective as an analyst, should investors decide to cash out to lock in their profits, HBAR might struggle to maintain its $0.25 support. If this happens, it could signal a bearish trend that may drive the price down towards $0.18. This development could further fuel market doubts, deepening the skepticism surrounding HBAR.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2024-12-29 18:43