As a seasoned researcher with a keen interest in the cryptocurrency market, I find myself both intrigued and disheartened by the recent lawsuit against the producers and promoters of Hailey Welch’s Hawk Tuah meme coin. Having closely followed the meme coin space for several years now, I’ve seen my fair share of scams and rug pulls. Yet, the sheer audacity of the Hawk Tuah launch still manages to shock me.

Investors who bought into Hailey Welch’s Hawk Tuah meme token are taking legal action against certain token creators and influencers, claiming they were involved in a scheme of misrepresenting securities.

The lawsuit doesn’t list Welch personally as a defendant, implying that she won’t take part directly in the legal proceedings.

Hawk Tuah Rug Pull

In early December, the debut of Hawk Tuah stirred up a significant controversy within the meme coin sector. The launch of the HAWK token was met with immense excitement and an initial market value of half a billion dollars. However, the token plummeted just 20 minutes after its release. As per a recent court filing, some investors in this asset are now pursuing legal action against those deemed responsible.

According to the lawsuit, it was evident that the project aimed to capitalize on opportunities within the U.S. market. However, despite strong signs suggesting it was a security, the HAWK Token was not registered by the defendants.

To put it simply, the plaintiffs aren’t primarily targeting the “rug pull” incident in their case. Nevertheless, the Hawk Tuah launch appears to be a textbook example of this type of scam. In fact, some analysts believe that it had a significant and chilling impact on the overall meme coin market.

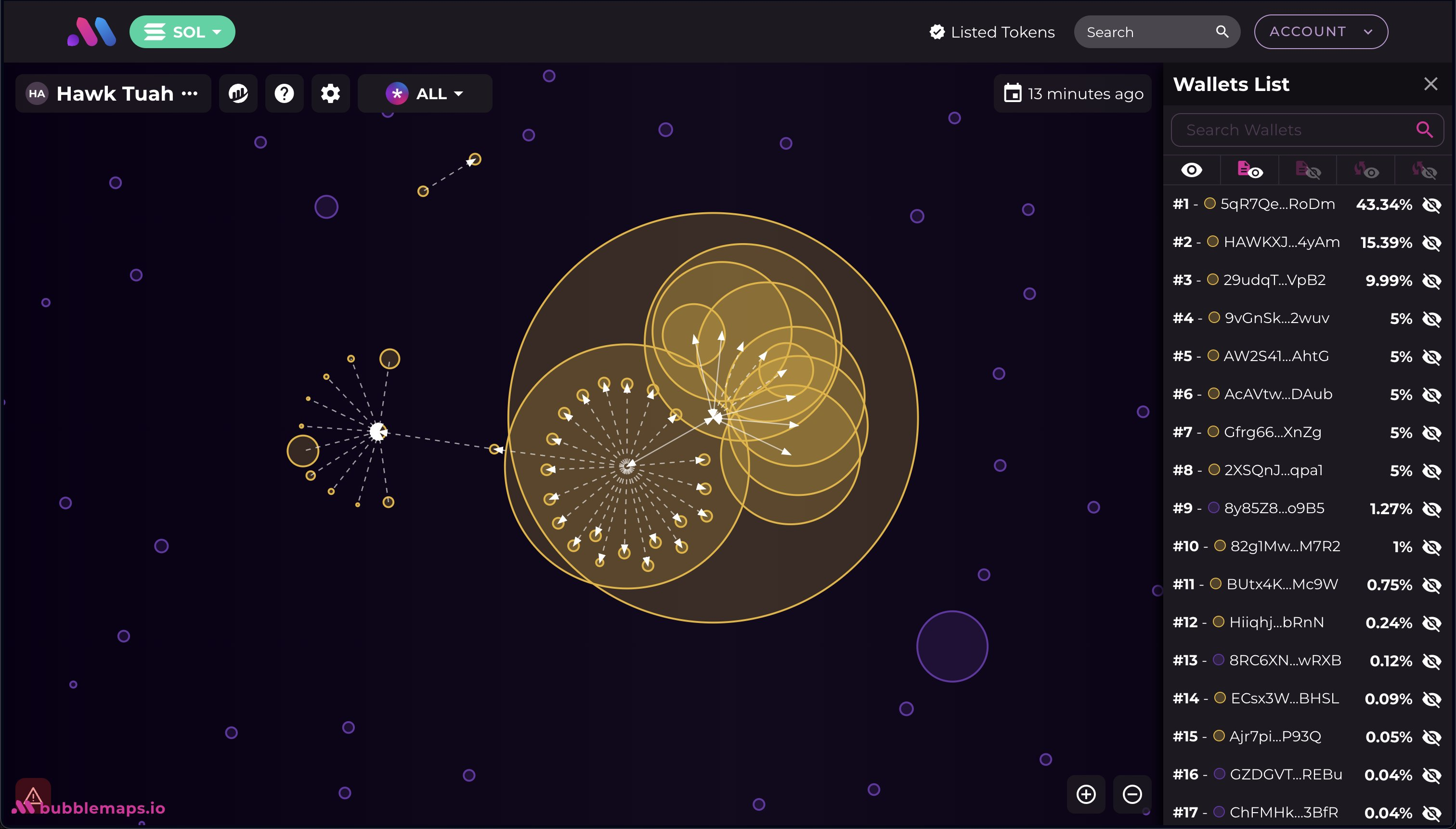

Instead, they’re focusing on a few clearly sketchy traits, like the asset’s token distribution.

The plaintiffs argue that although OverHere Ltd, the developer of Hawk Tuah, asserted that token holders would essentially function as shareholders, they point out that the distribution of these tokens was highly unbalanced. By accusing the company of breaching securities laws, this lawsuit provides a promising avenue for attacking the firm’s actions.

While rug pulls have generally decreased in 2024, the combination of internet popularity and meme coin scams can still be quite powerful. For instance, YouTuber MrBeast used his influence to advertise questionable investments as part of an insider trading scheme. Additionally, even hacked celebrity accounts can propel fictitious meme coins into prominence.

Meme coins rise and fall based on hype cycles, and celebrity endorsements can rapidly boost a potentially fraudulent investment. However, Hailey Welch herself isn’t explicitly implicated in the lawsuit, meaning her personal wealth might remain unaffected if the plaintiffs face harsh penalties. Nevertheless, her reputation within the community is likely to suffer damage.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-19 21:14