As an analyst with over a decade of experience in the dynamic world of cryptocurrencies, I find the Grayscale Research report for Q1 2025 intriguing. Having navigated through the crypto boom and bust cycles, I’ve seen firsthand how smart contracts have been transforming this space. The report’s emphasis on the competitive nature of the smart contract market is not surprising, given the explosive growth we witnessed at the tail end of 2024.

The report’s predictions align with my own observations, especially the potential of Ethereum‘s rivals like Solana, Sui, and TON. It’s fascinating to see how these platforms are eating into Ethereum’s market share despite its landmark victories such as the ETF and software upgrades.

However, I must admit, it’s a bit amusing that even though Grayscale Research predicts a bright future for smart contracts, only a few of their Top 20 assets fall into this category, and Ethereum itself is not even among them! It seems the old saying, “The more things change, the more they stay the same,” holds true even in the world of crypto.

In closing, I’d like to remind everyone that while we can make educated guesses based on trends and data, the crypto market remains unpredictable and volatile. So, as always, invest wisely and remember: In the world of crypto, the only certainty is uncertainty!

Today, Grayscale Research unveiled a fresh report outlining their forecasts for the leading cryptocurrency sectors expected to excel during Q1 2025. The final quarter of 2024 was marked by significant achievements, fostering a competitive and vibrant environment within the sector.

From my personal perspective as a seasoned researcher in the blockchain industry, I firmly believe that smart contracts hold immense potential and dynamic energy unlike any other technology I’ve encountered. However, it’s important to acknowledge that there are other promising areas such as tokenization and DeFi (Decentralized Finance) which have caught my attention and piqued my curiosity. As a researcher, it’s essential for me to stay informed about these emerging trends and their potential impact on the industry. In my experience, staying ahead of the curve is crucial in this rapidly evolving landscape.

Grayscale Report Highlights Strong Competition in the Smart Contract Market

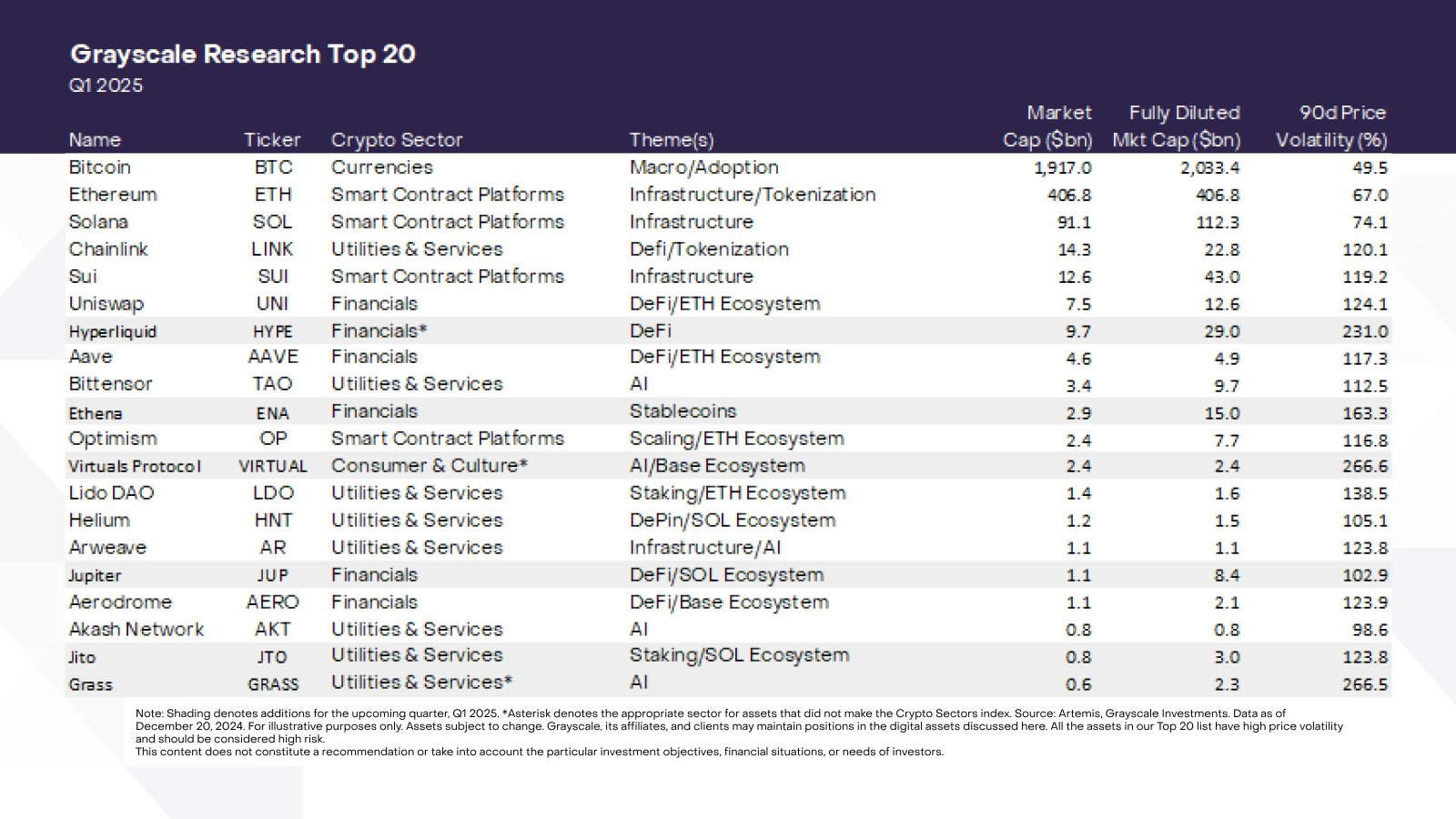

In Q4 2024, Grayscale – one of the top Bitcoin ETF providers – published a report filled with insights on their predictions. The company believes that the crypto market experienced significant growth during this period, attributing it to intense competition among smart contract platforms. Additionally, they presented a list of the top 20 investments in DeFi, Web3, and cryptocurrencies that performed exceptionally well.

As an analyst, I observe that smart contracts have emerged as a highly competitive niche within the digital assets industry. Despite notable achievements such as the ETF approval and a significant software upgrade, Ethereum has underperformed relative to its competitors. Instead, rivals like Solana, Sui, and TON have seized market share, underscoring the dynamic nature of this rapidly evolving sector.

Grayscale has high hopes for smart contracts, but only a handful of its Top 20 assets meet these criteria, not including the top one. Additionally, there are other areas of focus like scaling solutions, tokenization, and DeFi (Decentralized Finance) that were popular in the previous report.

In essence, regardless of a network’s specific design or its inherent advantages and disadvantages, one significant aspect that contributes to the worth of smart contract platforms is their capacity to generate revenue from transaction fees. The more effective a network is at producing fee income, the more it can distribute value back to the network by means of token destruction or staking rewards. According to the Grayscale Research Top 20 report for this quarter, these are the featured smart contract platforms: Ethereum (ETH), Solana (SOL), Suisei Network (SUI), and Optimism (OP).

The company is a subordinate of the Digital Currency Group (DCG), and boasts a rich background within the cryptocurrency sector. Grayscale spearheaded the legal campaign for a Bitcoin Exchange-Traded Fund (ETF), which was approved in January 2024. However, following the launch of this new market, the company rapidly surrendered its position as market leader.

As a researcher delving into this field, despite encountering some hurdles along the way, our efforts have been instrumental in spearheading the approval of Ethereum ETFs by the SEC and expanding ETF options trading. However, it’s essential to clarify that the success of selling an ETF does not necessarily translate into our ability to critically evaluate market prospects.

To be fair, the Q1 2025 report by Grayscale Research doesn’t delve deeply into the ETF sector, perhaps viewing it as only peripherally important to their primary focus. Nonetheless, Grayscale remains quite bullish on the future of cryptocurrency.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- USD ILS PREDICTION

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- PENGU PREDICTION. PENGU cryptocurrency

- Everything We Know About DOCTOR WHO Season 2

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

2024-12-31 04:05