As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed the evolution of investment products from their infancy to their maturity. The recent move by Grayscale Investments to file an updated prospectus for its Bitcoin Covered Call ETF is a testament to the growing sophistication of cryptocurrency investments and the adaptability of traditional finance (TradFi) strategies to this burgeoning asset class.

Grayscale Investments recently submitted a revised version of the investment proposal for their Bitcoin Covered Call Exchange-Traded Fund.

Following the approval by the Commodity Futures Trading Commission (CFTC) for the listing of spot Bitcoin ETF options, it sets off a rapid response.

Grayscale Pursues Bitcoin Covered Call ETF

This investment fund, set to provide access to Bitcoin and the Grayscale Bitcoin Trust (GBTC), intends to create income via strategically managed call and put options on Bitcoin-related exchange-traded products (ETPs). The initial filing for this fund was submitted to the United States Securities and Exchange Commission (SEC) in January 2024.

As stated in the document, this ETF aims to meet its goals by offering investment exposure to GBTC. Additionally, it plans to implement a strategy known as a “covered call,” which involves selling call options to generate revenue, with Bitcoin or GBTC acting as security for these transactions.

The investment strategy mainly involves actively managing investments in the Grayscale Bitcoin Trust (GBTC), along with buying and selling option contracts that are tied to GBTC, according to the document filed in January.

According to James Seyffart, a specialist in ETF analysis at Bloomberg Intelligence, he believes that Grayscale is taking advantage of the green light given for Bitcoin ETF alternatives.

As a forward-thinking crypto investor, I’m excited to share that Grayscale has swiftly acted following the approval of BTC ETF options. They’ve submitted an updated prospectus for their upcoming Bitcoin Covered Call ETF, still waiting on its ticker symbol. This innovative fund promises exposure not only to GBTC and BTC but also involves writing or purchasing options contracts on Bitcoin ETPs, aiming to generate additional income, as Seyffart pointed out.

Following the green light from the US Securities and Exchange Commission (SEC) on options trading for spot Bitcoin ETFs, I’m thrilled about the possibilities this regulatory milestone brings. Announced last month, it enables ETF issuers to incorporate options strategies into their Bitcoin-focused funds. This move not only broadens my investment horizons but also presents exciting opportunities in the crypto market.

The Office of the Comptroller of the Currency (OCC) is gearing up to introduce trading options on a Bitcoin Exchange-Traded Fund (ETF). Another ETF industry expert, Eric Balchunas, highlighted the importance of the decision made by the Commodity Futures Trading Commission (CFTC). He stated that it paved the way for the creation of more advanced Bitcoin investment opportunities.

Now that various choices are available, investment opportunities such as Grayscale’s Covered Call ETF can meet the needs of investors who desire income in a market with high volatility.

Grayscale’s ETF Strategy on a Broader Context

Grayscale’s application for a Covered Call ETF is one step in their broader strategy to become a dominant player in the field of cryptocurrency ETFs. Back in October, the SEC recognized Grayscale’s petition to transform its Digital Large Cap Fund into an ETF, indicating their dedication to expanding their product range.

Moreover, Grayscale is collaborating with NYSE Arca to seek authorization for listing various ETFs, encompassing ones centered around digital assets other than Bitcoin. This strategic move signifies their aim to introduce high-quality investment tools to the burgeoning crypto market.

Integrating options trading within Bitcoin Exchange-Traded Funds (ETFs) might signal a significant milestone for the cryptocurrency sector. Strategies like covered calls, where funds sell options on their held assets, can provide consistent income – an aspect that could potentially draw in a wider range of investors.

Grayscale’s quick action and initiative towards a Bitcoin Options ETF demonstrates their ability to adapt to the evolving regulatory landscape. By submitting a revised proposal for their Bitcoin Options ETF, the company is strategically preparing to capitalize on the increasing demand for investment options in cryptocurrencies.

Should it be granted, the Bitcoin Covered Call ETF might open up a fresh era of financial instruments, blending traditional investment tactics with cutting-edge digital assets. As regulatory systems adapt to embrace these advancements, the cryptocurrency investment sector appears set for substantial expansion.

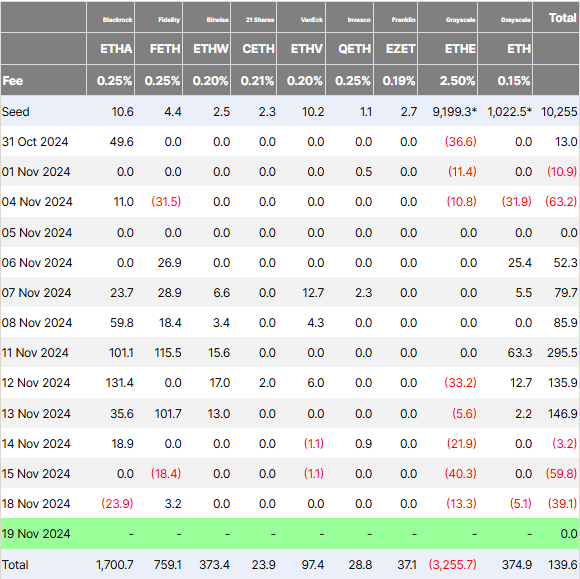

As an analyst, I’ve observed that our Ethereum ETF has been experiencing a consistent trend of redemptions over the past five business days since November 12, with daily outflows being the norm during this period.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-19 19:07