As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The recent performance of GRASS has piqued my interest, especially its meteoric rise at listing and subsequent neutralization.

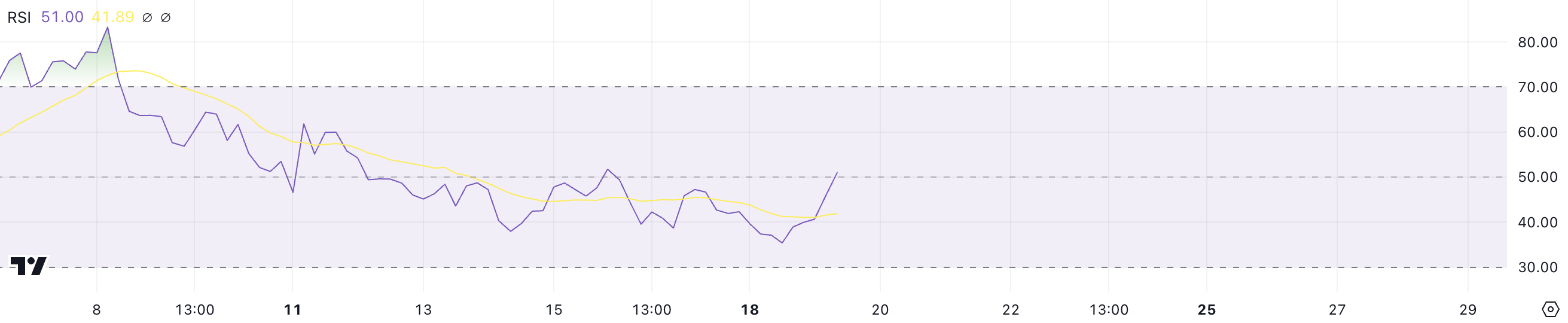

The price of GRASS has been quite dynamic since it was listed on significant exchanges towards the end of October. In just its initial week, the price soared from $0.65 to an impressive $1.60. However, recent statistics suggest that GRASS is currently in a balanced phase, with its RSI at 51 and ADX at 14.84. This implies a modest recovery and a relatively weak trend power.

Traders should keep an eye on crucial resistance and support thresholds, as the market’s trajectory could either experience a 44% increase or a 26% decrease, largely contingent upon the vigor of its current upward trend.

GRASS Is Currently In The Neutral Zone

The Relative Strength Index (RSI) for GRASS has climbed to 51, up from a low of approximately 35. This shift indicates a recovery in momentum, moving from oversold territory toward a more balanced state. RSI, a key momentum indicator, measures the strength and speed of price movements, providing insight into whether an asset is overbought or oversold.

In simpler terms, an RSI (Relative Strength Index) value less than 30 usually indicates that a security is oversold, meaning it might be undervalued and could potentially increase. On the other hand, values greater than 70 indicate overbought conditions, suggesting the security might be overvalued and could experience a decrease. For GRASS, with an RSI of 51, its momentum is neutral, which means there’s neither significant buying nor selling pressure at the moment; it’s neither strongly bought nor sold.

Despite being down nearly 15% over the past seven days, GRASS price has surged almost 10% in the last 24 hours. The RSI’s movement to 51 aligns with this short-term rebound, suggesting a shift toward stabilization after recent declines.

In simpler terms, if Relative Strength Index (RSI) is in a neutral position, Green Airdrop Coin (GRASS) might prepare for consolidation or modest growth. However, if RSI surpasses 70, it could indicate stronger upward trends for GRASS, potentially making it one of the significant coin increases in 2024.

GRASS Current Trend Isn’t That Strong

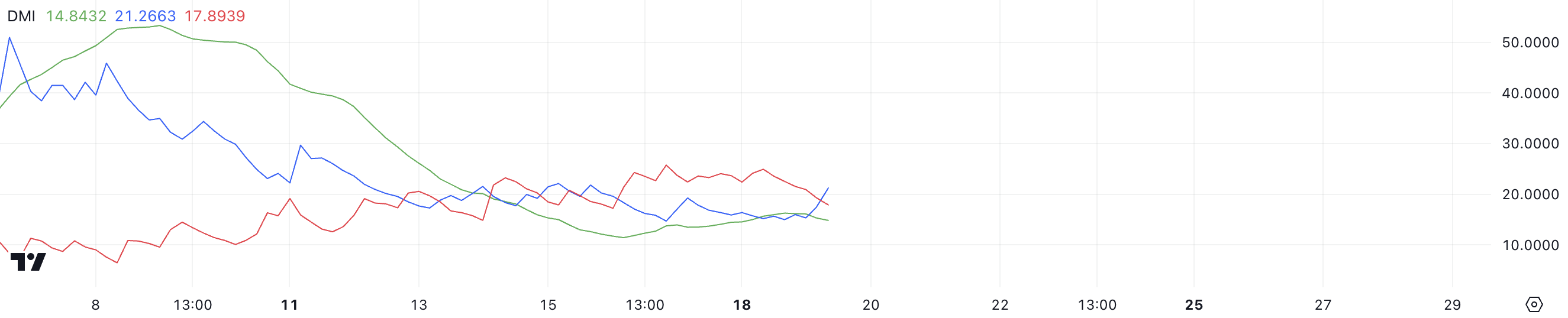

In simpler terms, the Directional Movement Index (DMI) for GRASS shows an ADX value of 14.84, implying a weak directional movement in the market. The Average Directional Index (ADX) determines the strength of a trend without specifying its direction. Generally, values over 25 signify a strong trend, while values under 20 suggest a weak or undefined trend momentum.

At 14.84, the ADX indicates that the trend strength for GRASS is currently weak, implying that future price changes might not persist in a consistent direction.

The DMI (Directional Movement Index) consists of two components: the +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator). These elements help determine the direction of the price movement. Right now, GRASS’s +DI stands at 21.26, suggesting a slightly increased bullish influence, while its -DI is at 17.89, implying reduced bearish energy.

In other words, when the Average Directional Index (ADX) falls below 20, it indicates that neither bullish nor bearish forces are robust enough to create a clear trend direction. This market condition often results in sideways price action, where prices may fluctuate without a definitive upward or downward trend until the ADX experiences a substantial increase.

GRASS Price Prediction: A 44% Surge?

Right now, GRASS’s price is surging above its brief-term moving averages, suggesting an increase in bullish strength over the short term. Short-term moving averages, also known as Exponential Moving Averages (EMAs), help clarify trends by smoothing out the data and swiftly reacting to price fluctuations.

This development indicates that buyers are taking charge, and the direction for GRASS’s short-term price movement appears to be improving. Should this momentum persist, GRASS’s price may challenge significant resistance points, offering a more definitive indication of prolonged bullish tendencies.

If the upward trend continues strongly, GRASS might encounter its next resistance level at approximately $2.91. Overcoming this barrier could lead to additional bullish momentum, possibly pushing the price up to $3.66 – a potential increase of about 44%. However, if the upward trend starts to falter, the price may reverse and test the support at around $2.41 instead.

If we can’t sustain this current level, it might trigger a more pronounced decline, possibly driving the GRASS price down to approximately $1.87. This would represent a 26% decrease. The significance of the trend’s momentum in predicting the next major price shift cannot be overstated.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-11-20 00:18