As a seasoned analyst with over two decades of experience under my belt, I have witnessed the ebb and flow of market dynamics, particularly in the tech sector. The potential dismantling of Google, if it indeed materializes, would undoubtedly reshape the landscape of the industry, much like the breakup of AT&T did in the 1980s.

As a crypto investor, I read with great interest the Bloomberg report on August 14th suggesting that the U.S. Justice Department is contemplating the breakup of Alphabet Inc., more commonly known as Google. According to sources familiar with the matter, this decision comes after a court ruling declared Google guilty of monopolizing the online search market. If this move materializes, it would be the first instance since the unsuccessful attempts against Microsoft two decades ago where a company is dismantled for illegal monopolization.

Based on reports from Bloomberg, the U.S. Department of Justice is examining various strategies to counteract Google’s market power. Although dissolving the company entirely is one possibility being considered, other potential actions might involve compelling Google to share more information with rivals and setting guidelines to ensure fairness in AI technology development, thereby preventing any undue advantages.

According to an article by Bloomberg, it appears that if a separation plan proceeds, Google’s Android operating system and Chrome web browser could be the assets up for divestment. Additionally, it’s rumored that the Department of Justice is considering compelling Google to sell AdWords, their text-based advertising platform.

The debate within the Justice Department has grown more vigorous since Judge Amit Mehta’s decision on August 5th, as reported by Bloomberg. This ruling accused Google of unlawfully monopolizing the markets for web search and text ad search. Despite Google’s intention to challenge this decision, both parties have been instructed to initiate preparations for the subsequent stage of the lawsuit, which will focus on ideas to reestablish fair competition in these markets.

According to Bloomberg’s report, any proposed action by the U.S. government regarding Google would require Judge Mehta’s approval. If a forced separation were to take place, it would mark one of the largest dismantlings of an American company since AT&T was split up in the 1980s.

The Bloomberg piece further notes that legal advisors within the Justice Department have voiced worries over Google’s stronghold in search engines potentially granting it an edge when it comes to creating artificial intelligence (AI) tech. As a possible resolution, authorities could propose barring Google from compelling websites to make their content available for certain AI applications if they wish to be included in search results.

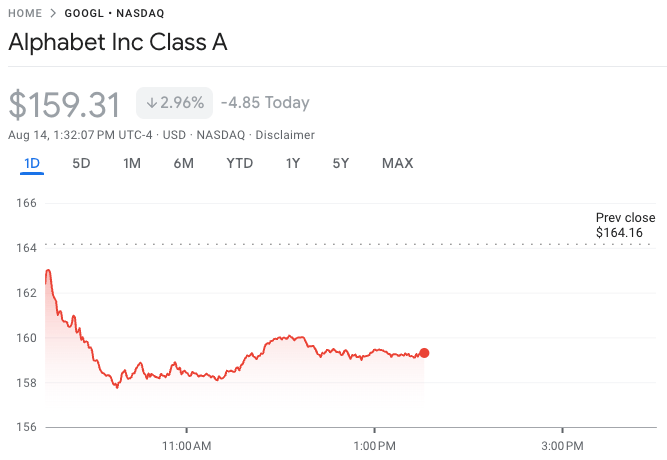

At precisely 5:30 PM UTC on August 14th, Alphabet’s Class A shares (traded as NASDAQ: GOOGL) were being exchanged for approximately $159.31, marking a decrease of almost 3% in value compared to the day’s start.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

- All 6 ‘Final Destination’ Movies in Order

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- How Much Time Does It Take To Beat Tainted Grail The Fall of Avalon?

2024-08-14 21:04