Behold, dear reader, the curious case of gold and silver, whose prices have ascended with the fervor of a man fleeing a ghostly apparition. One might suppose, as the naive do, that this frenzy is born of artificial intelligence’s siren song, yet the truth lies elsewhere-beneath the surface of the Federal Reserve’s labyrinthine machinations.

Gold, that ancient alchemist’s dream, has surged 74% in 2025, reaching $4,562 per ounce, a figure that would make even the most stoic banker clutch his chest. Silver, ever the mercurial companion, has outdone its cousin with a 175% leap, nearing $80 per ounce. Both metals now outpace the S&P 500’s meandering path, as if the stock market itself had succumbed to a fit of existential doubt.

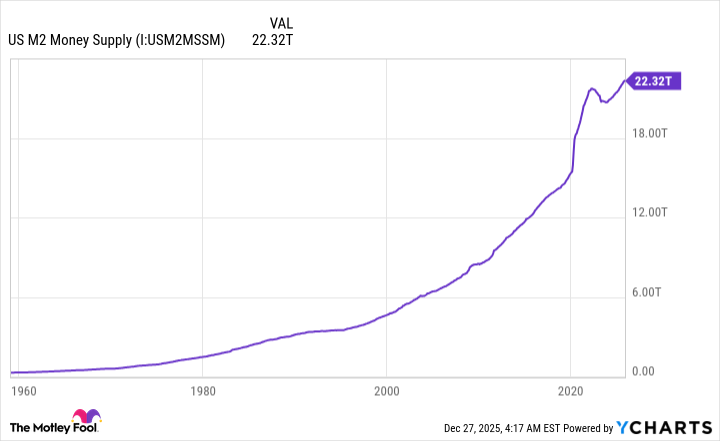

Yet the causes of this meteoric rise are not as straightforward as they seem. While the pandemic’s shadow, trade wars, and the M2 money supply’s inflationary gush have all played their parts, a subtler force looms-a discordant note in the Federal Reserve’s symphony of control.

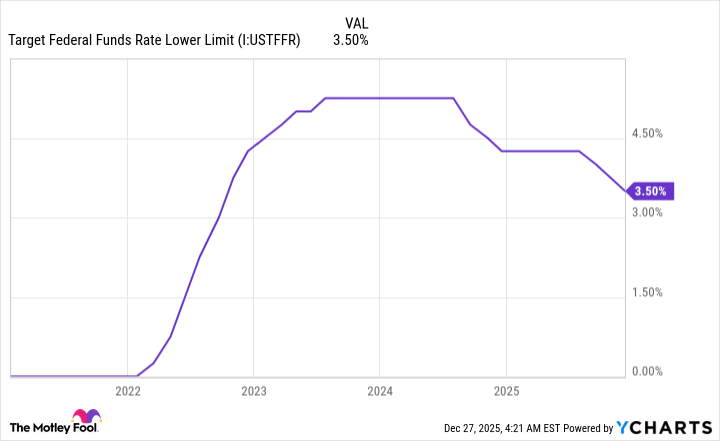

Consider the Fed, that enigmatic institution tasked with steering the nation’s economic ship. Its members, once united as a choir of wisdom, now resemble a troupe of clowns with conflicting scripts. In the latter half of 2025, four FOMC meetings witnessed dissenting votes so stark they might have been plucked from a Kafka novel. One member, it seems, wished to slash rates by 25 basis points, while another demanded a 50-point cut-each convinced their plan was the work of divine inspiration.

What is this but a tale of bureaucratic absurdity? The Fed, once a bastion of order, now quivers under the weight of its own contradictions. Its chair, Jerome Powell, faces the inevitable: a term’s end in May 2026, leaving the succession question as murky as a Moscow fog. Will the next leader be a sage or a charlatan? Only the Kremlin of finance knows.

The public, meanwhile, watches with bated breath as the Fed’s internal strife mirrors the chaos of a circus where every performer has forgotten their act. Inflation and unemployment, those twin specters of economic dread, now dance together, hinting at a stagflation nightmare. And in this maelstrom, gold and silver rise-not as commodities, but as symbols of a world grown weary of promises.

Let us not forget the physical demand for these metals, which, like a stubborn peasant, refuses to yield to the whims of supply chains. Solar panels and electric vehicle batteries, those modern-day marvels, demand silver in quantities that even the most optimistic miner would deem excessive. Yet the market, ever a fickle lover, remains enraptured by the allure of scarcity.

And so, the tale concludes with a warning: until the Fed’s chorus falls into harmony, gold and silver shall glitter, their prices a testament to the chaos of human ambition. A final thought, dear reader-when the central bank itself becomes a source of uncertainty, what sane man would not seek refuge in the cold, unyielding embrace of precious metals?

🚨

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-29 11:14