The golden age of gold has arrived, or so the headlines insist. A veritable feast for the discerning investor, this yellow metal has ascended to new heights, dragging its mining brethren along for the ride. One might say it’s the stock market’s most reliable parlor trick: a 28% surge year-to-date, while the S&P 500 limps along at a mere 10%. A masterclass in contrarianism, if you’ll permit the term.

Gold, that most steadfast of safe havens, has traditionally danced to the tune of market turmoil. Yet this latest crescendo defies convention. The S&P 500 and gold have both ascended in unison, a curious duet. The catalyst? A certain invasion in Eastern Europe and the subsequent freezing of assets-a geopolitical spectacle that has sent central banks into a frenzy of gold-buying, as if diversifying from the dollar were a matter of national survival.

Pushing gold

Central banks, ever the cautious souls, have been amassing gold at a rate of 80 metric tons monthly-a sum that would make even the most seasoned financier blush. The U.S., in its infinite wisdom, has further stoked this fervor with tariffs and deficits that have left the dollar looking rather the worse for wear. One might call it an unconventional method of economic diplomacy, though it’s unlikely to win any awards for elegance.

The U.S. Dollar Index, that barometer of global confidence, has dipped nearly 10% this year. A falling dollar, as any seasoned investor knows, is a golden opportunity for those who prefer their assets in bullion. Thus, the price of gold rises, not out of necessity, but as a matter of sheer, unrelenting momentum.

Shine your light on this miner

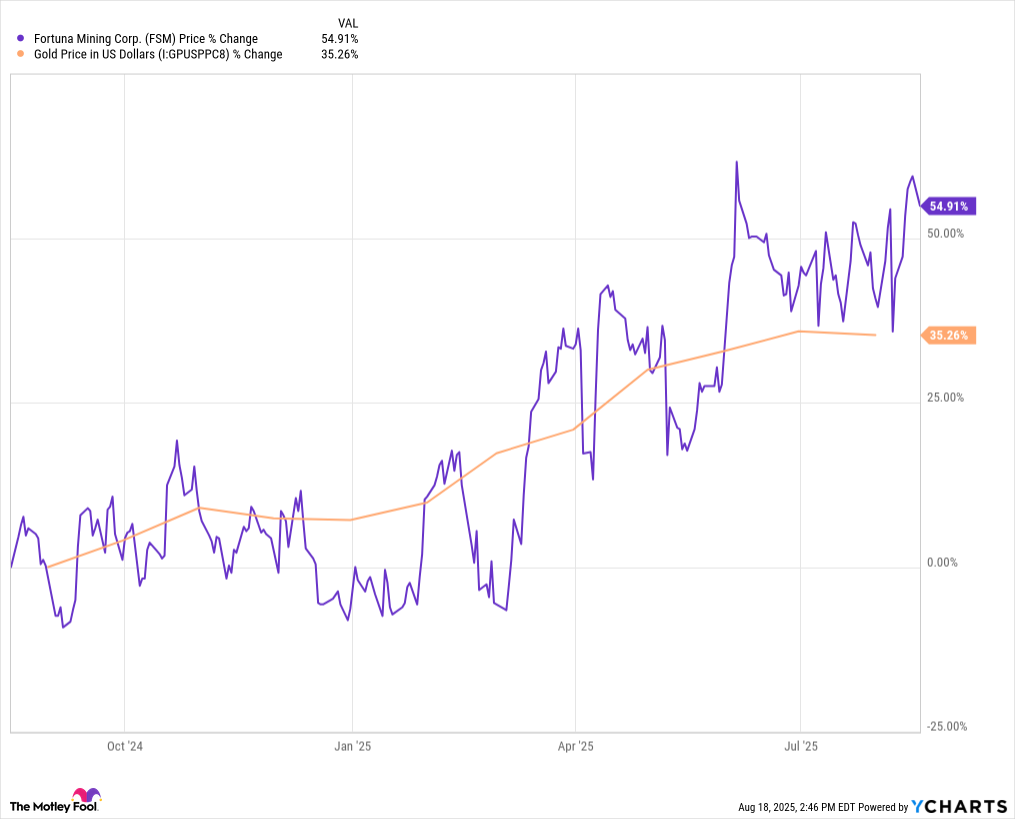

For those seeking to partake in this glittering affair, Fortuna Mining (FSM) stands out like a well-tailored suit at a masquerade. Its stock has surged 70% year-to-date, a performance that would make even the most jaded analyst raise an eyebrow. Based in Vancouver, this company operates mines in Cote d’Ivoire, Argentina, and Peru, while eyeing new frontiers in Senegal and Mexico. A portfolio as diverse as a well-stocked liquor cabinet.

Despite a slight dip in production this year-due, ironically, to the sale of a mine in Burkina Faso-Fortuna’s recent discovery of 724,000 ounces of gold in Senegal has reignited interest. A 53% increase from last year’s estimate, no less. One might call it a stroke of luck, or perhaps a testament to the company’s relentless pursuit of opportunity.

Investors would do well to keep a watchful eye on Fortuna’s Senegal project. It is, after all, the sort of venture that can turn a modest portfolio into a veritable treasure trove. Gold, for all its allure, remains a fickle mistress-but then, so are markets. A dash of caution, paired with a touch of audacity, is often the recipe for success.

The current climate, fraught with geopolitical intrigue and fiscal unpredictability, offers both peril and promise. For those with a keen eye and a steady hand, the gold rush remains a tempting proposition. After all, as the saying goes, “He who hesitates is lost”-but then again, so is he who acts without thought. 🌟

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-19 04:34