Well, now. Gold and silver, those ancient symbols of… well, everything, have decided to put on a show. Five thousand dollars an ounce for gold, a hundred for silver – it’s enough to make a sober man consider a career in alchemy. The S&P 500? A respectable, if somewhat pedestrian, affair by comparison. In 2026, it seems, the yellow metal and its paler cousin are leaving the stock market eating dust. A repeat performance of 2024 and 2025, you say? The market, my friends, is a fickle mistress, but these metals… they have a certain staying power, a stubborn refusal to be ignored.

Let us dissect this phenomenon, shall we? Separate the genuine sparkle from the fool’s gold. It’s rarely about inherent value, you understand. It’s about stories, about anxieties, about the eternal human desire to possess something shiny and claim it’s worth more tomorrow than it is today.

The Drivers of This Peculiar Rally

Any asset that climbs rapidly does so on a blend of logic and lunacy. There’s a fever pitch of enthusiasm, a sort of collective delusion, but beneath it, a foundation of… let’s call it ‘circumstance’. The fundamentals, as the analysts say, are ‘strong’. A convenient term, isn’t it? It implies a solid structure when often it merely means a large number of people are convinced it should be strong.

- Gold and silver, you see, are the traditional refuge of those who suspect the paper money in their pockets is about to become… less pocket-worthy. A hedge against inflation, they call it. A polite way of saying they expect the authorities to make a mess of things.

- The central banks, those secretive institutions, are accumulating gold. China and India, in particular. One suspects they have their reasons, reasons they aren’t eager to share with the likes of us.

- A weakening dollar and geopolitical tensions? Excellent! A perfectly crafted storm to send investors scurrying towards the perceived safety of precious metals. It’s a bit like running from a small fire directly into a volcano, but who are we to judge?

- The dollar, having endured a rather unpleasant year, is looking a bit… peaked. Those who believe its decline will continue are naturally inclined to favor assets not tied to its fate. Diversification, they call it. A fancy word for not putting all your eggs in one basket, especially if that basket has a hole in it.

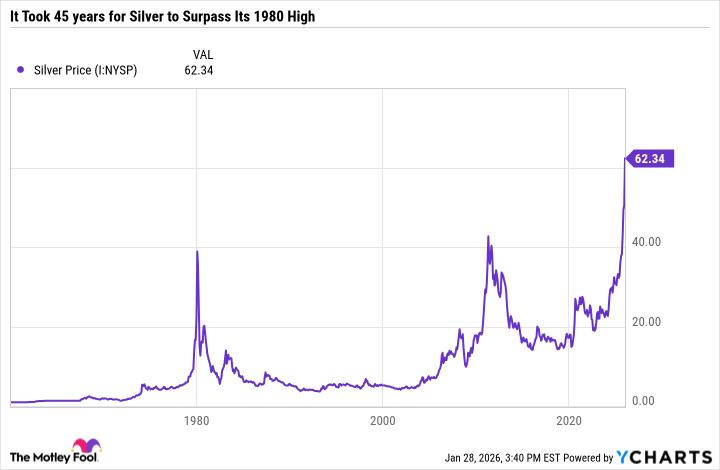

- Silver, long in gold’s shadow, finally had its moment. Surpassing its 1980 high in 2025? A remarkable feat, though one wonders if it was merely catching up or preparing for something more ambitious.

Silver, unlike its golden sibling, has a practical side. Used in industrial processes, electric vehicles, and even those mysterious AI data centers. Investors, ever the pragmatists, are searching for ways to profit from the AI boom without joining the stampede for Nvidia. A sensible approach, if you ask me. Though, of course, sensible and profitable rarely travel together.

Incorporating Glitter into a Sensible Portfolio

Evaluating gold and silver is… different. With stocks, you analyze balance sheets, assess management, and try to predict the future. With gold and silver, you’re essentially betting on fear, greed, and the whims of central bankers. Earnings? Irrelevant. Price is dictated by supply and demand, and right now, demand is… enthusiastic.

Looking at silver’s price chart, one might detect a certain… parabolic quality. A bubble, perhaps? The same could be said of gold. But attempting to time the market is a fool’s errand. A far better approach is to determine what role, if any, these metals should play in your overall portfolio.

Five percent? Ten percent? More? Opinions vary wildly. Warren Buffett, that sage of Omaha, avoids gold like the plague, believing stocks will always outperform in the long run. And then there are those who see Bitcoin as the modern-day digital gold. A fascinating debate, though I suspect both sides are equally convinced of their own brilliance.

The greatest mistake an investor can make is falling in love with a rising price. If you’re interested in gold and silver simply because they’ve been soaring, take a step back and consider the fundamentals. Or, more accurately, the lack thereof.

Buying the Shine Through ETFs

If you believe central banks, institutional investors, and retail investors will continue to hoard gold and silver, then allocating a portion of your portfolio to these metals, even at all-time highs, is not entirely unreasonable. And one of the easiest ways to do so is through exchange-traded funds.

Holding physical gold and silver involves a host of logistical nightmares: security, storage, liquidity. ETFs like SPDR Gold Shares or iShares Gold Trust provide a convenient solution. They employ custodians to hold the physical metal on your behalf. A bit like a bank, but with more glitter.

This allows you to buy and sell gold and silver within your brokerage account, providing greater liquidity and clarity. Though, of course, nothing is free. ETFs charge expense ratios – fees for their services. Vanguard S&P 500 ETF boasts a minuscule ratio of 0.03%. Cathie Wood’s ARK Innovation Fund? A rather more substantial 0.75%. SPDR Gold Shares clocks in at 0.4%, while iShares Gold Trust offers a more reasonable 0.25%. The iShares Silver Trust, with a 0.5% ratio, remains the most reputable option, boasting a hefty $38 billion in net assets.

Keeping a Level Head Amidst the Glimmer

Gold and silver are indeed outpacing the S&P 500 in 2026, and that trend may continue. But instead of choosing between stocks and precious metals, focus on determining the appropriate role for gold and silver within your portfolio. And consider your preferred method of gaining exposure – ETFs versus physical bullion or coins.

By prioritizing portfolio allocation, you can establish a position in gold and silver without allowing the price action to dictate your investment decisions. For those consistently adding to their investment accounts, dollar-cost averaging into gold and silver ETFs over time could be a prudent strategy. It mitigates the emotional stress of opening a position only to witness a subsequent price decline.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-01-30 14:54