Five years. 232% return. FIFTY-ONE percent in the last year. Numbers. Just numbers. They scream from the screen, a gaudy, obscene display of…what? Luck? Skill? Or just the inevitable consequence of a rigged game? Goldman Sachs. The name itself feels…reptilian. And here we are, picking over the carcass of their recent performance, trying to divine the future. Frankly, it feels like staring into the abyss, and the abyss is wearing a power suit.

They call it an investment bank. A polite term for a highly sophisticated gambling den. They advise companies on mergers, acquisitions, IPOs…basically, they grease the wheels of capitalistic excess. They help the rich get richer, and take a hefty cut for their trouble. It’s simple, really. Brutally simple. And they’re good at it. DAMN good.

Market conditions, they say. Interest rates. Regulatory regimes. The usual hand-wringing. Before 2025, things were…sluggish. A downturn. A correction. The champagne corks weren’t popping. Then came Trump. Or maybe it was just lower interest rates. Who the hell knows? The point is, the money started flowing again. IPOs, M&As…the whole grotesque carnival of finance roared back to life. And Goldman, naturally, was right in the thick of it, collecting its blood money.

Now, everyone’s whispering about OpenAI, SpaceX…the next big things. The potential IPOs are enough to make a sane man lose his mind. The hype is…palpable. A fever dream of venture capital and inflated valuations. And Goldman, of course, will be there to facilitate the madness. They ALWAYS are.

Buy, sell, or hold? The question hangs in the air like a bad omen.

The Valuation: A Tightrope Walk Over a Volcano

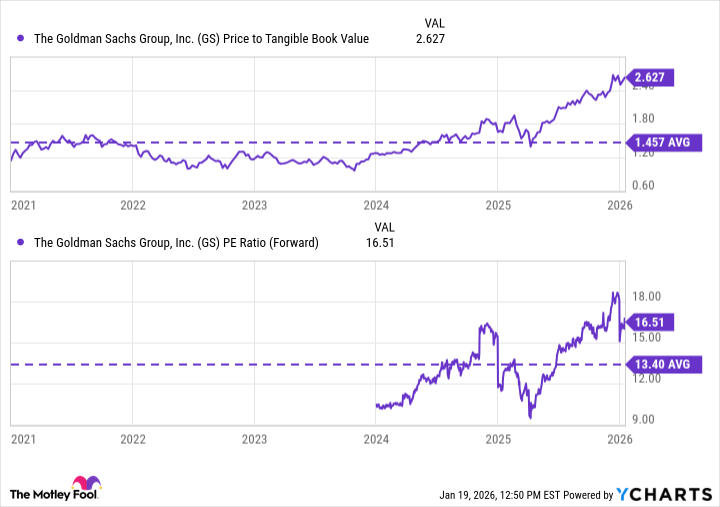

High. That’s the word. Valuation is HIGH. Price-to-tangible-book-value, forward price-to-earnings…it’s all inflated. A bubble waiting to burst? Maybe. But let’s be honest, in this world, bubbles tend to float a lot longer than anyone predicts.

They’ve cleaned house, apparently. Abandoned some ill-fated consumer lending ventures. Sold off some alternative investments. Trying to look…efficient. Capital efficient. It’s all a game, a carefully constructed illusion. But they’re good at it. Uncomfortably good.

Prediction markets, they say. David Solomon, the CEO, is considering it. A new revenue stream. A new way to extract value. It’s like watching a shark circling its prey. Calculating. Assessing. Waiting for the opportune moment to strike.

So, should you buy? No. Not yet. The valuation is insane. Hold? Maybe. If you’re already in, ride the wave. But be prepared for the inevitable wipeout. A dip? NOW THERE’S A POSSIBILITY. A chance to get in on the ground floor of the next great bubble. But remember this: in this game, the house ALWAYS wins. ALWAYS.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-22 16:52