As a seasoned market analyst with over two decades of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The current state of the market, characterized by escalating geopolitical tensions and economic uncertainty, has once again proven the age-old adage: “What goes up must come down.”

Amid escalating international conflicts, more and more investors are moving toward secure investments. Traditionally regarded as a safe asset, gold has been more attractive than Bitcoin, especially during periods of market instability, as suggested in a report by Brian McGleenon for The Block released today.

Currently, Kitco News reports that the price of gold is rapidly increasing. This surge is due to a mix of advantageous external market conditions and increased technical buying. As of 7:05 p.m. UTC on Monday, the spot price for gold stood at $2,470.30, marking a 1.63% rise and approaching its record high.

Additionally, there’s a modest decrease in U.S. bond interest rates and an increase in crude oil costs, which are boosting the demand for gold.

Contrarily, Bitcoin has faced difficulties in preserving its reputation as a dependable safe-haven asset. Jasper De Maere, the Head of Research at VC firm Outlier Ventures, emphasized this issue in a recent conversation with The Block. He pointed out that unlike gold, which detached from broader market indices such as the S&P 500 and Nasdaq during last week’s market downturn, Bitcoin has stayed linked to tech stocks. This tight association has sparked closer examination of Bitcoin’s function as a hedge.

Maere pointed out that theoretically, due to its scarcity, Bitcoin should resemble gold, functioning as both a safe place to store value and a possible means of exchange. Yet, in reality, the connection between Bitcoin and Ether over a 30-day period remains above 0.95, indicating that Bitcoin continues to trade more like a speculative tech stock than a reliable hedge. This strong correlation, according to him, is intensified by the absence of clear regulations for cryptocurrencies and the youthfulness of the crypto market.

Regardless of these obstacles, De Maere remains hopeful about Bitcoin’s future as a widespread hedge. He emphasized the continuous advancements within the Bitcoin network, notably in institutional decentralized finance (DeFi), where Bitcoin is proving its competitiveness against more established systems.

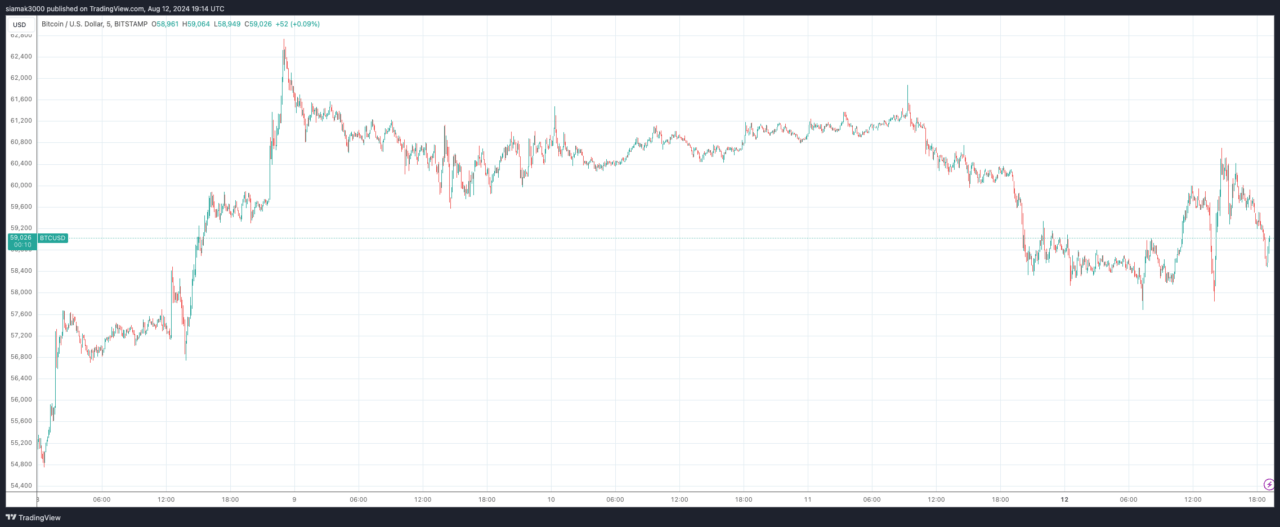

Currently, a single Bitcoin is being transacted for approximately $59,035. Over the last day, its value has decreased by 1.7%. Over the past fortnight, this decrease extends to 11.9%.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-08-12 22:35