As a seasoned analyst with over two decades of market experience under my belt, I must say that the current gold rally is nothing short of intriguing. Having witnessed numerous market cycles and shifts, I can confidently say that this surge in gold price is driven by a perfect storm of factors – economic uncertainties, dovish Fed stance, and geopolitical tensions.

As a seasoned investor with over two decades of experience under my belt, I have seen my fair share of market fluctuations and learned to read between the lines when it comes to economic indicators and geopolitical events. This week, I noticed that gold has experienced a significant increase in value due to several factors, as reported by Ernest Hoffman for Kitco News.

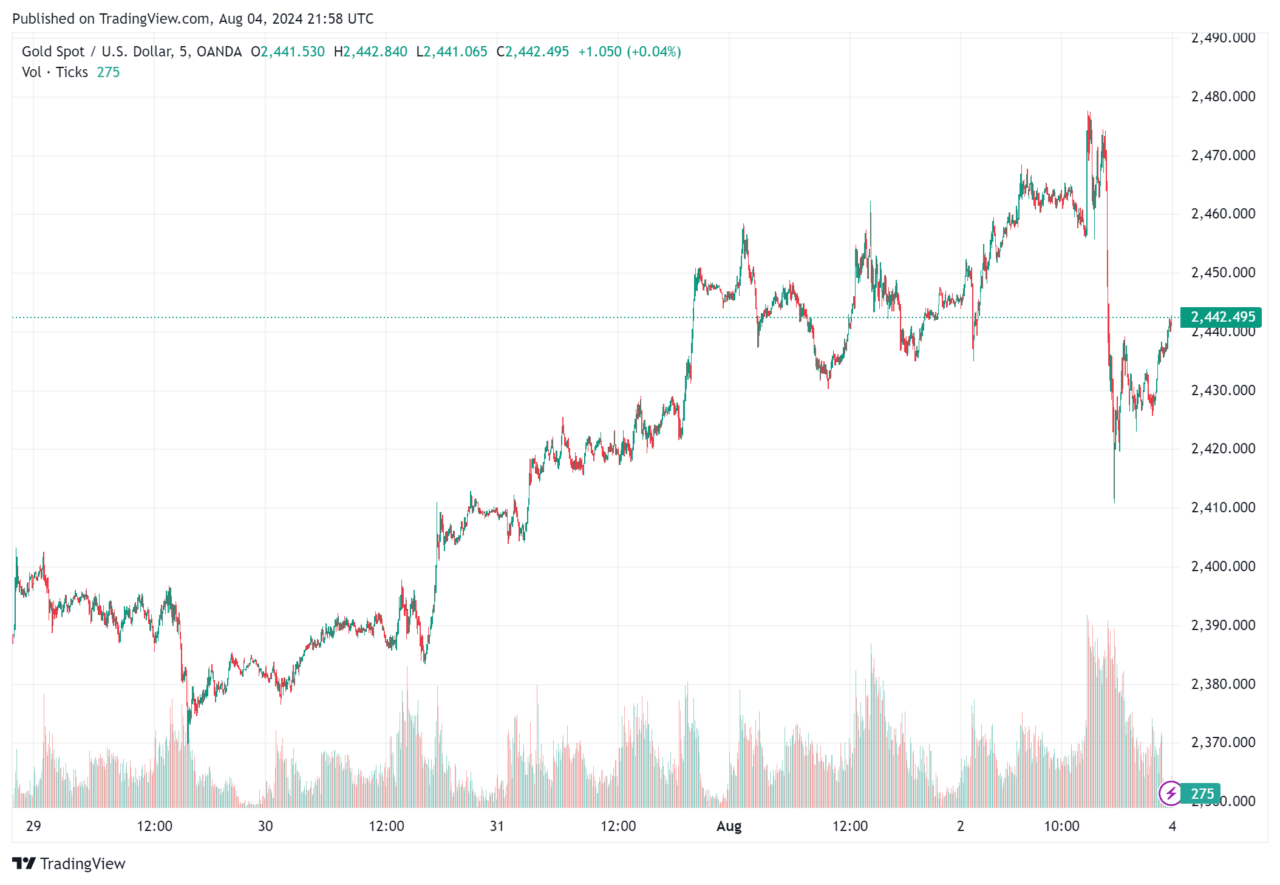

Last week, Kitco observed that gold was trading around $2,400 per ounce at the start, then moved between $2,375 and $2,400. On Tuesday, as U.S. manufacturing data fell short of expectations, strengthening the anticipation of a more accommodating Fed, gold prices overcame resistance levels. By Wednesday, according to Kitco, spot gold hit a new weekly high, approaching $2,430 per ounce before the Fed’s rate decision. Following the Fed’s announcement of a dovish stance and weaker U.S. job reports, gold climbed to $2,457.86, maintaining its higher range throughout the week.

The ongoing geopolitical disputes, particularly in the Middle East, have sparked a heightened interest in gold as a secure investment option. According to Kitco, news of growing conflicts, such as Israel’s missile attacks on Iran and Lebanon, have increased market apprehensions, leading investors to seek safety in gold. These geopolitical events, coupled with economic instability, have made gold more appealing, Kitco noted further.

According to a survey conducted by Kitco, most analysts and traders are optimistic about gold’s price increase in the upcoming week. Adrian Day from Adrian Day Asset Management, one of those interviewed, predicts that gold may surpass its previous highs because of the struggling U.S. economy and possible interest rate reductions by the Fed. Marc Chandler of Bannockburn Global Forex, another participant in the survey, expects a calmer week but notes that there’s potential for gold to test resistance levels at $2,500. Additionally, Bob Haberkorn of RJO Futures believes the recent drop in gold prices is an overreaction and recommends buying as geopolitical risks remain high.

According to Mike McGlone, the Senior Commodity Strategist at Bloomberg Intelligence, he appears to hold a pessimistic view toward both U.S. stocks and Bitcoin, while maintaining an optimistic stance on gold.

Considering the current surge in the US stock market, Bitcoin, and T-bills offering a 5% yield, why add gold to your portfolio might be reconsidered. This thought could change as macroeconomic indicators shift. You can find more insights on this topic in our comprehensive report accessible via the Bloomberg terminal: [BI COMD]

— Mike McGlone (@mikemcglone11) August 4, 2024

Currently, as I’m typing this, Bitcoin was previously traded at approximately $58,449, representing a decline of around 14% over the last seven days.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-08-05 01:23