As a seasoned analyst with over two decades of market experience under my belt, I have seen my fair share of bull runs and corrections. The recent 17% surge in GOAT‘s price following OKX’s announcement is certainly intriguing. The meme coin’s ongoing recovery from the sharp correction has sparked optimism for further gains, but it’s essential to remain cautiously optimistic.

On December 12th, when OKX announced they would list the GOAT/USDT trading pair, the price of GOAT tokens increased by around 17%. This news has added to the token’s ongoing recovery from a recent steep decline, sparking optimism for even more growth.

As a crypto investor, I’m observing signs that suggest our digital asset, GOAT, is gearing up for some positive movement. Two key metrics, the Average Directional Index (ADX) and Relative Strength Index (RSI), are indicating a build-up of momentum, hinting at potential bullish activity. The upcoming days are crucial as they could determine if this listing propels GOAT to surpass resistance levels and potentially reach prices above $1.

GOAT Listing Announcement Could Spark New Surge

On December 12th, OKX announced they would list their USDT spot pair for GOAT, causing the price to surge approximately 17%. With the meme coin already rebounding from a previous correction, further gains could be possible if certain indicators perform favorably in the coming days.

On December 10th, GOAT’s ADX (Relative Strength Index) climbed above 32, suggesting the intensity and durability of a substantial downtrend that led to a 40% price drop over a mere three-day period. Despite this steep correction, GOAT continues to be the largest meme coin originating from Pump.fun in terms of market capitalization.

During that specific timeframe, I observed a significant decline, which was primarily driven by intense selling activity. Additionally, the Average Directional Index (ADX) suggested robust and enduring bearish momentum throughout this duration.

The Average Directional Index (ADX) evaluates the intensity of a trend without taking its direction into account. A value less than 20 signals a feeble or absent trend, whereas values exceeding 25 suggest a robust trend.

Should this trend continue to intensify, the potential for a brief resurgence in GOAT’s price might increase as optimistic sentiment grows. However, given the moderately low Average Directional Index (ADX) value, it suggests that the emerging trend is still in its infant stages and requires additional validation before becoming more definitive.

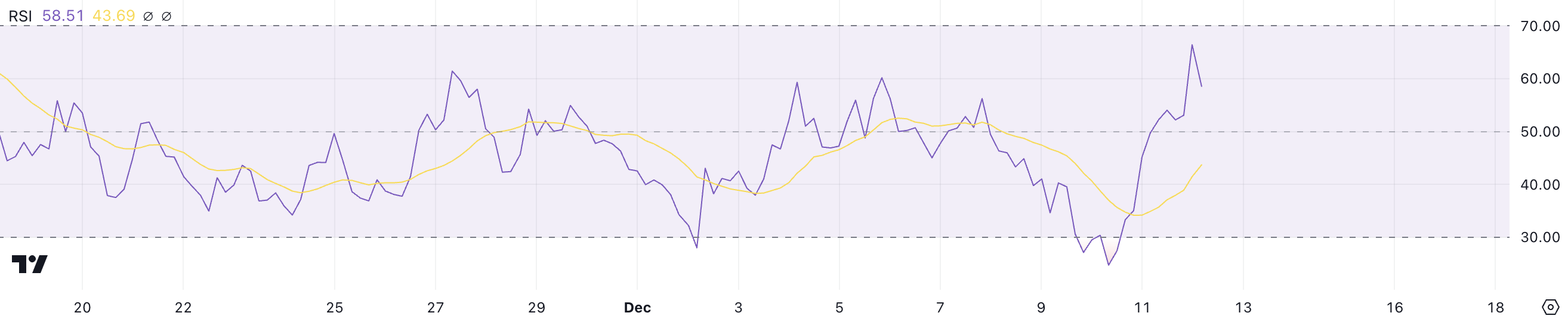

GOAT RSI Isn’t In The Overbought Zone Yet

On December 10, the Relative Strength Index (RSI) of the GOAT reached 24, suggesting an oversold state following intense selling activity. Yet, it has since rebounded to 58.7, implying a move towards neutral territory, which suggests that the selling pressure is lessening and the coin is recovering its balance as buying activity resumes. In other words, this change indicates that the momentum for selling has slowed down, while the coin is regaining its footing with increased buying interest.

The Relative Strength Index (RSI) is a tool that analyzes the rate and size of price fluctuations to determine if an asset is either overbought or oversold. If the RSI value falls below 30, it usually signals an oversold situation, which may present good chances for buying since the asset might be undervalued. Conversely, when the RSI exceeds 70, it typically indicates that the asset is overbought, possibly leading to increased selling activity due to its inflated price.

GOAT’s Relative Strength Index (RSI) stands at 58.7, suggesting it’s moving toward a bullish zone, yet it hasn’t quite reached the overbought area just yet. This position might mean there’s potential for more price increases in the near future if buying interest sustains the ongoing recovery.

GOAT Price Prediction: Levels Above $1 Are Hard, But Not Impossible

At present, the price of GOAT is moving within a defined range. It’s been supported at around $0.65, but it’s encountering significant resistance at approximately $0.87. If this resistance can be breached, we might see the price rise to challenge $0.95. A successful break above that level could propel GOAT towards a new high of $1.27 in weeks, marking its first such increase in quite some time.

Making such a move could indicate a significant increase of around 70% if it continues, suggesting robust positive momentum, or in other words, a very optimistic outlook for further growth.

Maintaining the $0.65 level as a support is vital to keep the present upward trend going. If we can’t manage to uphold this level, it may lead to GOAT falling below $0.6, suggesting possible vulnerability.

Keeping an eye on its Exponential Moving Average (EMA) lines is crucial too, as the shortest EMA is about to perform a bullish crossover. In case this crossover happens, it might serve as a trigger for a significant increase, thereby enhancing the chances of breaching resistance levels and maintaining the upward trend.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-13 00:35