As a seasoned researcher who has witnessed countless market trends and cycles, I can’t help but feel a mix of excitement and caution when analyzing GOAT‘s recent performance. On one hand, it’s impressive to see such an astronomical rise within a month, breaking into the $1 billion market cap and securing its place among the top 10 meme coins. However, the recent shift in BBTrend and RSI indicators suggest that we might be witnessing the early stages of a correction.

In the past month, the price of GOAT has surged an impressive 214.29%, propelling it into the $1 billion market capitalization club and solidifying its spot as the 10th largest meme coin. It currently holds a position slightly above MOG, with the latter not far behind in the rankings.

As a crypto investor, I’ve noticed some signs pointing towards a possible slowdown in GOAT’s upward trajectory, which leaves me pondering if this surge can continue or if a correction might be imminent.

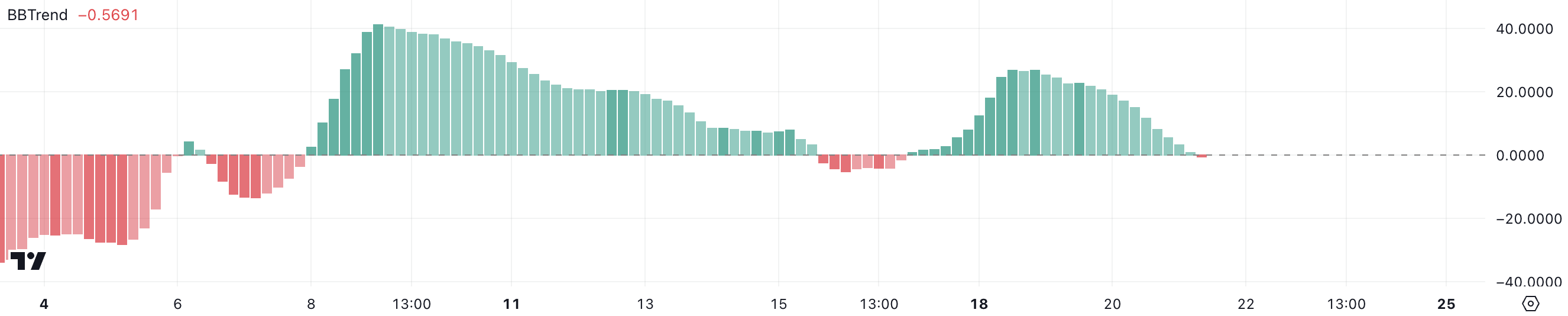

GOAT BBTrend Is Negative For The First Time In 4 Days

For the first time since November 17th, the BBTrend GOAT has dipped below zero, currently standing at -0.54. This change indicates a growing influence of bearish trends, as the initial uptrend of the asset appears to be softening or reversing.

BBTrend measures the strength and direction of price trends using Bollinger Bands, with positive values indicating an uptrend and negative values signaling a downtrend. A negative BBTrend reflects increased downward pressure, which could indicate the start of a broader market shift.

GOAT has had an impressive November, gaining 61% and reaching a new all-time high on November 17.

On the other hand, if the unfavorable BBTrend continues and intensifies, it might suggest a possibility for additional downward pressure or bearish continuation.

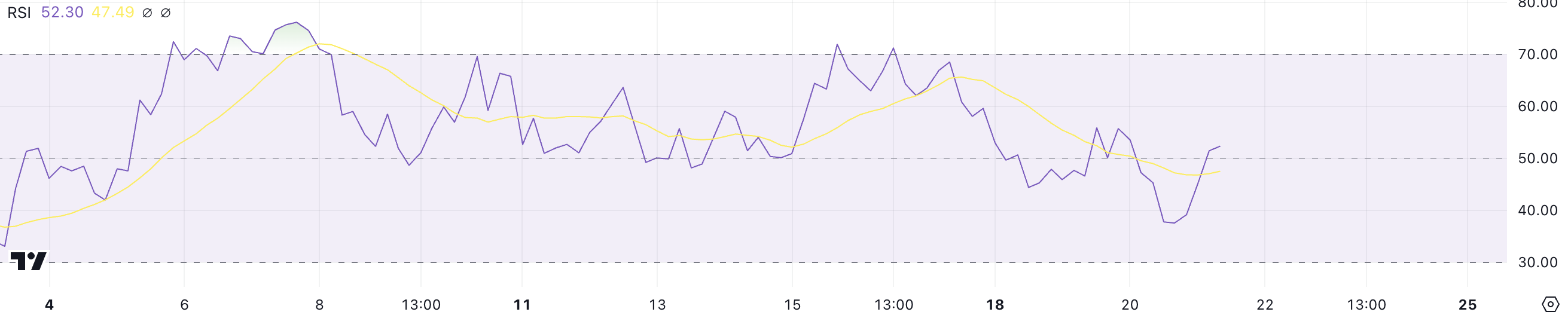

GOAT Is In A Neutral Zone

The RSI of the GOAT (Greatest of All Time) has dipped to 52, a decrease from more than 70 just a few days ago when it hit its record high. This decrease suggests that the buying fervor has begun to subside, and the market has shifted out of the overbought territory.

As a researcher, I’m observing a trend where the decrease in value seems to indicate a move towards a more balanced emotional stance among traders, as they consolidate their recent gains. The intense bullish pressure that was prevalent earlier appears to be easing off.

The Relative Strength Index (RSI) gauges the intensity and speed of price fluctuations, where numbers above 70 denote overbought conditions, and values below 30 suggest oversold situations. As for GOAT, its RSI currently stands at 52, placing it in a neutral region; neither indicating robust bullish nor bearish trends.

In simpler terms, this suggests that the ongoing increase in price might be weakening, which could lead to a period of no significant change or movement in the opposite direction, unless fresh demand pushes the price up again.

GOAT Price Prediction: A New Surge Until $1.50?

Should the ongoing upward trend of GOAT gain momentum once more, it might challenge its previous record peak of around $1.37, thus surpassing a capitalization of $1 billion, a significant benchmark that places it among the most prominent meme coins currently available in the market.

Reaching beyond the current level might trigger additional increases, possibly reaching values around $1.40 or even $1.50, suggesting a resurgence of buying power and investor trust.

On the other hand, signs such as RSI and BBTrend suggest that the upward trend might be weakening. If a downward trend occurs, the GOAT’s price may touch its nearby support levels around $0.80 and $0.69.

If these levels don’t maintain their strength, there’s a possibility that the price might drop even more, possibly hitting approximately $0.419. This could potentially threaten its current spot among the top 10 largest meme coins.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-21 19:51