The ticker for GlobalFoundries (GFS) performed a most undignified plummet today, descending some ten and three-tenths percent into the financial ether. One observes this, naturally, with the detached curiosity one reserves for a particularly clumsy beetle attempting flight.

Their missive, delivered this morning, boasted of earnings exceeding expectation – a minor triumph, to be sure, yet one often finds such boasts a prelude to a deeper, more unsettling disappointment. It appears demand has been… *shifted*, shall we say, expedited from the subsequent quarter, leaving the third quarter looking rather desolate, failing to meet the anticipations of those who spend their days conjuring figures from thin air.

A Motley Collection of Markets

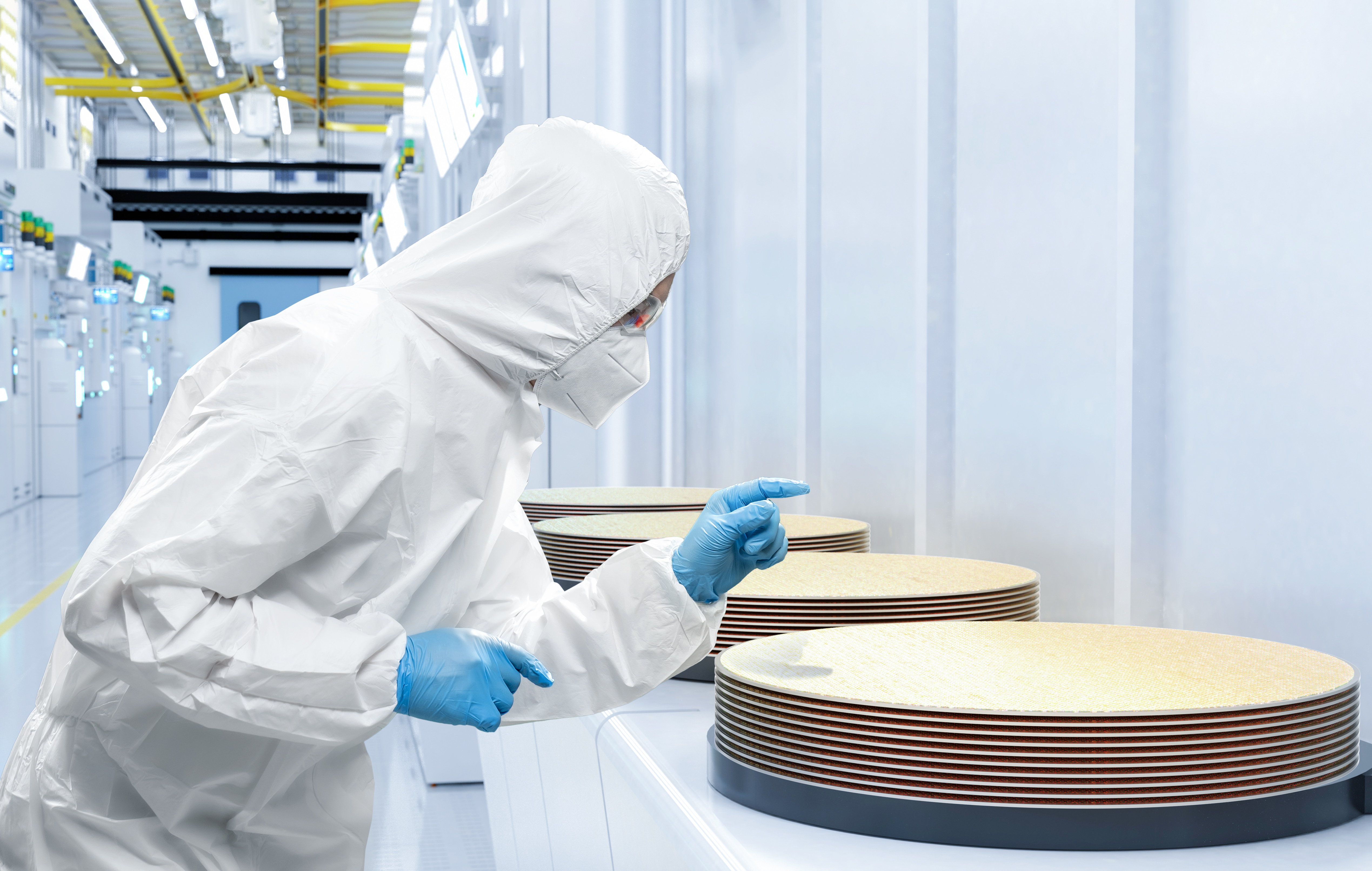

GlobalFoundries occupies itself with the fabrication of “specialty” semiconductors – those imperfect chips, not quite at the glorious pinnacle of progress, yet still required by a sprawling and rather demanding populace. They cater to the fancies of those who construct consumer trinkets, equip automobiles with their peculiar necessities, populate the realm of “Internet of Things” (a phrase that evokes a surprisingly melancholy image of discarded gadgets), and, in a small, almost apologetic corner, even serve the great, humming data centers.

In the last quarter, they managed an increment of 3.4%, climbing to $1.69 billion in revenue. Their earnings per share, adjusted for…well, adjustments, reached $0.42, a modest increase of eleven percent. Analysts, those oracles of the marketplace, declared themselves, momentarily, content.

Yet lurking beneath this placid surface lies a current of disquiet. Growth in automobiles and those mysterious data centers was indeed gratifying. Even those “Internet of Things” contraptions showed a flicker of life. But alas, their largest patronage – the realm of consumer electronics – continues its slow decline, sinking by a regrettable ten percent. One can almost hear the tiny lamentations of obsolete devices.

And improvement, it seems, is not presently on the horizon. Their prognosis for the third quarter offers a mere $1.68 billion in revenue and $0.42 in adjusted earnings per share – a slight contraction, and a profound disappointment to those who rely on prophesy. It appears they are anticipating less, accepting less, *expecting* less. A curiously passive stance, is it not?

Mr. Tim Breen, their chief executive, expressed a degree of placidity, noting their endeavors to “broaden the long-term value proposition.” A phrase redolent with the scent of committees and vague promises. One wonders if he, too, observes the beetle with a knowing smile.

A Geopolitical Necessity, If a Rather Drab One

GlobalFoundries, being a fabrication facility situated within the United States, exists less as a beacon of innovation and more as an uncomfortable contingency. A shield, if you will, against the potential disruptions that might emanate from the East. A rather inelegant hedge against geopolitical storms. Though, one suspects, a necessary one.

The price, thankfully, has begun to reflect this reality, nearing historical lows. The shares currently trade at a multiple of twenty times this year’s anticipated earnings, a respectable enough figure, and a more lenient fourteen and a half times earnings for 2026. A bargain, perhaps, for those prepared to appreciate a utility rather than a spectacle.

One might not find excitement here, but sometimes, stability is its own peculiar reward. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-06 03:16