As a seasoned researcher with a penchant for precious metals and global financial markets, I find these latest trends in gold ETF investments intriguing. With over two decades of observing market dynamics, it is not often that we see such consistent inflows across all major regions since April 2022. The political uncertainty, expectations of easing monetary policy, and declining bond yields seem to have sparked a renewed interest in gold as a safe-haven asset.

Based on a report by Ernest Hoffman for Kitco News, there were substantial investments into global gold exchange-traded funds (ETFs) last month, representing the largest influx since April 2022. The majority of these investments came from North American and European ETFs. According to data provided by the World Gold Council (WGC), a total of $3.7 billion was invested into gold-backed ETFs in July, making it the third consecutive month with inflows.

As a crypto investor, I’ve noticed an interesting trend: Kitco reports that all regions have been contributing positively, but Western gold ETFs have made the most substantial impact. The accumulation of these inflows, coupled with a 4% surge in gold prices, has propelled global assets under management (AUM) to an unprecedented high of $246 billion by the end of July. This growth was accompanied by a significant increase of 48 tonnes in collective gold holdings, bringing the total to a staggering 3,154 tonnes.

In North America, Kitco reported that funds poured approximately $2 billion into the market in July, counteracting the minor withdrawals from May and June. This surge was fueled by investors seeking safety due to political instability and anticipation of more lenient monetary policies after remarks made by US Federal Reserve Chair Jerome Powell. However, North American gold ETFs have collectively experienced a net outflow of $2.9 billion so far this year, with a decline in holdings amounting to 52 tonnes.

For the third consecutive month, Europe experienced an influx of funds, with a total of $1.2 billion invested in July, as reported by Kitco. This growth was primarily fueled by a decrease in bond yields and anticipation for additional monetary relaxation from both the European Central Bank and the Bank of England. Consequently, the Assets Under Management (AUM) of European gold ETFs increased by 12%, reaching a value of $103 billion.

As a researcher, I’ve been tracking the trends in global gold exchange-traded funds (ETFs), and it’s evident that Asian funds have been consistently pouring money into these markets. Notably, India is spearheading this trend. This year alone, Asian gold ETFs have seen an impressive $3.6 billion inflow, making them the region with the highest inflows among all global counterparts. The total Assets Under Management (AUM) for these funds has also hit a new record high of $15 billion.

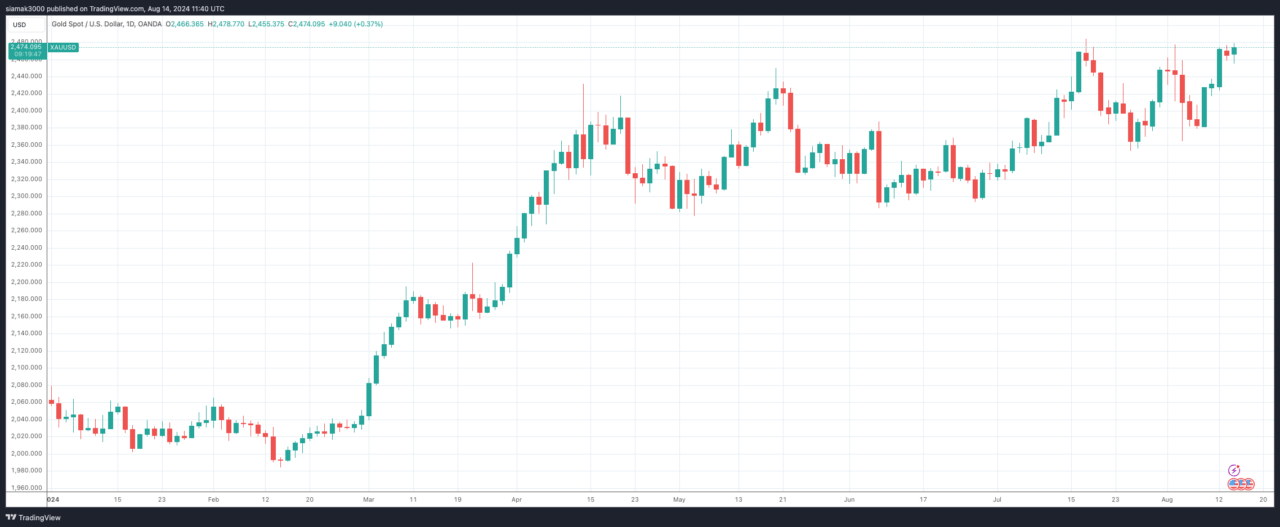

At 11:40 a.m. UTC on August 14, gold was being exchanged at $2,473.23, marking an increase of 0.42% for the day. Gold previously hit its record high of $2,483.74 on July 17.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2024-08-14 14:56