As a seasoned crypto investor who has witnessed the ebb and flow of countless digital assets, I can confidently say that the recent turn of events for Gifto is a stark reminder of the wild west nature of this industry. The delisting by Binance, followed by the allegations of a token dump, has left many investors, including myself, questioning the integrity of the project and its team.

Due to its recent decision to release and flood the market with GFT tokens, Gifto is encountering resistance. Binance made an announcement on November 26 stating that they will remove the GFT/USDT trading pair from their platform as of December 10, 2024.

The removal of eight altcoin trading pairs from Binance’s platform (which is part of a larger decision by Binance), has already created ripples throughout the cryptocurrency market.

Gifto’s Controversial GFT Token Dump

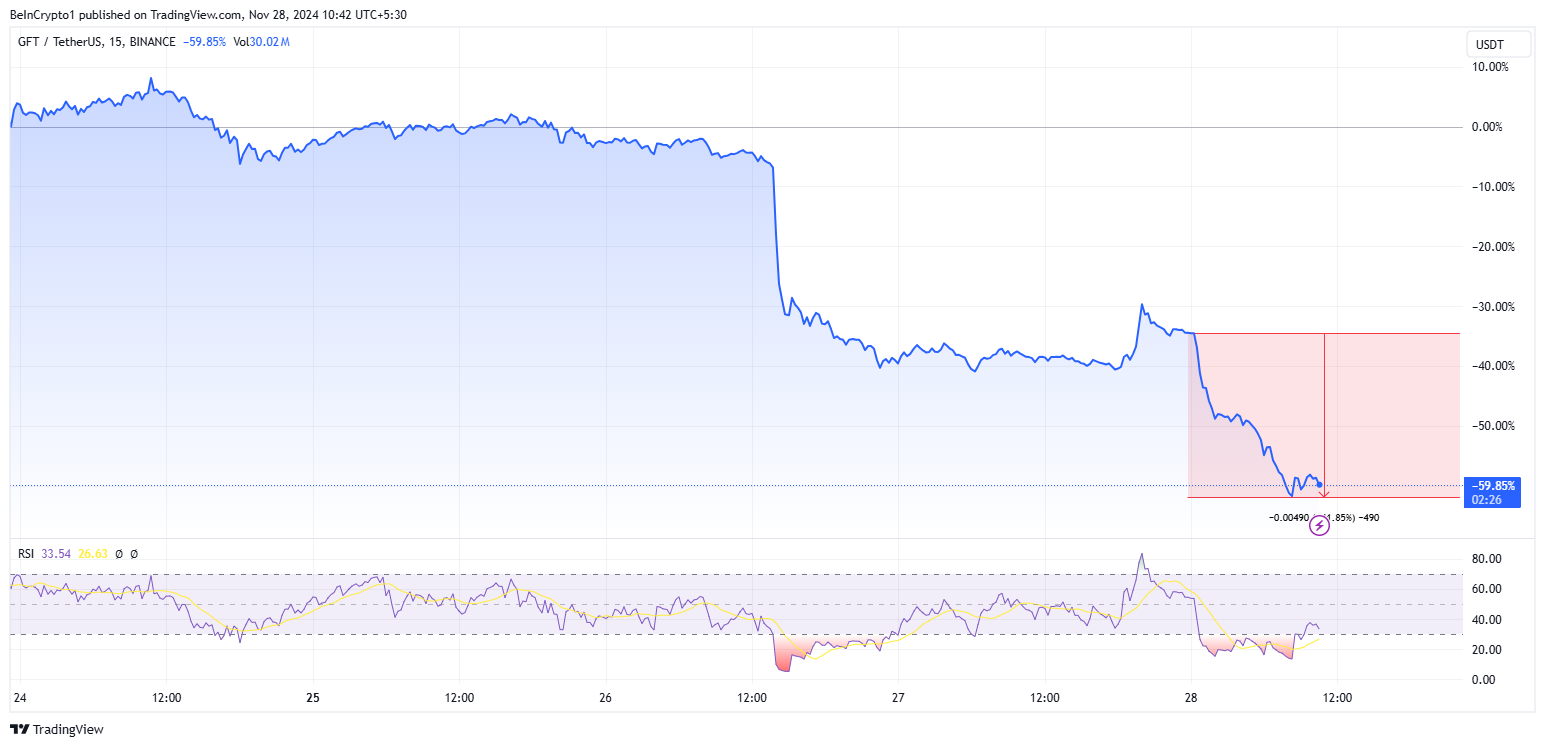

Following Binance’s decision to delist the GFT token on Tuesday, there was a quick and dramatic fall in its value. This steep drop, which can only be explained by a significant loss of investor trust, amounted to roughly 25%. As is common with such delistings from prominent exchanges like Binance, this move sparked widespread panic selling due to reduced liquidity and accessibility to the asset.

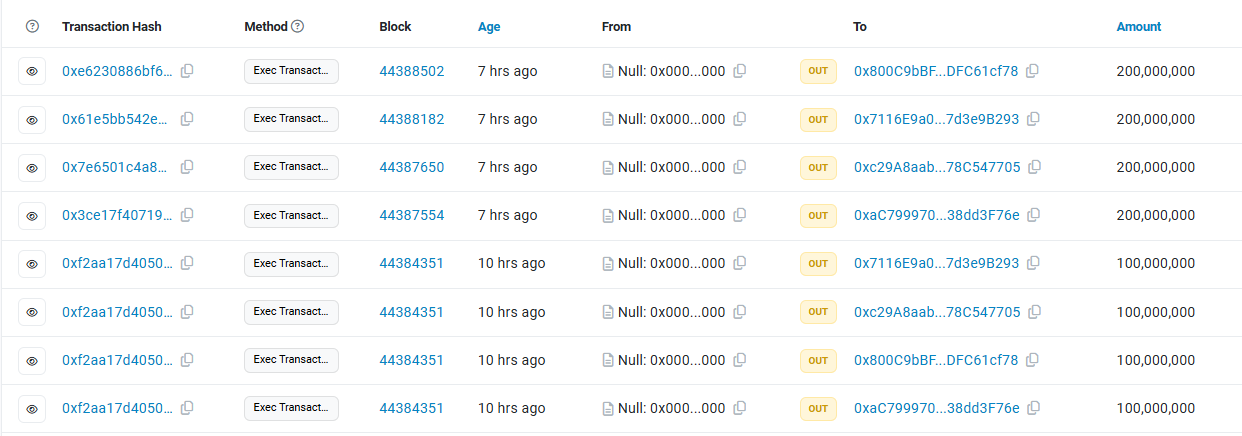

On Thursday, the Web3 data analysis tool Lookonchain accused Gifto of a major token dump. Based on blockchain analysis provided by the firm, the Gifto team reportedly minted approximately 1.2 billion GFT tokens, worth around $8.6 million, within an eight-hour period. Subsequently, these newly created tokens were transferred to exchanges, which appeared to coincide with a concerning 40% decrease in the market value of GFT.

On November 26th, Binance stated that they would remove the trading pair for GFT on December 10th, 2024. Within the past 8 hours, the Gifto team minted a staggering 1.2 billion GFT tokens worth approximately $8.6 million and transferred them to exchanges. It’s possible that these tokens were sold quickly by the Gifto team, leading to a steep drop in the price of GFT – down around 40%. According to Lookonchain, this is the current situation.

The coordinated selling of a cryptocurrency at a strategic moment is drawing skepticism and criticism within the crypto community. Many view this move as a tactical way to cash out, which deepens doubts about the token’s integrity. A user on platform X (previously Twitter) has expressed disapproval over Gifto’s actions.

The action of removing a project from a platform and distributing tokens among holders, which is reminiscent of traditional web2 practices, is being criticized here as an underhanded tactic. This underscores the importance of decentralized projects that can’t employ such exit strategies. Let’s focus on authentic DeFi instead.

Broader Implications of Binance Delistings

Binance’s decision to delist GFT and seven other altcoins reflects a growing trend in the cryptocurrency space. Exchanges continuously evaluate and remove underperforming or problematic tokens. The assets set to be delisted alongside Gifto include IRISnet (IRIS), SelfKey (KEY), OAX (OAX), and Ren (REN).

Removing a token from an exchange can have significant impacts on its value. Immediately, there might be a drop in price, but the effects go beyond just that. The token may experience reduced liquidity, which makes it harder for buyers and sellers to trade. This can also lead to a loss of market confidence due to fewer transactions happening. Moreover, potential investors could find it difficult to enter the market because of these factors. In severe cases, the long-term future of the token might be called into question as it loses the exposure and trading activity that platforms like Binance offer.

The situation surrounding Gifto is particularly challenging due to the double blow of delisting and the questionable token sell-off. This turbulence has left its user base in a state of confusion. Typical investors, who usually act late in market changes, are at a disadvantage as prices drop rapidly and significant token holders liquidate their assets.

As a researcher immersed in the dynamic world of cryptocurrency, I’ve come to realize that the ongoing Gifto incident serves as a stark reminder of the critical vulnerabilities inherent within our ecosystem. The concentration of control over token creation and distribution can potentially lead to situations such as this one. When trust is compromised, it’s often retail investors who end up shouldering the consequences of questionable decisions.

This episode offers a lesson about the potential dangers of relying too heavily on tokens tied to centralized exchanges. As decentralized finance (DeFi) and decentralized trading platforms (DEXs) gain popularity, there’s increasing support for more transparent and robust solutions. For those holding GFT, the future remains uncertain, with December 10th being a significant date to keep an eye on.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-11-28 09:22