The rain hadn’t let up in three days. I sat in my office overlooking the exchange, watching traders shout like extras in a gangster picture. The markets whispered promises they rarely kept. That’s when I reached for the VEA and SPDW prospectuses. Old friends. Both cheaper than a dive bar whiskey, both tracking developed markets like a detective shadows a two-timing husband.

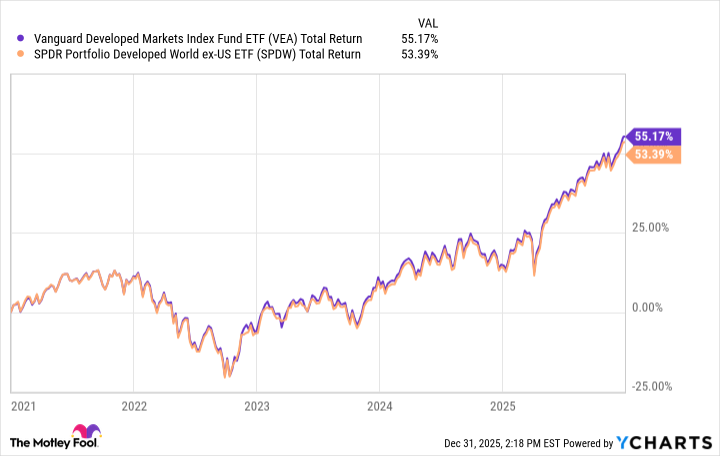

VEA’s got more assets than a widow’s inheritance – $260 billion to SPDW’s $33.5. Same 0.03% fee, but VEA’s yield’s higher, if you’re into that sort of thing. Both funds twitched like corpses in a morgue when the market coughed – betas of 1.03 and 1.06. Five years back, they’d both taken bullets: SPDW down 30.23%, VEA 29.71%. Close enough to call it a tie in a knife fight.

Numbers Don’t Lie (Much)

| Metric | SPDW | VEA |

|---|---|---|

| Issuer | SPDR | Vanguard |

| Expense ratio | 0.03% | 0.03% |

| 1-yr total return | 35.2% | 35.9% |

| Dividend yield | 2.3% | NA |

| Beta | 1.03 | 1.06 |

| AUM | $33.5B | $260.0B |

Beta’s a drunkard’s measure – how much you stagger compared to the S&P 500. Five-year weekly returns tell the tale.

They both invest like accountants with a taste for danger – market-cap weighted, unhedged, no funny business. VEA’s got 3,864 stocks, SPDW 2,390. Same cocktail party crowd: ASML, Samsung, AstraZeneca. SPDW’s just a little more European – Roche, Novartis, Nestle. The sort of companies that take their tea at 4 and their profits in Swiss francs.

Portfolio Breakdown

| Metric | SPDW | VEA |

|---|---|---|

| Max drawdown (5 y) | -30.23% | -29.71% |

| Growth of $1k (5 yrs) | $1,302 | $1,308 |

The Long Game

VEA’s median holding’s worth $51 billion – skyscrapers in Tokyo, London towers. SPDW’s $768 million median? More like back-alley betting parlors. Five years ago, both took a bullet through the shoulder. VEA limped to $1,308 from $1k. SPDW managed $1,302. A difference of six bucks. Buy me a drink and we’ll call it even.

These aren’t love stories. They’re business propositions. Put your money in either and you’re buying a piece of every major exchange house except the New York skyline. Hedge against Uncle Sam’s next temper tantrum. Diversify like you’re walking a tightrope with a hangover.

Streetwise Dictionary

ETF: Bulletproof vest for your portfolio. Trades like a stock, holds like a diversified grudge.

Expense ratio: The vig the house takes for letting you play.

Dividend yield: The tab your broker picks up after a winning hand.

Beta: How much your sleep gets interrupted when the market snores.

AUM: The weight of the gold in Fort Knox’s little brother’s vault.

Max drawdown: How far you fall when the rug gets yanked.

Market-cap: The size of the shark in the pond.

Liquidity: Can you get out of the room when the lights go black?

Choose your poison. Both funds play the same tune on different pianos. I’d split my stake and keep the change for whiskey. 🕵️♂️

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-31 22:44