March 2025: A Month of Altcoin Madness!

As we approach the end of February, the world of Real-World Asset (RWA) altcoins is heating up. ONDO is attempting a recovery after a sharp decline, while TRADE struggles at its lowest levels since November 2023. Meanwhile, OM is surging to new all-time highs, solidifying its position as a dominant force in the RWA ecosystem. XDC is showing signs of a rebound after trading below $0.1, and BKN is gaining momentum with a 20% increase, driven by its asset tokenization platform.

ONDO: The Rollercoaster Ride

ONDO has been down almost 20% in the last seven days, although it’s attempted a recovery in the last 24 hours. Its market cap now stands at $3 billion, a significant drop from the more than $5 billion it reached in the last days of January. Even with this correction, ONDO remains one of the biggest RWA coins, although Mantra recently surpassed its market cap.

If ONDO can regain its momentum from previous months, it could test the resistance at $1.09. Breaking through this level could see it rising to $1.25 next, and if the uptrend gains enough strength, it might even reach $1.44. This potential rally could be fueled by ONDO’s stronghold in tokenized credit markets, a dominance noted by Dave Rademacher, Co-Founder of OilXCoin, who emphasized ONDO’s strategic position.

“ONDO has carved out a dominant role in tokenized credit markets, securing backing from major players,” Rademacher told BeInCrypto.

TRADE: The Struggling Underdog

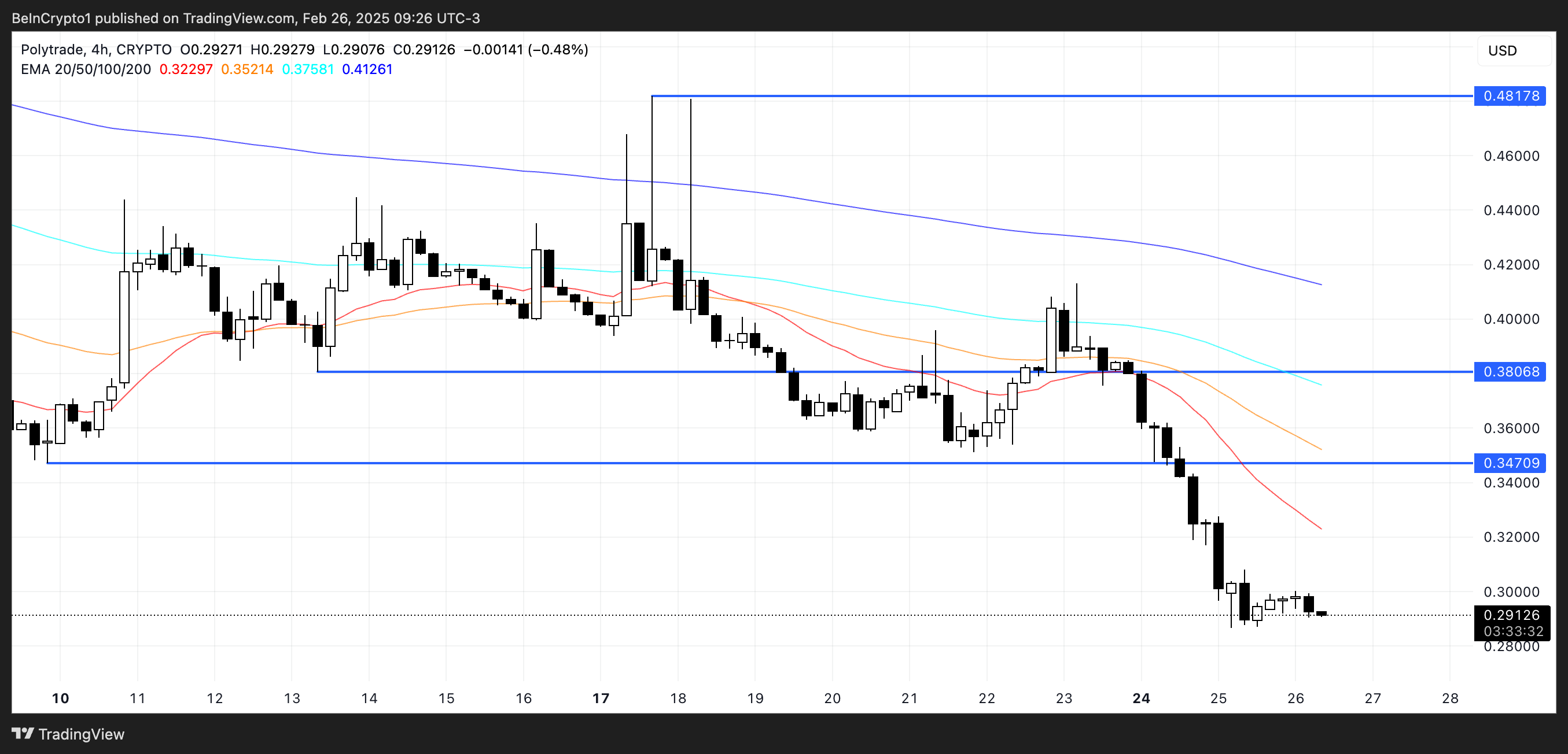

TRADE is down more than 43% in the last 30 days, with its market cap now standing at $12 million. It is currently trading at its lowest level since November 2023, reflecting a significant loss in momentum. Polytrade offers a platform for users to find, buy, and trade RWA assets across more than 10 chains. According to their website, the marketplace hosts over 5,000 assets.

If TRADE can regain an uptrend, it could test resistances at $0.34 and $0.38. If the bullish momentum is strong enough, breaking through these levels could push TRADE to as high as $0.48. Although Polytrade remains a small player and a few major players dominate the RWA ecosystem, there is considerable room for disruption coming from other players. Pat Zhang, Head of WOO X Research, highlights this potential:

“Leading RWA projects will likely evolve into infrastructure, while innovation in RWAFi will drive new opportunities. The biggest players are positioned to maintain dominance, but challengers will continuously push for disruption. Whether market share remains concentrated or becomes more distributed will depend on the pace of innovation and overall RWA growth,” Zhang told BeInCrypto.

OM: The Unstoppable Force

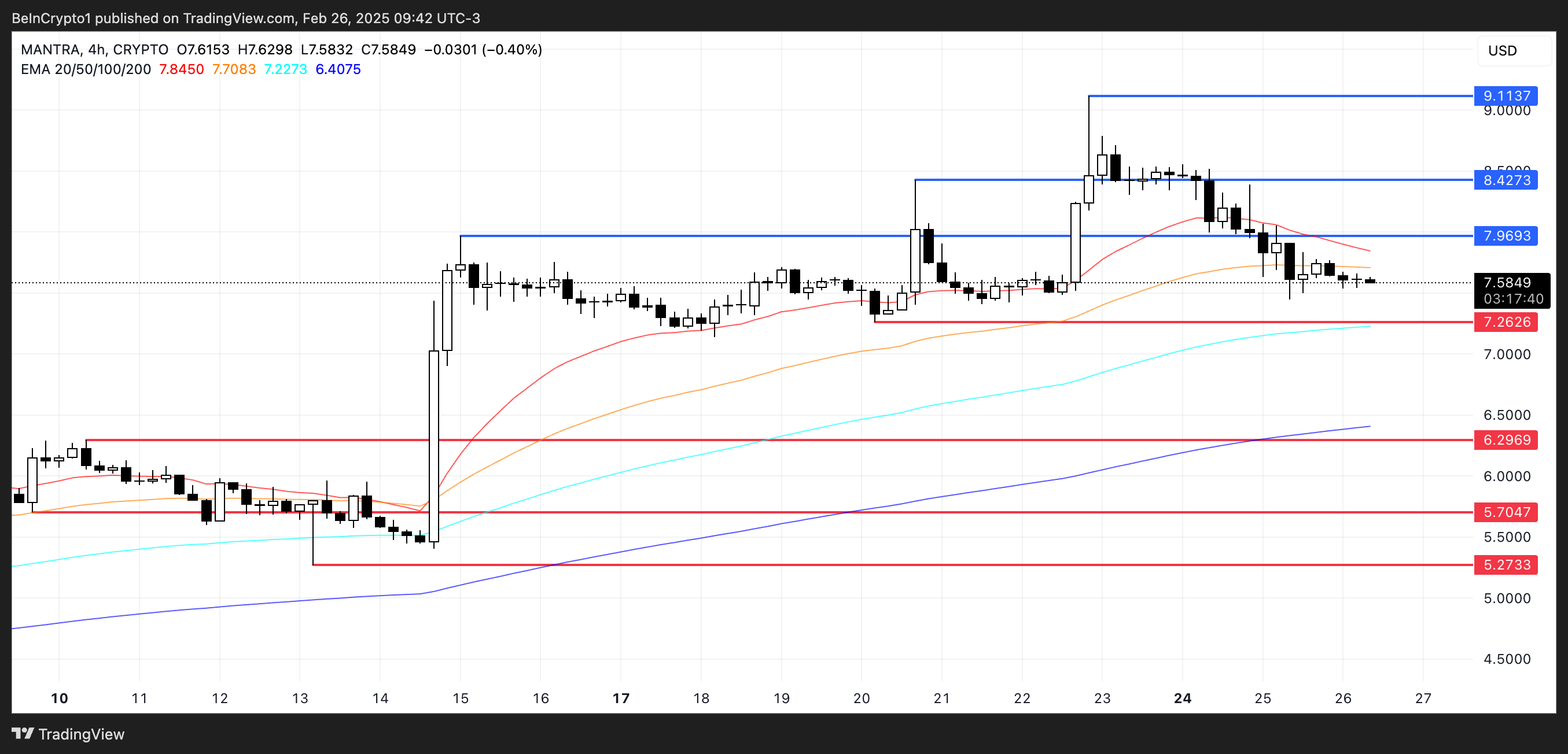

OM is the clear winner in the RWA ecosystem over the last 30 days, with its price surging nearly 60% and its market cap reaching a new all-time high of $8.66 billion on February 22. This impressive rally has positioned OM as a dominant force within the sector, attracting significant attention from investors. However, despite this momentum, questions remain about its sustainability.

If OM’s uptrend continues, it could test the resistances at $7.96 and $8.42. Breaking through these levels could push OM to new highs above $9 for the first time, solidifying its position as a leader in the RWA space. However, if the momentum fades, OM could test the support at $7.26, and if that level is lost, it could decline further to $6.29. In the event of strong selling pressure, the price could drop as low as $5.70 or even $5.27.

“OM has strong momentum, but its sustainability is uncertain. Quantitative firms like Manifold Trading accumulated OM at lower prices, and if they take profits, the price could decline sharply. OM’s long-term growth depends on whether these early large-scale buyers hold or exit,” said Zhang.

XDC: The Resilient Challenger

XDC is a mainnet that powers some of the most relevant RWA applications in the market. Despite trading below $0.1 for the last two weeks, it made a strong rebound attempt in the last 24 hours, showing signs of renewed momentum. However, XDC price is still down roughly 14% over the last 30 days, reflecting the broader market’s volatility.

With this recent rebound, XDC’s market cap is back above $1.3 billion, signaling that investor interest remains strong.

If the uptrend continues, XDC could test the resistance at $0.098. Should this level be broken, XDC could push above $1 again, potentially sparking a more sustained rally. However, if the previous downtrend resumes, XDC could test the first support at $0.072. If this support is lost, the price could decline further to $0.059.

BKN: The Tokenization Trailblazer

Brickken is a platform for asset tokenization, with more than $250 million in Total Tokenized Value. It allows companies to tokenize franchises, real estate, venture capital, and more. As institutions increasingly enter the RWA ecosystem, regulation is expected to play a pivotal role in shaping its future.

“Regulatory uncertainty has been the biggest anchor holding back institutional adoption of RWAs in the US. But now, we’re seeing signs that the tide is shifting. Pair that with a new US administration that’s signaling a more pro-crypto stance, and we could be looking at a much-needed regulatory reset,” said Dave Rademacher, Co-Founder of OilXCoin.

Rademacher also pointed out the importance of regulation in addressing sector-specific challenges:

“If multiple jurisdictions create supportive frameworks for RWAs, the sector will diversify, with new entrants competing across different asset classes. In the end, RWAs are shaping up to be more like traditional finance – where a handful of major players lead, but there’s plenty of room for sector-specific challengers.”

BKN has been up more than 20% in the last 24 hours, reaching its highest levels since the beginning of February. If this bullish momentum continues, BKN could rise to test the next resistance at $0.33. Breaking through this level could see it climb to $0.38 and potentially reach $0.43, which would push it above $0.4 for the first time since January 14.

However, if the positive momentum fades and a correction occurs, BKN could test the support at $0.24. If that support is breached, the price could drop to $0.21 or even as low as $0.18, marking its first dip below $0.20 since September 2024.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2025-02-27 02:13