The past year presented itself to those observing the automotive world as a peculiar game, a relentless cycle of challenges emerging only to be temporarily subdued. Affordability, a specter haunting potential buyers, danced with the growing presence of competitors from the East. Trade winds shifted capriciously, and the rapid advance of artificial intelligence—a force both promising and unsettling—complicated matters further. Supply chains, those delicate arteries of commerce, seemed prone to sudden constrictions. Yet, amidst this turbulence, General Motors has offered a report to its shareholders—a quiet assertion of stability and a promise of continued reward.

Despite these headwinds, General Motors has recently announced results for the fourth quarter that surpassed expectations. The message, delivered with a characteristic restraint, is simple: the company intends to continue returning significant value to those who have entrusted it with their capital. It is a narrative of resilience, a testament to the enduring power of established brands in a world increasingly captivated by novelty.

A Fortunate Conclusion

As the year drew to a close, General Motors exhibited a momentum that belied the prevailing uncertainties. Earnings for the fourth quarter exceeded the estimates of those who scrutinize such matters, and the company announced both an increase in its dividend and a new authorization for share repurchases. The dividend, a modest increment of three pennies per share, now stands at eighteen cents—a yield of approximately 0.8%. The repurchase authorization, amounting to six billion dollars, signals a confidence in the company’s future prospects and a willingness to deploy capital strategically.

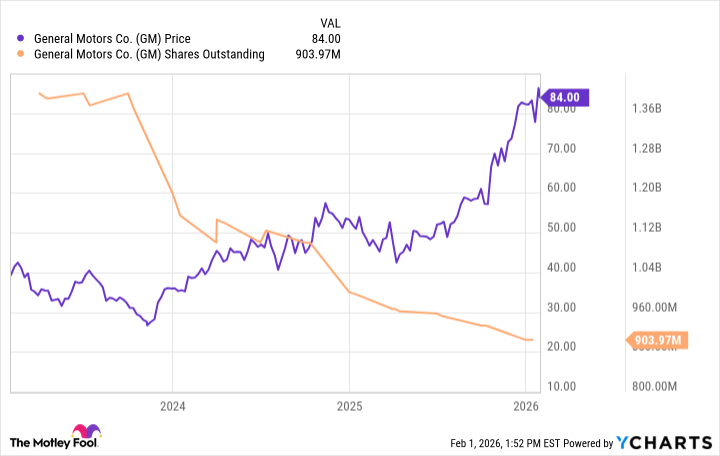

Mary Barra, Chair and CEO of General Motors, spoke of strong brands, winning vehicles, and technology-driven services. She alluded to operating discipline and consistent cash generation—qualities often overlooked in the breathless pursuit of innovation. It is a pragmatic assessment, a recognition that enduring success is built not on fleeting trends but on the solid foundations of sound management and consistent performance. This return of capital to shareholders, while not always prominently displayed, has become a defining feature of GM‘s strategy. Since 2023, the company has announced a staggering twenty-two billion dollars in share buybacks—a reduction in outstanding shares that enhances the earnings power of those remaining.

The Shadow of Adjustment

The fourth quarter was, by most accounts, a strong one for the Detroit automaker. Yet, a shadow lingered. The recent announcement by Ford Motor Company—a special charge of nineteen and a half billion dollars to recalibrate its electric vehicle strategy—had cast a pall over the industry. Investors, accustomed to anticipating such developments, awaited a similar pronouncement from General Motors.

While adjusted earnings—those figures favored by Wall Street analysts—remained unaffected, net income swung to a loss of three and a third billion dollars. This was attributable to special charges—seven and a quarter billion dollars—driven by a realignment of electric vehicle production capacity and investments. It is a necessary adjustment, a response to changing consumer demand and the ever-shifting landscape of policy, trade, and emissions regulations. The market, it seems, is not always rational. Expectations, like delicate blossoms, can wither quickly in the face of unforeseen circumstances.

Despite this considerable charge, the stock price rose nearly nine percent on the day the results were announced—a testament to the enduring appeal of a company that understands the value of returning capital to its shareholders. It is a signal, perhaps, that investors believe this performance to be sustainable—a belief that has prompted an increase in both the dividend and share repurchase efforts. GM’s commitment to rewarding its shareholders—a practice often understated in the clamor for innovation—remains a compelling reason to consider a position in this venerable Detroit automaker. It is a quiet strength, a subtle assertion of stability in a world consumed by change.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

2026-02-06 19:24