The market had a fit over GE Aerospace’s latest numbers. Sold off the stock like it was tainted. Seems the company suggested profit margins wouldn’t exactly leap into the stratosphere. A flatline in a world obsessed with vertical growth. Predictable, really. Investors crave miracles. They rarely get them.

Digging through the rubble, you find a few glimmers. Maybe. It’s a long shot, but a man can hope. Or at least, observe.

Engines and the Ghosts of Spare Parts

GE makes engines. Big, complicated things that strap to airplanes. They sell them at a loss initially. A clever trick, really. Like giving away the razor to sell the blades. For decades, they make money on service agreements, keeping those engines humming. An engine can last a long time. Forty years, sometimes more. Long enough to outlive most marriages.

Airlines used to hoard spare engines. A safety net against delays. A precaution born of paranoia and a healthy dose of Murphy’s Law. Then the supply chains choked. Lockdowns, you see. Suddenly, airlines needed those spares. It was a seller’s market. A temporary fix, of course. Everything is.

The Margin Squeeze

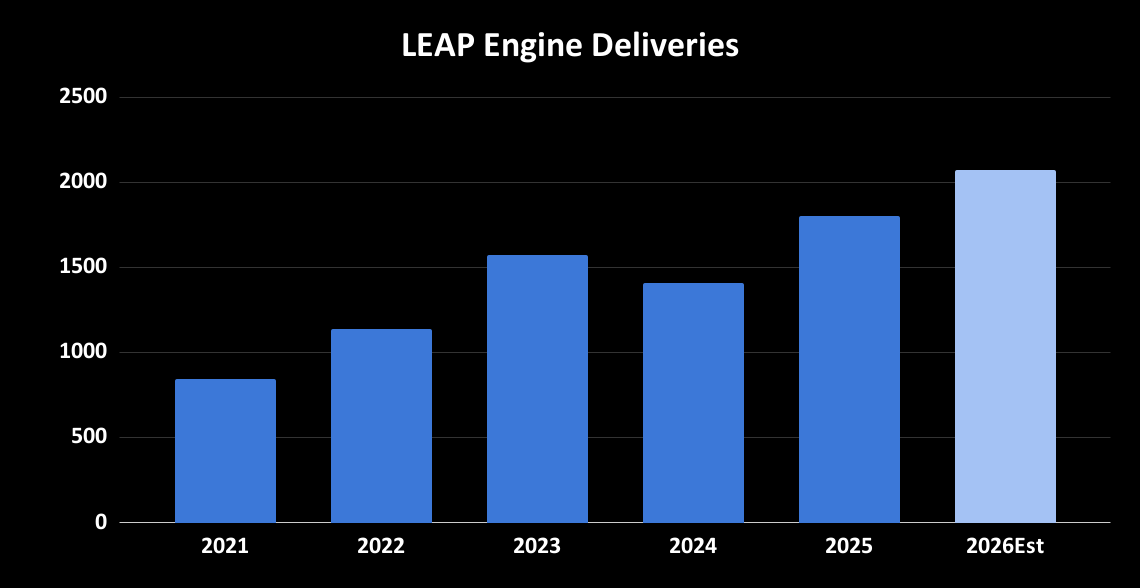

Now the supply lines are easing. Airlines are shedding those extra engines. It’s simple economics. Less demand, less profit for GE. The CFO, a man named Ghai, admitted as much. Margins are “flattish.” A polite way of saying they’re taking a hit. The LEAP engine, their latest model, is ramping up. More installed engines, fewer spares. The math isn’t kind.

The Illusion of Recovery

The market overreacts. It always does. They see a short-term dip and panic. They forget that engines, unlike most things, don’t just disappear. Ghai pointed out that retirement rates are holding steady. Old planes keep flying. That’s good for aftermarket sales. Keeps the repair shops busy. A slow, steady business. Not glamorous, but reliable.

More installed engines mean more flying hours. An engine sitting in a hangar doesn’t earn a dime. It’s a dead weight. The more those engines are used, the more revenue GE generates. It’s a simple equation. A little common sense, really.

They expect LEAP deliveries to increase as the supply chain untangles. A good sign, if you believe in long-term trends. But long-term is a foreign concept on Wall Street. They’re only interested in the next quarterly report.

A Gamble, Not a Sure Thing

The stock isn’t cheap. Forty times earnings. A steep price for a company in a cyclical industry. But the sell-off feels excessive. A knee-jerk reaction to a temporary setback. It’s a gamble, not a sure thing. But sometimes, a man has to take a chance. Or at least, look at the numbers with a cynical eye.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 20 Best TV Shows Featuring All-White Casts You Should See

- Mel Gibson, 69, and Rosalind Ross, 35, Call It Quits After Nearly a Decade: “It’s Sad To End This Chapter in our Lives”

- Umamusume: Gold Ship build guide

- Top 20 Educational Video Games

- Most Famous Richards in the World

- Celebs Who Married for Green Cards and Divorced Fast

2026-01-29 01:02