As a researcher with a background in financial markets and experience following the meme stock phenomenon, I find Keith Gill’s recent moves with GameStop intriguing. His significant increase in shares and the speculation surrounding his call options add fuel to the ongoing volatility of this stock.

As an analyst, I’ve noticed some intriguing developments in the investment activities of Keith Gill, also known as “Roaring Kitty” online. On Thursday, he disclosed an update on his E-Trade portfolio through a post on Reddit’s Superstonk forum. The new data reveals that his holdings in GameStop have significantly grown. He now owns over 9 million shares of the company and over $6 million in cash. This is quite a leap from his earlier disclosure at the beginning of June, where he reported holding 5 million shares alongside 120,000 call options on GameStop.

Call options grant the holder the privilege, not the mandatory action, to buy a certain number of shares at a set price prior to a given expiration date. It’s undisclosed how Gill arrived at his present situation. He could have disposed of all 120,000 call options and employed the proceeds to purchase additional shares or sold some and exercised the remaining early.

According to CNBC’s report, there was a noticeable increase in trading activity for GameStop call options with a $20 strike price and a June 21 expiration date during the afternoon of Wednesday. This surge in trading, combined with a decrease in both GameStop’s share price and the value of these call options, fueled suspicions that Gill might have started selling off his options.

If Gill had chosen to exercise all his call options, it would have cost him approximately $240 million to purchase 12 million shares at a price of $20 each. This sum far surpassed the amount displayed in his E-Trade account. Amidst the ongoing rumors, Gill has yet to address this matter publicly.

By Thursday night, the sum value of Gill’s investments, which encompassed cash, surpassed $268 million, marking an increase from $210 million at the start of the month. On that very day, GameStop’s stock experienced a significant rise of over 14%.

A new report from Fortune adds an intriguing layer to Gill’s trading strategy. The article proposes that Gill may have plans beyond just making profits from his trades. It is suggested that he could be aiming to wield influence over GameStop’s future by pursuing a spot on the company’s board. This theory gains credence as Gill revealed in a recent Reddit post that he has earned $58 million this month, showcasing his substantial financial growth and potential desire for a more active involvement with the company.

As a researcher investigating recent events in the financial market, I came across an intriguing development concerning GameStop’s annual shareholder meeting. Initially scheduled for 11 a.m. ET on Thursday, the event was set to take place via ComputerShare. However, due to an unprecedented influx of interested parties attempting to access the meeting, the event encountered significant technical issues.

As a crypto investor, I’d put it this way: The meeting was about to begin, but it was abruptly halted due to unexpected technical issues. We were told to reconvene at 12:30 p.m. ET on Monday. The representatives from GameStop and ComputerShare apologized for the inconvenience, explaining that their servers had been inundated with an unprecedented amount of traffic.

GameStop disclosed this week that it successfully secured over $2 billion through an equity sale. This windfall comes as a result of renewed market buzz surrounding meme stocks. The corporation intends to employ these resources for various business objectives, which may encompass purchases and investments.

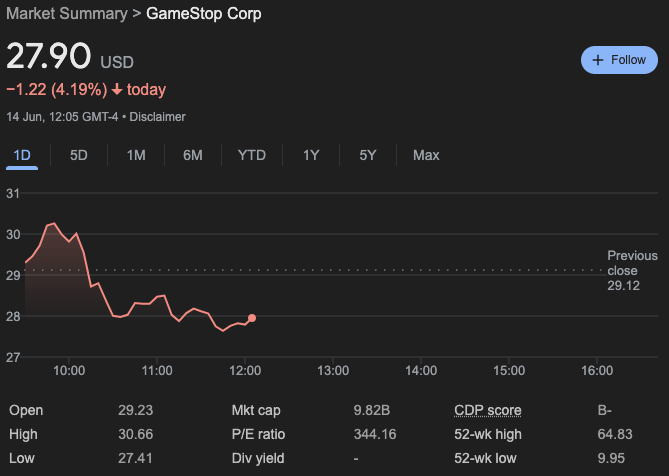

At this moment (11:05 a.m. ET on a Friday), GameStop’s shares are being bought and sold for $27.90 each, representing a decrease of 4.19% in value compared to the previous day.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 9 Kings Early Access review: Blood for the Blood King

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-06-14 19:25