As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find Galaxy Research’s predictions for 2025 both intriguing and plausible. The projected growth of Bitcoin and Ethereum aligns well with my own analysis, and I’m particularly excited about the potential surge in Bitcoin adoption among major corporations and nations.

One can’t help but wonder if the increased competition among nation-states will lead to an international race for digital gold mining, akin to the Space Race of old! Perhaps we might even see a moon-mining base established by 2030, with astronauts moonwalking their way to new Bitcoin blocks.

The forecasted growth of Dogecoin also catches my attention, especially considering its humble origins as a meme-inspired currency. If it can reach $1 and a market cap of $100 billion by 2025, who knows what other unlikely contenders may rise to prominence in the crypto realm!

The evolving stablecoin market is another area I find fascinating. With new entrants offering yield-bearing alternatives, it will be interesting to see how Tether responds and whether they’ll indeed introduce a delta-neutral stablecoin as suggested. The potential for USDC to gain momentum through rewards programs is an exciting development that demonstrates the growing convergence of crypto and traditional financial services.

On the regulatory front, I agree with Galaxy Research’s assessment that while there may be some movement towards examining Bitcoin reserve policies, significant steps may not materialize immediately. However, bipartisan legislation establishing stablecoin regulations in the US is a positive development that could encourage broader adoption of dollar-backed digital currencies and bring greater oversight to the market.

In closing, I find it amusing to think about the day when we’ll look back on 2025 as the year that saw Bitcoin surpassing gold in value and Dogecoin reaching unimaginable heights. It’s a reminder that even the most outlandish predictions can become reality in the world of cryptocurrencies!

Galaxy Research has shared its forecasts about the cryptocurrency market in 2025. The report underscores significant tendencies such as Bitcoin possibly touching a fresh record high and the ongoing growth of the stablecoin sector.

Industry predictions suggest a lively year is on the horizon, as the use of Bitcoin by countries could become more flexible, while Tether’s influence over the stablecoin market may lessen.

Bitcoin and Ethereum to Reach New Heights

According to Galaxy Research’s predictions, Bitcoin is expected to break previous records and attain new heights in 2025. The firm anticipates that the leading cryptocurrency will soar past $150,000 during the first half of the year and continue rising to reach approximately $185,000 by the last quarter.

This increase is likely to be propelled by a rise in acceptance among prominent businesses and countries. The forecast suggests that five companies from the Nasdaq 100 list and five nations are expected to incorporate Bitcoin into their financial assets, primarily due to strategic portfolio diversification and trading transaction requirements.

Galaxy Research posits that rivalry among independent countries, including those with substantial financial reserves and those antagonistic towards the U.S., is likely to spur the development and implementation of strategies for either mining or acquiring Bitcoin.

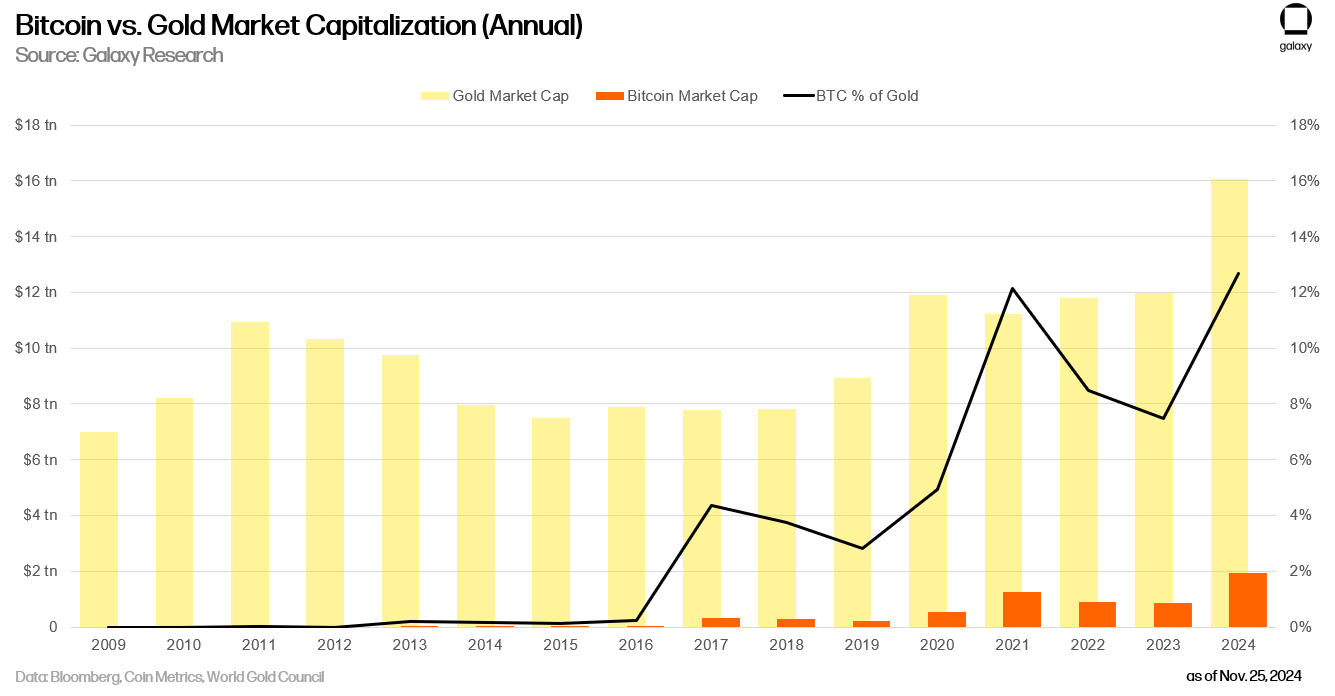

It’s anticipated that Bitcoin will see even more growth in the investment sector. Currently, Bitcoin ETFs based in the U.S. could potentially manage over $250 billion worth of assets, demonstrating Bitcoin’s importance as a significant alternative investment. By 2025, its market value could be comparable to 20% of gold’s current valuation, further cementing Bitcoin as a top-performing investment option.

In simpler terms, it’s anticipated that Ethereum, currently the second most prominent cryptocurrency, has potential for significant expansion. Forecasts predict Ethereum could be worth around $5,500 by 2025, primarily due to DeFi (Decentralized Finance) and staking. Positive regulatory changes are expected to create a conducive environment, potentially increasing Ethereum’s staking participation to over half of all activity and enhancing its overall network activity.

As a dedicated crypto investor, I’m optimistic about the future of Dogecoin. Based on their projections, this digital currency could hit a significant milestone by reaching $1 and a market capitalization of an impressive $100 billion. This bullish outlook is largely due to the strong community backing and continued expansion of its practical uses.

Stablecoin Market to Evolve Further

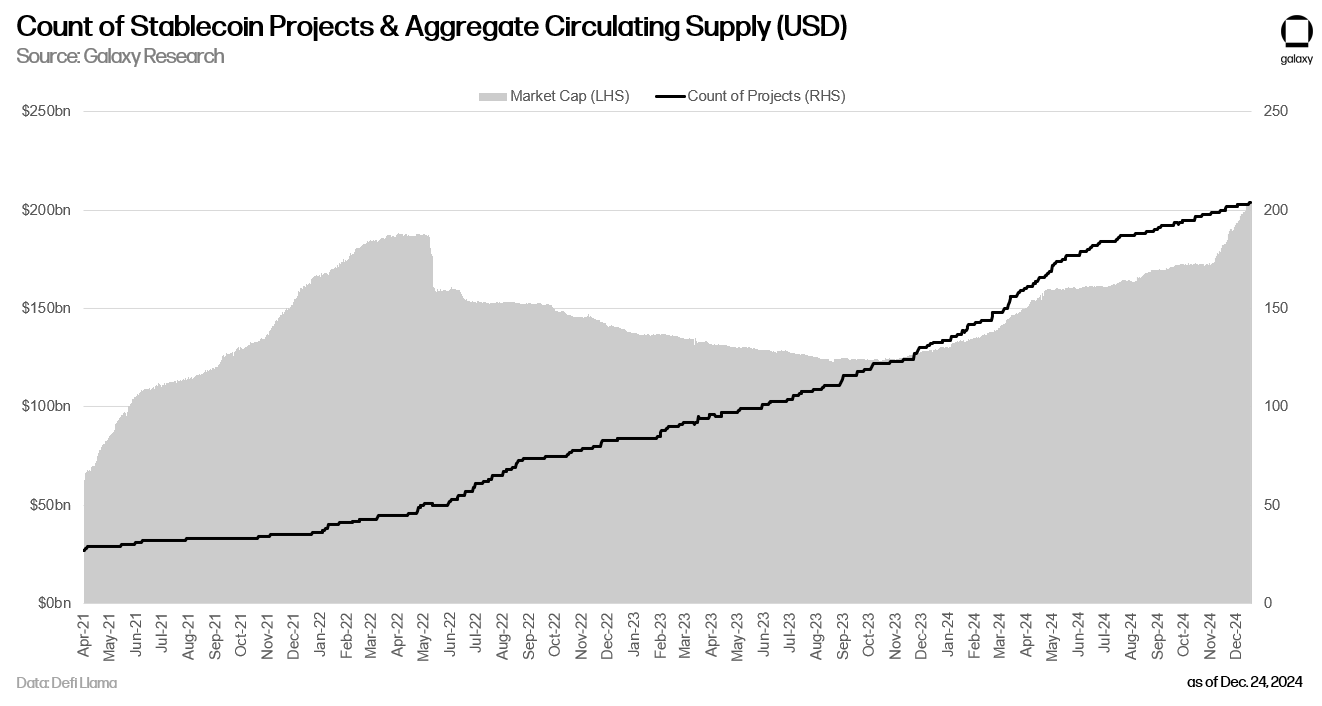

According to Galaxy Research’s forecast, there will be a significant change in the stablecoin industry. The report anticipates that the total supply of stablecoins could exceed $400 billion by 2025, with around ten new stablecoin projects supported by traditional financial collaborations joining the market. These advancements are expected to broaden the applications of stablecoins for transactions, remittances, and settlements.

According to Galaxy’s prediction, the enhancement of regulatory transparency for current stablecoin providers, as well as banks, trusts, and depositories, could result in a significant increase in the number of available stablecoins by the year 2025.

Instead, it’s expected that Tether’s market dominance will decrease below 50% due to the emergence of new competitors offering yield-generating alternatives. These rivals might lure users by distributing a portion of their reserve yields as revenue, forcing Tether to reconsider its approach. The company proposes that Tether could introduce a stablecoin that maintains neutrality with respect to price changes to remain competitive in the market.

It’s expected that USDC will continue to pick up speed due to rewards programs being integrated onto popular platforms such as Coinbase. This approach might greatly increase user acceptance and stimulate the Decentralized Finance (DeFi) sector, showcasing the increasing merge of conventional finance and cryptocurrency.

Policy and Market Structure in Focus

From a regulatory perspective, it’s improbable that the U.S. government will directly purchase Bitcoin, but they might accumulate their current holdings instead. There could be talks about establishing a Bitcoin reserve policy, however, concrete actions might not occur right away.

According to the statement, certain departments and organizations are considering a more comprehensive Bitcoin reserve plan, which might involve changes.

According to Galaxy Research, it’s expected that there will be bipartisan lawmaking in the U.S., aiming to set rules for stablecoins. Such legislation might establish a more robust supervision system and potentially boost the acceptance of digitized dollars among a wider audience.

As an analyst, I find myself acknowledging that the clarification of stablecoins is progressing, yet I can’t help but express concerns about the delay in comprehensive regulatory reforms across the broader cryptocurrency market. This lingering uncertainty in the sector remains a significant issue to navigate.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-28 21:51