As a seasoned researcher with years of experience delving into the complex world of cryptocurrencies and their associated legal battles, I find myself intrigued by this developing situation between FTX, Binance, Crypto.com, and their respective executives. The allegations of fraudulent transactions, undermining strategies, and asset lockdowns are not new to the crypto space, but they certainly add another layer of complexity to an already convoluted industry.

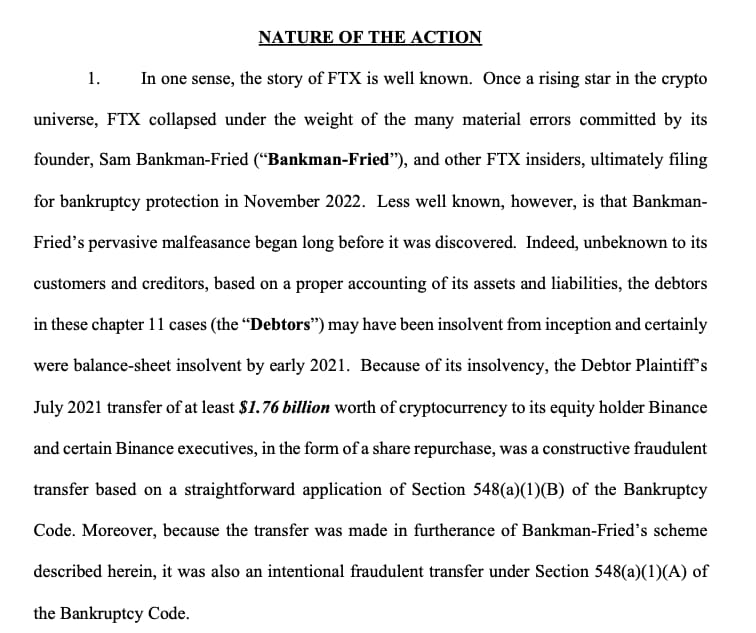

On November 10, 2024, a lawsuit was submitted claiming that Binance and its leadership received approximately $1.76 billion worth of cryptocurrency through a supposedly fraudulent transaction masterminded by FTX’s co-founder, Sam Bankman-Fried.

A company linked with FTX, named Alameda Research, has recently lodged a claim against Crypto.com to access approximately $11 million kept in a Crypto.com account.

On November 7, Alameda Research initiated a lawsuit in the U.S. Bankruptcy Court for the District of Delaware, asking Crypto.com to disburse around $11.4 million from an account linked to “Ka Yu Tin,” an alias related to Alameda’s operations prior to FTX’s bankruptcy. The lawsuit states that Alameda has made several attempts to recover these assets, which they assert are essential for their debt repayment plan, but Crypto.com is reportedly withholding them.

Background of the Allegations

The core of the lawsuit centers on a July 2021 transaction in which Bankman-Fried repurchased approximately 20% of FTX International and 18.4% of FTX US from Binance. The payment for this repurchase was made using a combination of FTX’s native token (FTT), Binance Coin (BNB), and Binance USD (BUSD), collectively valued at $1.76 billion at that time. The FTX estate contends that both FTX and its sister company, Alameda Research, were insolvent as early as 2021, rendering the repurchase transaction fraudulent.

Accusations Against Binance and CZ

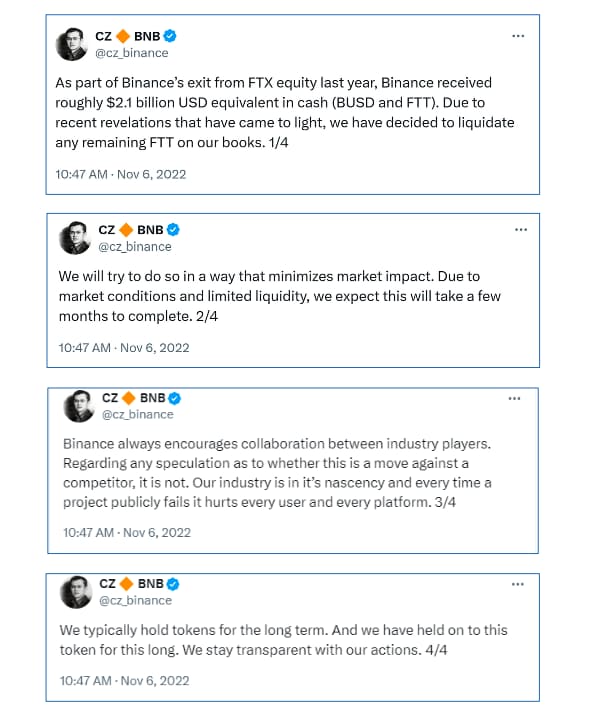

Apart from the monetary dealings, the lawsuit alleges that Zhao orchestrated a plan to weaken and dismantle FTX. This includes Binance’s massive sale of FTT tokens before FTX’s fall in November 2022, which is claimed as part of a calculated strategy to harm FTX’s market standing. The FTX legal team contends that Zhao’s actions were strategically planned to have the maximum effect on the market, causing a drop in the value of FTT and negatively impacting FTX’s financial health.

Implications for the Cryptocurrency Industry

In the midst of FTX’s bankruptcy process and criminal repercussions, their focus on retrieving assets frozen on platforms like Crypto.com becomes crucial to compensate creditors. The ongoing legal battle against Crypto.com underscores the obstacles FTX encounters as it approaches a potential financial recovery for its affected users.

This court case is one aspect of a larger initiative by the FTX bankruptcy administrators aimed at retrieving assets and compensating creditors. It’s subsequent to other legal moves, such as the recent agreement with the Bybit exchange that resulted in a $228 million settlement.

From my perspective as a researcher, at this moment, neither Binance nor Changpeng Zhao (CZ) have issued any public statements regarding the ongoing lawsuit. The judicial process will unfold, potentially influencing both parties significantly and possibly impacting the broader cryptocurrency market.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-11-12 17:08