As a seasoned researcher with years of experience delving into the complexities of financial fraud and its consequences, I must say that the sentencing of Gary Wang is indeed intriguing. On one hand, his cooperation with authorities in exposing the FTX scandal has undeniably been a significant contribution to the justice system. However, on the other hand, the leniency shown towards him sets a questionable precedent for future cases, as Dennis Kelleher’s memo rightly points out.

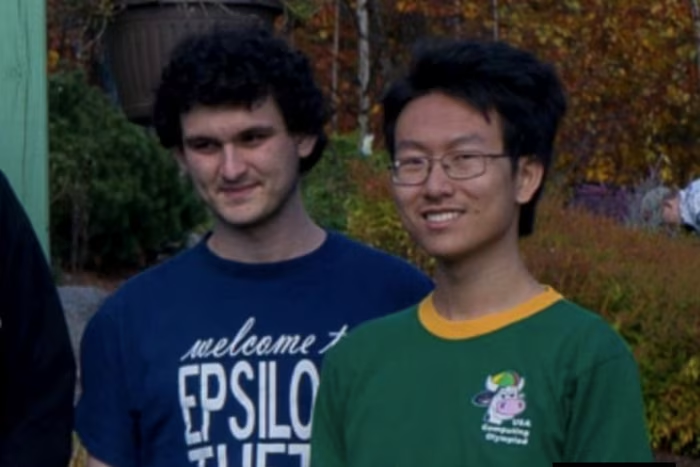

The judge decided that the FTX co-founder, who is also a close associate of Sam Bankman-Fried, will serve no prison time but instead be under supervision for three years.

Officials acknowledge that Wang played a significant role in facilitating the swift return of the former CEO from the Bahamas, which took place in December 2022.

Cooperation With Prosecutors Exempts Wang From Prison

On the 20th of November, Gary Wang received a sentence for his part in the fall of the 2022 crypto exchange FTX. Wang now joins the former FTX engineering head Nishad Singh as the second individual to avoid prison time; Singh received his sentence in October.

Judge Lewis A. Kaplan stated during the trial, ‘You acted in your best interest and what was best for the country. If this wasn’t the most significant financial fraud case in U.S. history, it was definitely one of the top few. The court has decided that you will serve three years under supervised release following your time in prison.’

Current circumstances: Sam Bankman-Fried, the previous CEO of FTX, is currently serving a 25-year prison term due to the misappropriation of more than $11 billion in funds belonging to customers and investors. The court found him guilty on seven charges including fraud, money laundering, and conspiracy. He has since submitted an appeal.

In September, authorities accused former CEO Caroline Ellison of Alameda and ordered her to surrender money as well as sentencing her to two years behind bars. Previously, Wang had provided testimony about the case, explaining that Alameda Research, FTX’s sister company, allegedly illegally accessed funds through an open line of credit with no limits.

Based on Wang’s account, Alameda was granted exclusive use of a ‘borrow-to-withdraw’ function within the FTX system, thanks to modifications in the FTX code. This feature allowed them to take funds from the platform by essentially borrowing assets.

The co-founder of FTX developed the software powering their popular cryptocurrency trading platform. However, it was later discovered that Wang, the creator, inserted a hidden entryway (backdoor) into the system, granting Alameda unrestricted access to users’ funds. In the aftermath of the controversy, he employed his technical expertise to aid law enforcement in future investigations.

In a letter, Wang’s legal team stated that Gary collaborated with the government to create and construct a novel software system aimed at identifying possible financial scams within public marketplaces.

Yet, not everyone admired Wang’s efforts to restore his tarnished image following the incident. Some contended that his cooperation shouldn’t function as a “pass for freedom from prison.” While Wang’s role in unveiling the fraud was substantial, it nonetheless attracted criticism.

Critics are worried that his soft approach could create an unsettling pattern for similar instances in the future. Dennis Kelleher, head of Better Markets, wrote a memo responding to Wang’s legal argument.

As a researcher, I acknowledge Wang’s extensive cooperation and its significant impact. However, it’s crucial not to provide an unconditional release as a ‘free pass.’ Such an action could foster undesirable incentives, encouraging potential wrongdoers to persist in their criminal activities, with the hope of escaping punishment but also strategizing to secure leniency if apprehended. This could result in a surge of criminals intentionally planning to be among the first to confess, seeking minimal or no penalties upon arrest.

After the fall of FTX subsides, there continues to be intense discussion about the legal and moral repercussions of its key figures’ decisions. This incident is likely to be seen as one of the biggest financial scams ever uncovered in U.S. history.

As a crypto investor, I’m navigating these volatile markets while also acknowledging the challenges faced by the broader cryptocurrency industry. We’re working together to restore trust and uphold robust safeguards to prevent future misconducts that have tarnished our reputation in the past.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-11-20 21:58