As a seasoned researcher with years of experience navigating the volatile crypto market, I must admit that the recent surge in FTT is a fascinating development. Having closely observed the ebb and flow of this digital asset, I’ve learned to expect the unexpected in this space.

Today, FTT, the token from the now-bankrupt cryptocurrency platform FTX, is showing significant growth, jumping up by more than ten percent over the past 24 hours.

This gathering takes place with the market anticipating the start of FTX’s court-sanctioned restructuring plan, known as the Chapter 11 Plan of Reorganization, set for January 3.

FTX To Commence Reorganization Plan in January, FTT Climbs

In a recent statement, the former cryptocurrency exchange FTX announced that January 3 marks the start date for their court-sanctioned Chapter 11 Reorganization Plan. As per the announcement, the initial round of refunds is expected to be processed within two months following this commencement date.

In the remaining nine days, there’s been an increase in FTT trading. Currently, the altcoin is priced at $3.21 and has risen by 14% within the last day. This significant upward trend has made it the best performer in the market during this period.

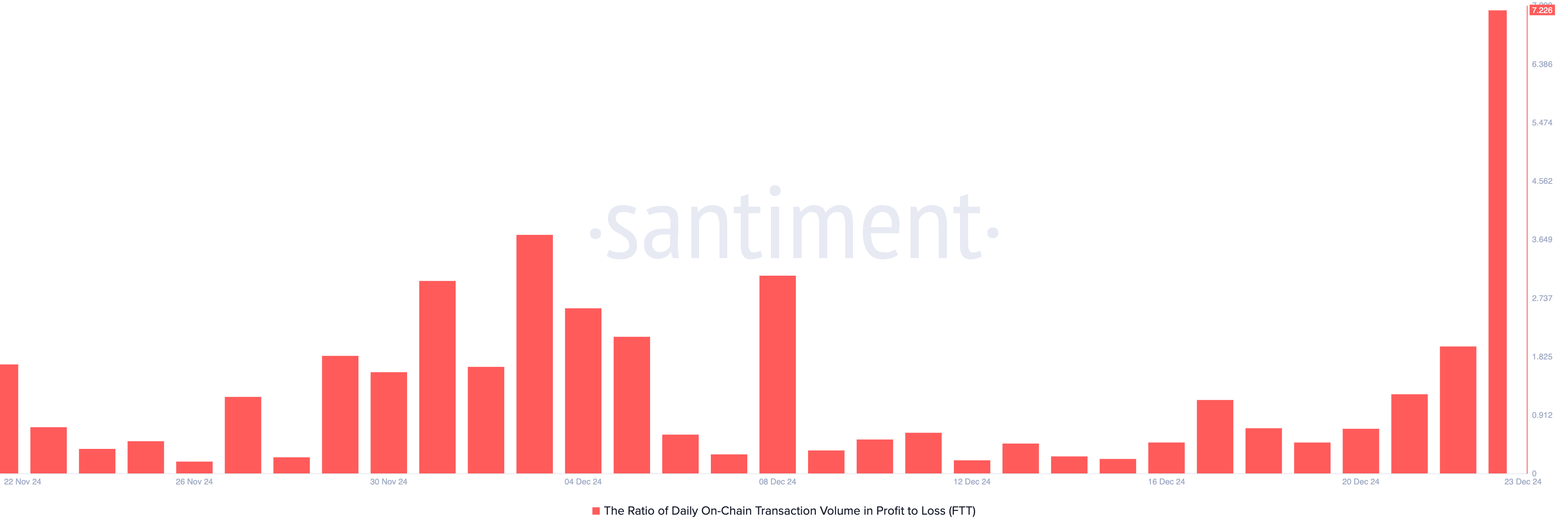

Furthermore, the increase in FTT’s price has resulted in a rise in the profitability of its trades. An analysis by BeInCrypto shows that the proportion of FTT transactions on the blockchain that are profitable is higher than those that result in losses.

According to Samtiment’s data, the current ratio is 7.22. In simpler terms, this implies that for every 1 FTT transaction ending in a loss today, there have been 7.22 transactions that resulted in a profit.

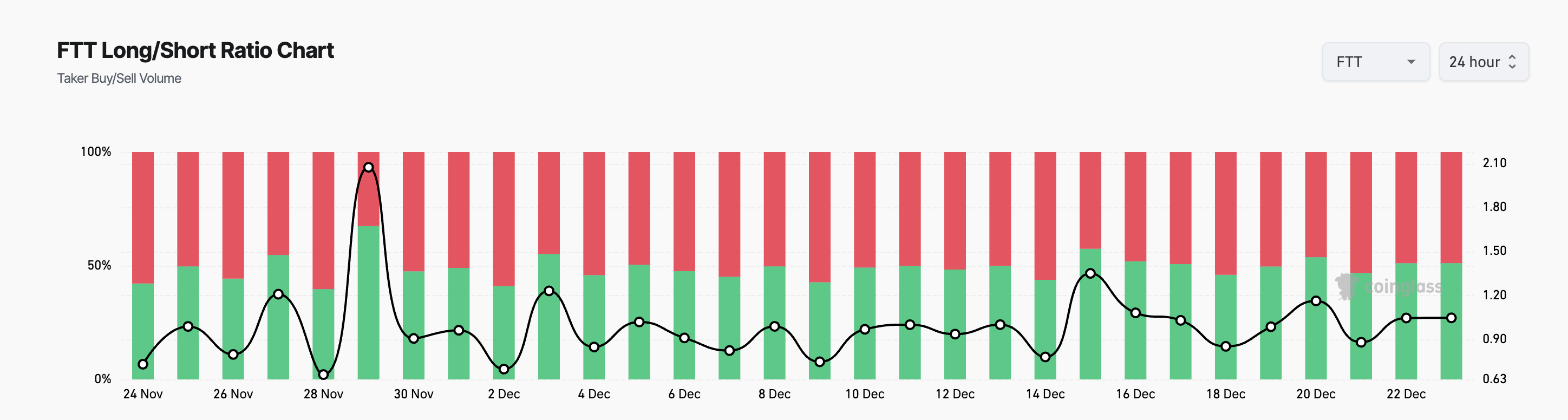

Additionally, with January 3 approaching, it’s observed that more bets are being placed by FTT holders for a continuous price increase. This trend is evident in the Long/Short Ratio, which currently stands at 51.15%, indicating a predominant bullish sentiment.

This measure compares the number of traders who believe prices will increase (by taking long positions) with those who think prices will decrease (via short positions) in a given market. A long ratio of 51.15% from FTT implies that more traders are wagering on price rises rather than falls, suggesting a relatively optimistic outlook or bullish sentiment.

FTT Price Prediction: What To Expect?

The surge in FTT’s token price has pushed it past the resistance point set at $3.29. If the buying interest continues to grow, the token’s price could break through its next resistance level at $3.78 and aim for a return to its one-year high of $4.40.

If the effort to surpass the $3.78 price point is unsuccessful, it might trigger a decline in the FTT token’s price. In such a case, the value of this altcoin could potentially drop to $2.95.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

2024-12-23 16:01