As a seasoned crypto investor with over a decade of experience navigating the ever-evolving digital asset landscape, I find the recent decision by the Frax community to utilize BlackRock’s Institutional Digital Liquidity Fund (BUIDL) as collateral for its upcoming frxUSD stablecoin incredibly intriguing. This move is not only a testament to the growing acceptance of yield-bearing stablecoins but also a significant step forward in bridging the gap between traditional finance and blockchain technology.

Having closely followed BlackRock’s digital asset strategy since its early days, I can attest to their impressive growth and influence in the industry. With over $10.4 trillion in global assets under management, partnering with such a reputable institution can potentially minimize counterparty risk for the stablecoin’s collateral, making it an attractive option for investors like myself.

The increasing demand for yield-generating opportunities, especially within stablecoins, is a trend that I have noticed over the years, and it’s exciting to see projects like Frax capitalizing on this demand. The integration of BUIDL as collateral by other projects such as Ethena Labs and Curve Finance further validates its potential as a reliable backing for stablecoins.

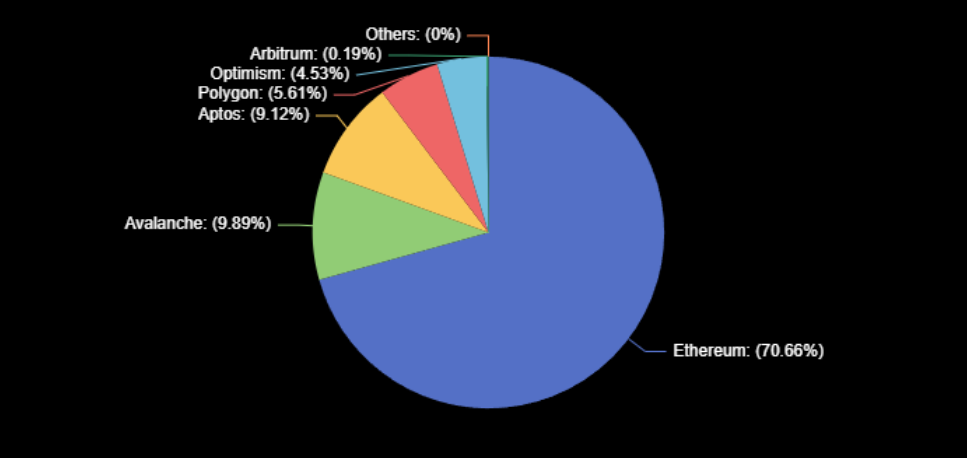

The expansion of BUIDL to multiple blockchains, including Aptos, Arbitrum, Avalanche, Optimism, and Polygon, demonstrates BlackRock’s commitment to embracing the decentralized finance (DeFi) revolution. This aligns with my belief that real-world asset tokenization will play a significant role in shaping the future of the stablecoin industry.

In closing, I find it amusing how the world of traditional finance and blockchain technology are increasingly merging, much like my two favorite hobbies, bridge and chess – both require strategy, patience, and the ability to adapt to changing circumstances. The Frax community’s decision to partner with BlackRock is akin to an opening gambit in this new game of digital finance, setting the stage for exciting developments in 2025 and beyond.

According to the decision made within the Frax community, they have endorsed a plan to employ BlackRock’s Institutional Digital Liquidity Fund (BUIDL) as security for their forthcoming frxUSD stablecoin.

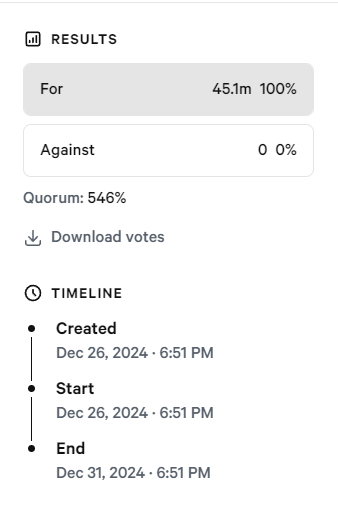

The proposal, identified as FIP-418, received unanimous support after a six-day voting period.

The Increasing Demand for BlackRock’s BUIDL Fund

The BUIDL fund managed by BlackRock, which totals more than $648 million in assets, offers yield-producing possibilities for those holding frxUSD. This approval marks a substantial milestone for the Frax Protocol.

BlackRock, known as the world’s largest asset manager, boasts a staggering $10.4 trillion worth of assets globally. Consequently, investing in a tokenized fund supported by BlackRock could theoretically reduce the potential risk associated with the stablecoin’s collateral, due to the strength and reliability of their backing.

Furthermore, this action aligns with an increasing pattern seen in stablecoin initiatives, as they begin to offer income-generating alternatives that compensate token holders financially, all while ensuring stability.

On December 22nd, Securitize, the managing brokerage for the BUIDL fund, first introduced the concept. This new frxUSD stablecoin is designed to maintain a 1:1 parity with the U.S. dollar and will be backed by U.S. government securities as part of the BUIDL project.

Simultaneously, other projects have begun using BUIDL as collateral for their stablecoins. Ethena Labs introduced the USDtb (USDTB) stablecoin on December 16, which is backed by the BUIDL fund. The current market value of this asset stands at $70 million.

In November, Curve Finance introduced a feature that allows users to generate Elixir’s interest-yielding stablecoin, deUSD (DEUSD), by utilizing BUIDL as security.

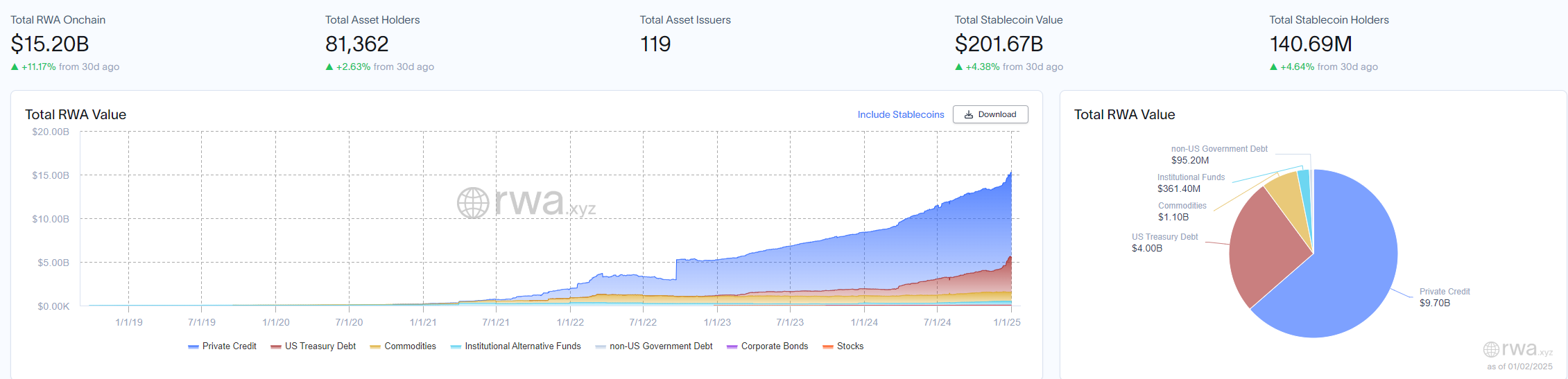

The Rise of Real-World Asset Tokenization

By the end of 2024, BlackRock broadened its BUIDL initiative across five significant blockchain networks. These networks were Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

These advancements line up with BlackRock’s comprehensive approach towards digital assets, encompassing endeavors such as the proposed Bitcoin ETF through IBIT and fund projects based on tokens.

As a seasoned investor with over two decades of experience in the financial industry, I can confidently say that the adoption of tokenized real-world assets (RWAs) is one of the most exciting developments I have witnessed in my career. In 2024, I saw several major players reach significant milestones in this field, which has only served to strengthen my belief that RWAs are poised for even greater growth in the coming years. The potential benefits of this technology are immense, from increased liquidity and accessibility to a broader range of assets for everyday investors, to streamlined processes and reduced costs for businesses. I am eagerly looking forward to observing and participating in the continued evolution of RWAs in 2025 and beyond.

By next February, Tether intends to launch its Hadron RWA tokenization platform. This move enables institutional investors to gain direct access through Application Programming Interfaces (APIs).

Moreover, Hedera has incorporated Chainlink’s Data Feeds and Proof of Reserve systems to bolster its DeFi and Real-World Asset (RWA) functionalities.

To put it simply, the move by the Frax community to incorporate BlackRock’s BUIDL fund into their stablecoin underscores the growing intersection of conventional finance and groundbreaking blockchain technologies.

As an analyst, I can observe that this evolution signals a significant possibility for real-world asset tokenization to reshape and revolutionize the stablecoin sector. In simpler terms, this development could lead to a transformation in how stablecoins are utilized and perceived within the financial landscape.

Read More

2025-01-03 00:59