The market’s a fickle beast, isn’t it? One day it’s dancing on your toes, the next it’s dragging you through mud. But for those who’ve learned to read its moods-like a farmer gauges the sky before a storm-there are opportunities in the cracks. These four stocks, battered or bloated as they may be, still hold the scent of resilience. They are not promises; they are possibilities, etched into the bones of their businesses.

Shopify: The Merchant’s Plow

In the rustbelt of e-commerce, where giants trample small hands, Shopify remains a plowshare in the hands of the overlooked. Tobias Lütke, its founder-CEO, is no court jester of Wall Street. He’s a man who built a kingdom not for himself, but for the millions of merchants who sell socks, spices, and secondhand dreams. Since 2015, the company has turned 12% of American shoppers into unwitting allies of its cause. Yet here it stands, priced like a cathedral-106 times free cash flow, 19 times sales. Is it a temple or a tollbooth? Time will judge. But for now, it’s a machine humming with the grit of its users.

When AI becomes another tool in the merchant’s shed, Shopify’s value won’t be in its price tag, but in the lives it spares from the grind of starting over. That’s the quiet revolution it sells.

Wingstop: Wings Over a Cracked Floor

Three months ago, Wingstop’s stock fell like a dropped pie-31% in a blink. Same-store sales dipped 2%, a scar on a company that once knew only upward flight. Yet here it remains: 66 times forward earnings, still a bird with clipped wings. For 21 years, Wingstop’s customers have grown fat on its wings, and its stores-2,000 in the pipeline-will stretch like veins across the country. The hunger for greasy solace is eternal. The question is whether the shareholders will taste it before the next downturn.

Expansion is a gamble, but Wingstop’s gamble is written in the language of appetite. People will always want to eat, even if they can’t afford to.

Coupang: The Bazaar of Seoul

Coupang’s story is one of fire and ash. In 2021, it burned bright at $50 a share, then collapsed to $10. But from the embers rose a phoenix with 24 million loyal customers in South Korea. CEO Bom Kim didn’t build a company; he built a lifeline for a nation’s shoppers. Now, with ambitions in Taiwan, luxury goods, and cloud computing, Coupang’s reach stretches like a beggar’s hand. Yet at 33 times cash from operations, it’s a gamble dressed in ambition. The real question isn’t whether it can grow-it’s whether the market will let it.

For the workers who deliver its goods, for the sellers who list their wares-Coupang is not just a stock. It’s a bridge over the chasm of modern commerce.

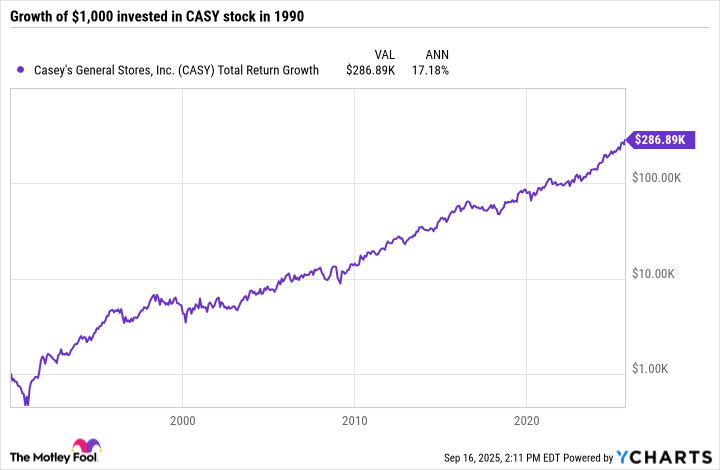

Casey’s General Stores: The Last Light on the Prairie

In the heart of Iowa, Casey’s General Stores is more than a convenience store. It’s a hearth in the snow, a place where the fifth-largest pizza chain in America hides in plain sight. For decades, it fed the forgotten towns, where the nearest McDonald’s is a day’s drive away. Now, it shifts its gaze eastward, into cities where the cost of a slice could buy a month’s rent. Its P/E ratio has doubled since 2023, but management’s promise of 500 new stores by 2026 is a siren song. Will the market believe it? Or will Casey’s remain a relic of the Midwest, stubbornly refusing to die?

For the gig workers who flip burgers and restock shelves, Casey’s is not a stock-it’s a job, a roof, a meal. And in that, its value is already priced.

These four stocks are not miracles. They are mirrors. They reflect the grit of the people who keep the wheels turning, even when the oil runs dry. And in that grit, there is a lesson: survival is not for the most powerful, but for the most persistent. 🌱

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-18 15:32