Dear Diary,

Today, I find myself staring at my portfolio, specifically the line item reading Ford Motor Company (F). It’s like looking at an old flame who keeps sending mixed signals-promising to change but then turning up with yet another scandal. And by scandal, I mean recalls. So many recalls.

Let me break it down for you:

- Vehicles Recalled in 2025 Alone: 7 million+

- Recalls Issued This Year: 105 (yes, one hundred and five)

- Percentage of Total U.S. Recalls Ford Accounts For: 39% (runner-up is Forest River at a modest 9%)

- Hours Spent Wondering If I Should Sell: Too many

Found on Roadside Dead? More like Found Myself Questioning My Life Choices.

An unfortunate record, indeed

So here’s what happened this week: Ford is recalling over 355,000 trucks because their instrument display panels are acting up. The affected models include the F-550 SD, F-450 SD, F-350 SD, F-250 SD, and the F-150-all from recent years. Now, if you’re thinking, “Oh well, at least they’re fixing things,” let me stop you right there. Yes, they’re addressing issues-but not before those issues have dented both their reputation and my dwindling patience.

You see, as a value investor, I’m drawn to companies that seem undervalued by the market. Ford has always had potential; its brand recognition is solid, and its product lineup is nothing short of impressive. But when warranty costs start eating into earnings, alarm bells ring louder than any engine ever could.

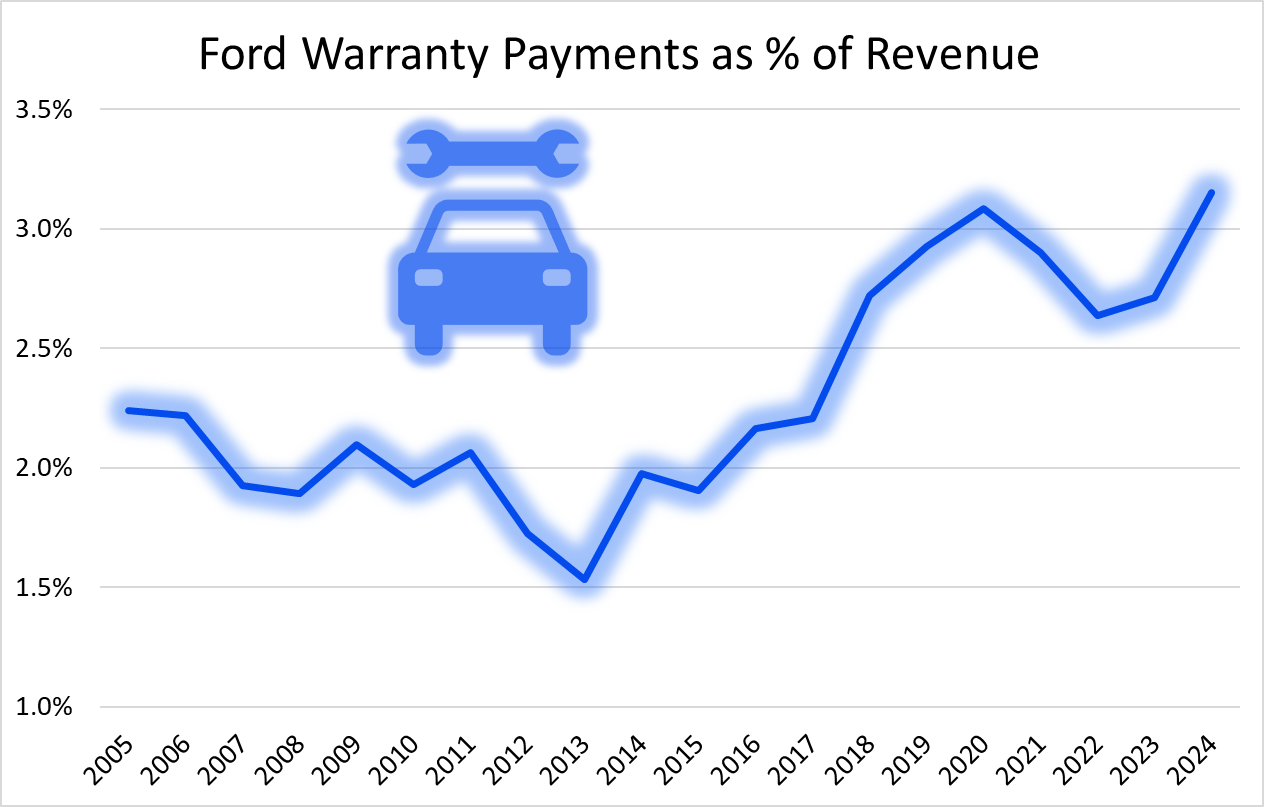

Here’s where it gets particularly galling: In the early 2000s, Ford’s warranty payments-to-revenue ratio was manageable. Recently, though, it spiked to 4%. Meanwhile, General Motors-Ford’s eternal rival-is sitting pretty at around 2.3%. Jim Farley, Ford’s CEO, admitted during a call with analysts last year, “Clearly our strategic advantages are not falling to the bottom line the way they should.” Translation: We messed up.

A silver lining, perhaps?

Now, here’s the part where I try to convince myself-and you-that all hope isn’t lost. Not all recalls are created equal. Some involve complicated hardware fixes requiring hours at dealerships, while others can be resolved with simple software updates. Lucky us, this latest recall falls into the latter category. Free software fix? Check. Minimal financial impact? Double check.

Ford’s management even framed this as evidence of tighter quality controls-a sort of ‘better late than never’ approach. They claim these higher recall numbers reflect proactive measures rather than systemic failures. Noble sentiment, or clever spin? Only time will tell.

If Ford manages to bend the curve on quality-and reduce those pesky warranty costs-I’ll admit, there’s upside here. Earnings power could improve significantly. But forgive me if I remain skeptical. Progress often feels invisible until it smacks you in the face-or shows up on a quarterly report.

For now, I’ll hold onto my shares, mostly out of stubbornness. After all, investing is less about logic and more about clinging to scraps of hope. Isn’t that why we’re all here? 🚗

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-03 15:01