Ford Motor Company (F) is executing a textbook case of capital reallocation, retiring two cash-generating nameplates to fund an uncertain electrified future. The discontinuation of the Escape and Lincoln Corsair by 2026 marks both a recognition of shifting regulatory pressures and a high-stakes wager on electric pickup truck demand. While sentimentalists may mourn the end of an era, investors should scrutinize the arithmetic behind this transition.

Market Realities vs. Nostalgia

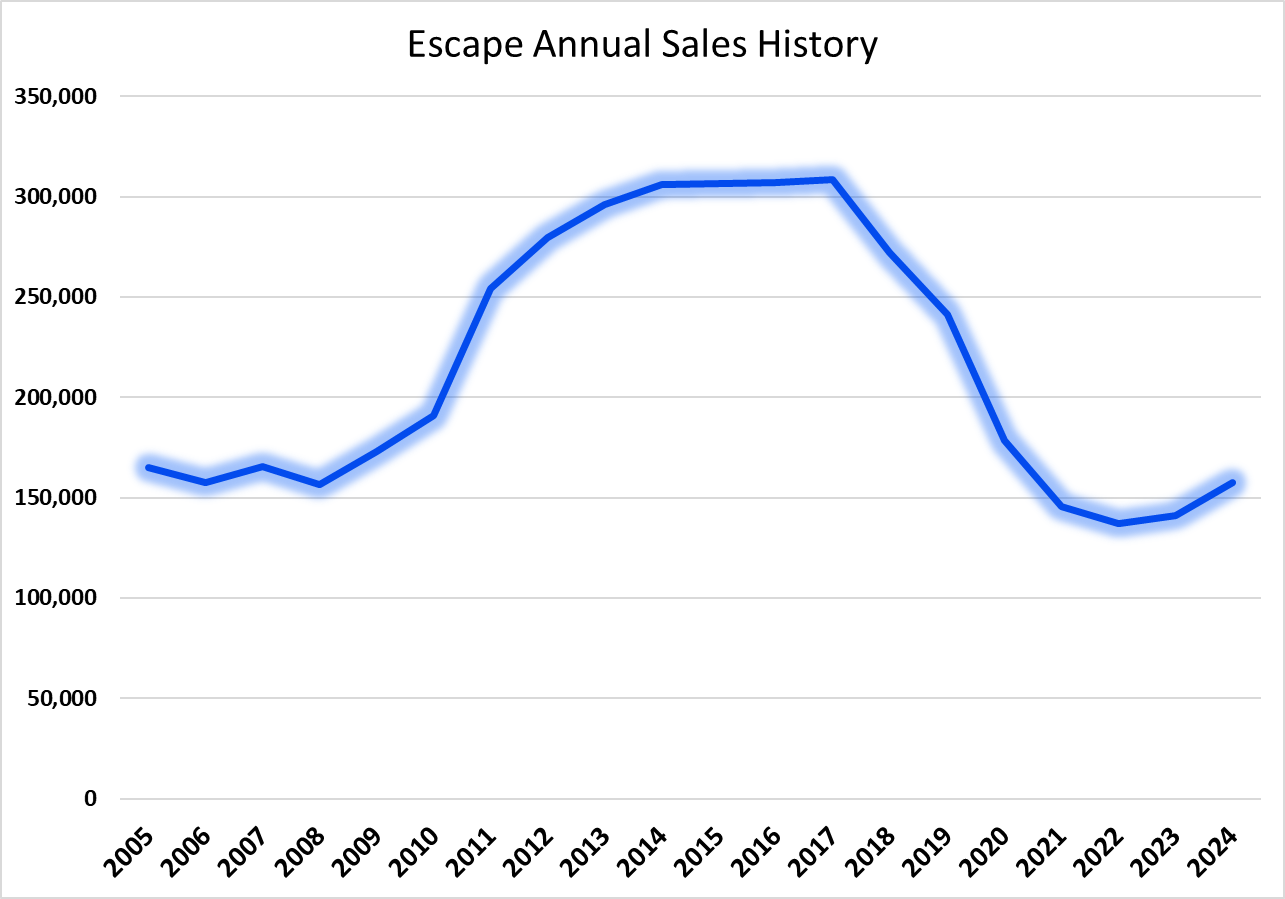

Contrary to surface-level perceptions, declining sales trajectories necessitated this move. Despite YTD 2024 U.S. sales outpacing the Bronco family, Escape volumes have deteriorated steadily since 2019:

- 2019: 399,519 units sold

- 2023: 238,581 units sold

The Corsair’s Lincoln division prominence masks its status as a mid-tier luxury crossover in a shrinking segment. Ford’s Louisville Assembly Complex retooling – a $5B operational pivot – prioritizes scalability for eight future EVs over sustaining legacy platforms.

Strategic Crossroads

The electric pickup strategy presents three critical considerations:

- Profitability Challenges: Model-e division’s $5.1B 2024 operating loss creates immediate headwinds against internal combustion vehicle (ICV) margin contributions.

- Market Timing: 2027 product launch coincides with potential regulatory headwinds, including pending EV tax credit rollbacks.

- Segment Dynamics: Pickup truck electrification faces unique hurdles in commercial adoption and charging infrastructure compatibility.

Comparative Analysis

Contrasting Ford’s approach with Stellantis’ reactive strategy reveals divergent philosophies:

| Automaker | ICV Phaseout | EV Investment | Risk Exposure |

|---|---|---|---|

| Ford | Proactive (Escape/Corsair) | $5B Louisville retooling | Execution-heavy |

| Stellantis | Reactive (Cherokee) | Delayed Ram EV rollout | Market share erosion |

Ford’s vertically integrated approach – anchoring new EVs to existing manufacturing infrastructure – theoretically mitigates supply chain volatility but requires flawless implementation.

Investment Implications

Three forward-looking scenarios emerge:

- Base Case: Electric pickup achieves 15% gross margins by 2029, offsetting ICV declines

- Bull Case: Regulatory tailwinds resume post-2025 elections, accelerating EV adoption

- Bear Case: Sustained consumer preference for ICVs creates $2B+ annual EBITDA gap

While Detroit’s newfound strategic coherence merits acknowledgment, execution risks remain elevated. This transition demands exceptional capital discipline in an environment historically characterized by cyclical overinvestment.

Shareholders would benefit from rigorous quarterly updates on Louisville Complex utilization rates and pre-production order pipelines. Until tangible monetization materializes, measured skepticism remains warranted. 🚗💨

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-20 04:23