Behold, the automaker of the red, white, and blue-Ford Motor Company (F)-has cast its lot with a $5 billion wager upon the electric horizon, a venture both quixotic and pragmatic, as if attempting to steer a steamship through a tempest of lithium and ambition. The announcement, delivered with the solemnity of a medieval scribe transcribing a prophecy, arrived last week, its ink still wet upon the parchment of corporate strategy.

And yet, what is a shareholder to make of this? The stock, that most capricious of courtiers, has languished since the dawn of the millennium, its value a frozen clockwork, while dividends, like stubborn constellations, have persisted in their celestial arc. A gambler might call this a long shot, a philosopher a paradox, but the question lingers: does this $5 billion represent a leap forward or a misstep in the grand chessboard of industry?

To unravel this tapestry, one must first acknowledge Ford’s prior forays into the electric realm-a modest gallery of hybrids, though its most heralded electric progeny, the F-150 Lightning and the Mach-E Mustang, remain tethered to the DNA of combustion, their bones still forged in the fires of tradition.

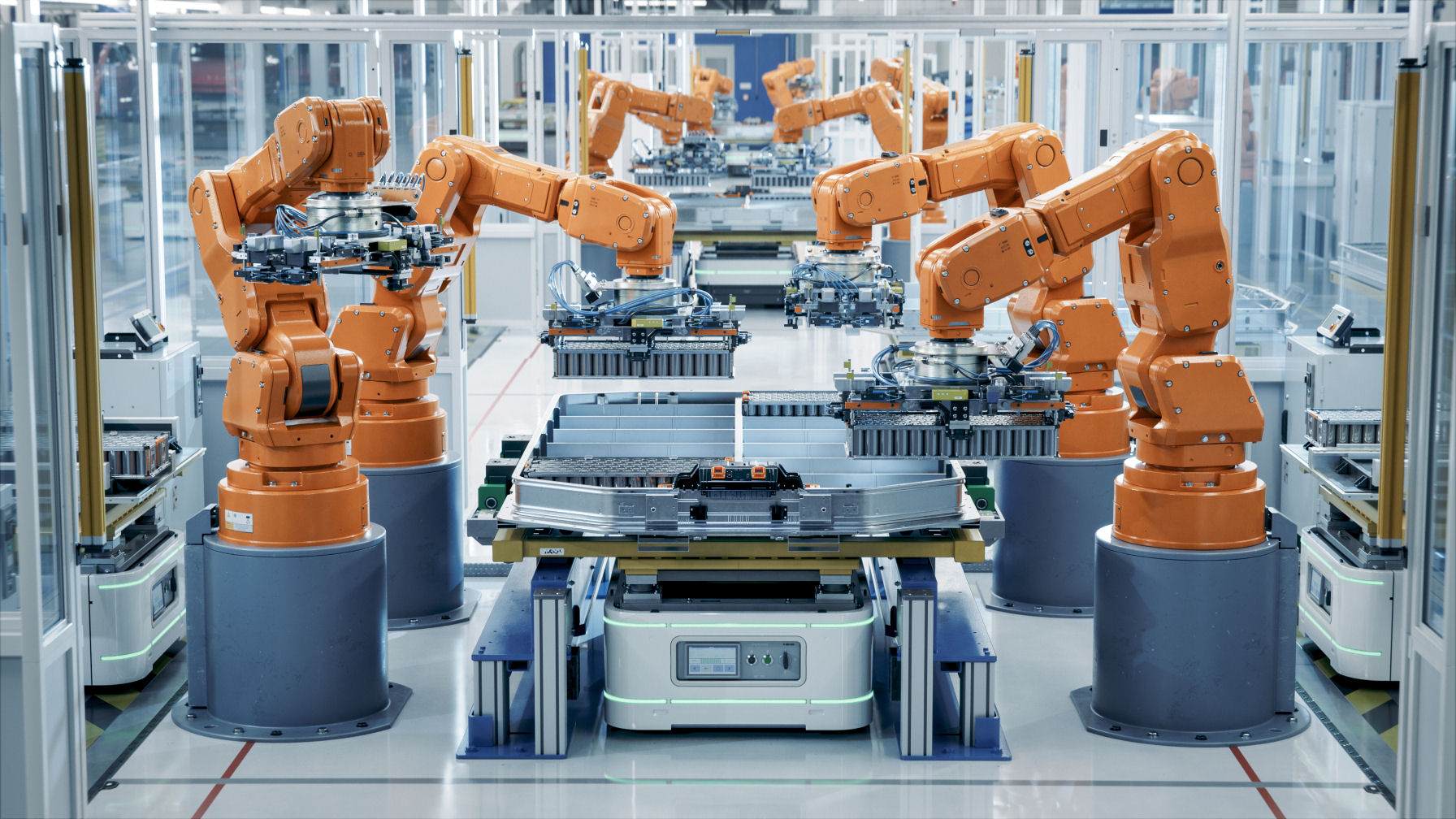

The Assembly Line: A New Genesis for Electric Vehicular Thought

Yet here lies the pivot: Ford’s plan envisions not mere modifications, but a renaissance. A new assembly line, a cathedral of electrons, will birth vehicles unshackled from the past-a light pickup truck, its price tag a siren song of $30,000. Half of the investment, however, is directed toward lithium batteries, whose alchemy promises to shrink both size and cost by a third, a feat akin to transmuting lead into gold, without sacrificing the range that fuels the soul of an electric journey.

But let us not romanticize. Ford’s existing EV endeavors, though valiant, have been a mélange of modesty and melancholy. Sales, a mere $3.9 billion in 2024, have dwindled by 35%, a decline as disheartening as a sonnet penned in a language no one understands. Its EV division, a fiscal leviathan, hemorrhaged over $5 billion, a wound that bleeds through the ledger’s pages.

The Market: A Fickle Muse

The challenge, then, is not merely technical but existential. Is the fault in production scale, demand, or the fickle whims of a populace that regards electric vehicles with the suspicion of a child encountering a spider? A survey by AAA reveals a mere 16% of Americans as potential buyers, a number that has waned like a sunset over four years, while skepticism swells like a tide.

Yet Ford, that quintessential American titan, casts its net beyond borders, where EVs dance to a different rhythm. China’s horizon, as per the International Energy Agency, glimmers with 80% EV sales by 2030-a future Ford’s batteries and trucks might yet court. But the heart of the company beats in Louisville and Marshall, its pulse tied to the pickup truck, a symbol as enduring as the Appalachian hills.

The All-In Bet: A Chess Game of Peril and Promise

This $5 billion wager, though not an existential crisis, is a high-stakes game of chess, where each move is a calculated risk. With net income of $5 billion and liabilities exceeding $100 billion, Ford teeters on a precipice. Should American consumers remain skeptical, the company’s trials may deepen, a labyrinth without a exit.

Yet, in the realm of finance, even peril can be a siren. Ford’s shares, trading at 8 times next year’s earnings and a 5% dividend yield, whisper of undervaluation. A cautious investor might find solace in this, though prudence dictates a modest stake, a single pawn in a grander game.

So, dear reader, as you ponder this tale of steel, silicon, and speculation, remember: the future is a mosaic of choices, and Ford’s electric gambit is but one tile in the ever-shifting pattern of commerce. 🚗

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-08-20 11:47