The numbers… they swim at you, don’t they? Ford, GM… these aren’t just automakers anymore, they’re casinos disguised as factories. Betting the farm on electrons and hoping the public suddenly develops a taste for silent, expensive metal boxes. And right now, the house is CLEANING UP. Sixteen BILLION dollars down the drain since 2022. Sixteen. BILLION. That’s enough to buy a small country, or at least a REALLY good collection of vintage muscle cars. But no, they’re chasing the phantom of the all-electric future, and it’s costing them a fortune.

The official line is “strategic investment.” I call it a slow-motion train wreck. They jumped the gun, saw Tesla’s shadow, and panicked. Now they’re flailing, throwing money at a problem that isn’t just about technology, it’s about… timing. The American consumer wasn’t ready to ditch the rumble of the V8 for the whine of an electric motor. They wanted it NOW, cheap, and with all the comforts of home. Ford gave them… well, they gave them a money pit.

The Cost of the Dream

Four point eight BILLION lost in the last quarter alone on the Model-e division. Just three models, and they’re hemorrhaging cash faster than a politician’s promises. They’re claiming a “slight improvement” from last year? A slight improvement is like saying a shark bite is a “minor inconvenience.” They’re still projecting another $4 to $4.5 billion loss in 2026. The sheer audacity of it all… it’s breathtaking.

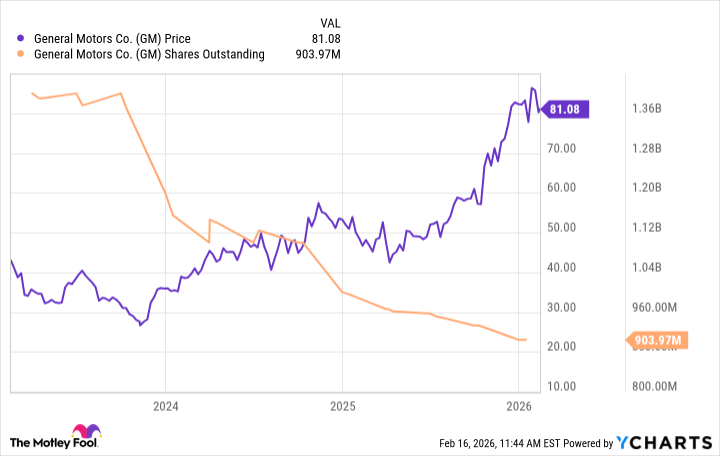

Meanwhile, GM is playing a different game. Share buybacks. Smart. They’re shrinking the share count, boosting the stock price. Ford could have been doing the same, but no, they’re fixated on the electric holy grail. It’s a classic case of short-term pain for long-term gain, except the pain is excruciating, and the gain is… uncertain. Look at the chart, folks. It screams a simple truth: fewer shares, higher price. It’s not rocket science, it’s basic finance.

This isn’t about technology, it’s about capital allocation. Ford is burning cash on a losing proposition, and that capital could be put to better use. Buybacks, dividends… anything but throwing good money after bad. It’s time to face facts: the EV dream is currently a nightmare for Ford shareholders.

When Does the Bleeding Stop?

Don’t hold your breath. The CFO, Sherry House, casually mentioned 2029 during the earnings call. 2029! That’s an eternity in the auto industry. They’re pinning their hopes on a new “assembly tree” and a “Universal EV Platform.” Sounds like something out of a science fiction novel, doesn’t it? A midsize electric truck priced around $30,000? It’s a Hail Mary pass, a desperate attempt to salvage a sinking ship.

They jumped the gun, took a $19.5 billion special charge to course-correct, and now they’re stuck in the mud. But here’s the thing: opportunity lurks in the chaos. If they can actually turn things around by 2029, that freed-up capital could be a game-changer. High-return projects, buybacks, dividends… the possibilities are endless. But it’s a BIG “if.” This isn’t a stock for the faint of heart. It’s a gamble, a high-stakes poker game where the house always has an edge. Ford is not firing on all cylinders, it’s sputtering and coughing, but for patient investors with a strong stomach, there might just be a payoff down the road. Just don’t expect it anytime soon.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Brent Oil Forecast

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

2026-02-19 07:22