Look, let’s be real. Investing in car companies is usually about as exciting as watching paint dry. It’s a brutal business. Everyone’s building a slightly shinier box to move people from point A to point B, and margins are thinner than my patience during a shareholder call. You’re basically betting on which CEO can yell the loudest about supply chains. But sometimes, just sometimes, you stumble across something… reasonable. And in the current market, “reasonable” feels like winning the lottery.

Enter Ford Motor Company (F 1.52%). They’re not reinventing the wheel, but they are handing out a dividend yield of around 4.2%. Which, in this economy, is basically them throwing money at you and saying, “Here, take this. Just… don’t ask too many questions.” As a trader, I appreciate directness. It’s refreshing.

Long-Term Thinking (Or, “Compounding: It’s Not Just for Nerds”)

People get obsessed with stock price appreciation. It’s like chasing the latest TikTok trend. Sure, it could pay off, but it’s also likely to disappear faster than your dignity after a karaoke night. Dividends, though? Dividends are the quiet, dependable friend who always shows up with a casserole. They’re the slow burn, and honestly, sometimes slow and steady is the way to go.

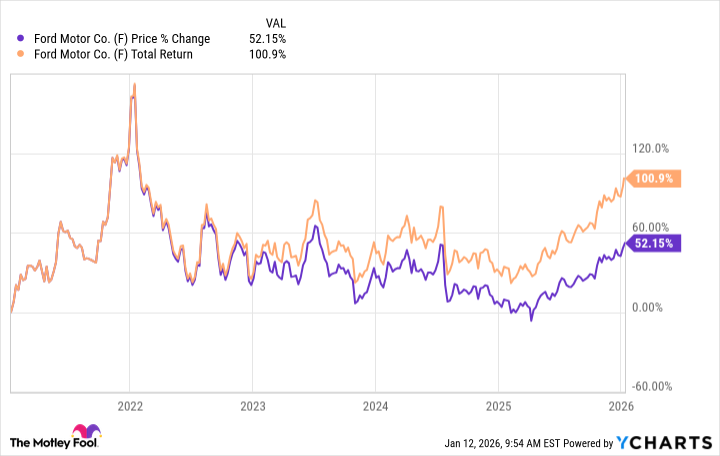

Check out that chart. Over the last five years, Ford’s total return – dividends included – doubled the value of just the stock price going up. That’s the magic of compounding, folks. It’s like free money… that you have to wait for. Still better than nothing.

Ford’s aiming to return 40-50% of its free cash flow to shareholders, and when they’re flush with cash, they even throw in a supplemental dividend. It’s like they’re saying, “Oh, you liked the first dividend? Here’s a little extra. We’re feeling generous.” It’s a good look.

Is Ford Actually Going Anywhere? (Asking for a Friend)

Dividend stocks are popular, especially when everyone’s panicking about the market. It’s a simple concept: get paid while you wait for things to maybe, possibly, eventually improve. Ford has a solid balance sheet, a mountain of cash (always a good sign), and potential upside if they can figure out this whole electric vehicle thing. No pressure.

Okay, let’s address the elephant in the room: Ford lost over $5 billion on its Model e business last year. That’s… a lot. They’re going back to the drawing board, streamlining costs, and hoping their Universal EV Platform will be a game-changer. Breaking even on EVs would free up capital for, you guessed it, more dividends. It’s a vicious, beautiful cycle.

And here’s a fun fact: the Ford family still owns significant special shares. They like dividends too, apparently. It’s comforting to know that the people in charge are also incentivized to return value to shareholders. It’s like a really weird, corporate version of “What’s good for the goose…”

Look, Ford isn’t going to make you rich overnight. But a solid dividend yield, a decent balance sheet, and a family that appreciates cash? That’s a recipe for a reasonably good investment. And in this market, “reasonably good” is a win. You can take that to the bank.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-17 03:32