The matter of Ford Motor Company (F 0.86%)… it is a curious one, is it not? A behemoth of metal and ambition, lumbering through the age of electricity as if perpetually surprised by the very notion of progress. Investors, naturally, are drawn to it, like moths to a flickering, unreliable gas lamp. Some, blinded by the sheer volume of the machine, see a ‘value proposition’ – a phrase as hollow as a samovar with no water. Others, lured by the promise of dividends – nearly 4.5%! – imagine a river of coin flowing directly into their pockets. One suspects it is more a trickle, perpetually threatened by the rising tide of… well, everything.

There are those, too, who cling to the strength of the full-size truck, a vehicle seemingly designed to compensate for… certain deficiencies. And the commercial Ford Pro business, a recurring revenue stream, a comforting predictability in a world gone mad. Then there is the distant glimmer of artificial intelligence and driverless vehicles, a future so remote it might as well be a tale told by a babushka in a snowstorm. All very well and good. But beneath the polished chrome and the promises of innovation, certain… irregularities persist.

An Affliction of Recalls

Recalls. Ah, recalls. In the automotive industry, they are as inevitable as a winter blizzard. A minor inconvenience, one might think. A mere expenditure of capital. But with Ford, it has become… a spectacle. A veritable festival of mechanical mishaps. Eighty-nine recalls in a single year? A paltry number, it turns out. Last year, the company surpassed itself, achieving a new record of 153 recalls, encompassing some thirteen million vehicles. Thirteen million! It is as if each automobile is possessed by a mischievous imp, determined to malfunction at the most inopportune moment.

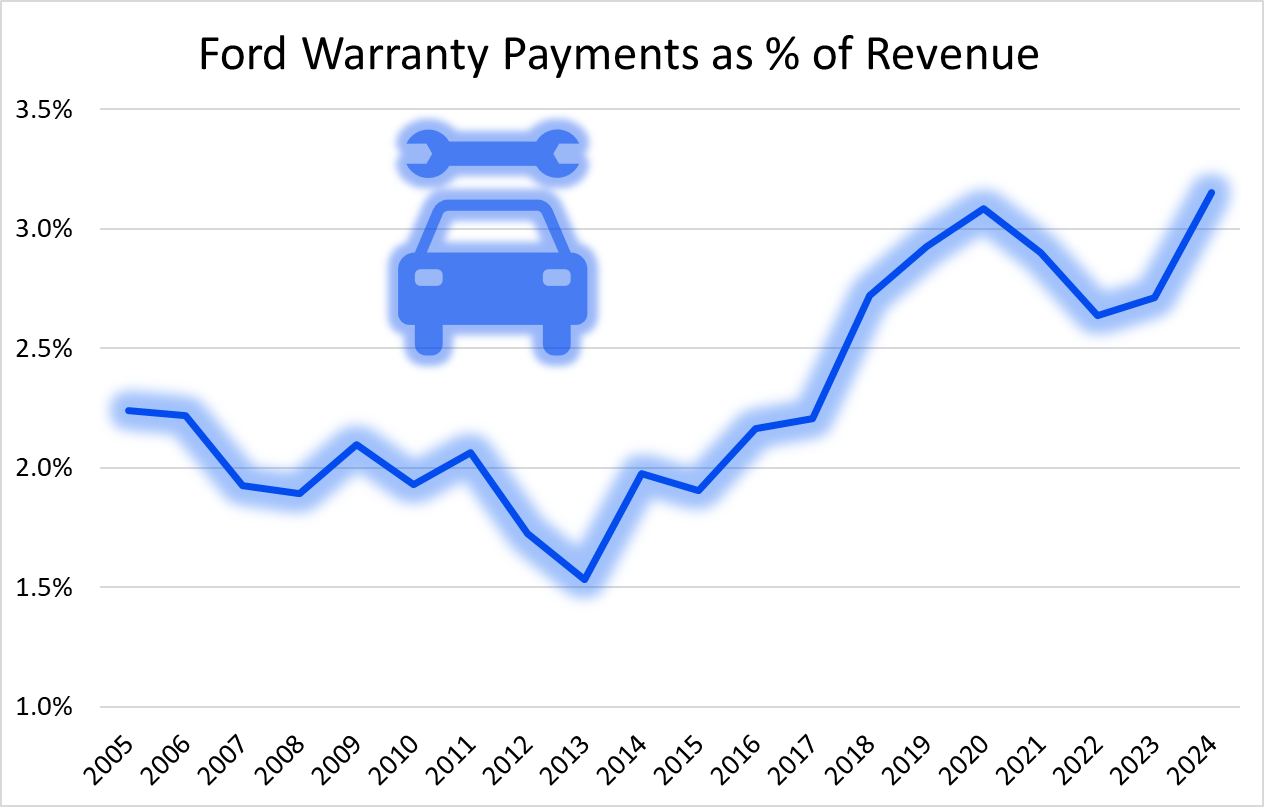

These incidents, naturally, manifest themselves in the quarterly earnings reports. A sudden spike in warranty costs – $800 million in the second quarter of 2024 alone! – a phantom expense that haunts the balance sheet. And beyond the numbers, there is the matter of reputation. To be known as the manufacturer of recalled vehicles… it is a stain, a smudge on the otherwise gleaming surface of the brand. To ‘conquer’ customers from rival companies becomes an exercise in futility, a Sisyphean task performed by increasingly disgruntled salesmen.

The current CEO, Mr. Farley, has declared a focus on quality, a noble ambition, to be sure. But one suspects the root of the problem lies not in a lack of effort, but in the sheer age of the global fleet. These vehicles, many of them, have witnessed decades of wear and tear, accumulated a sort of mechanical fatigue, a profound ennui. The chart, as you can see, confirms this… persistent tendency.

The Electric Mirage

The rush to electric vehicles… it was a frenzy, a collective delusion. The markets of Europe and China, eager to embrace the future, propelled the industry forward. Billions were invested, promises were made, and yet… the market failed to materialize with the anticipated speed. It is as if the electric current itself is reluctant to flow, hesitant to power this grand, ambitious experiment.

Ford’s Model-e division, responsible for these electric endeavors, has suffered a loss of over $5 billion in a single year. A staggering sum! One might call it a catastrophe. But perhaps… perhaps it is also an opportunity. A chance to recalibrate, to reassess, to avoid further descent into the abyss.

The company intends to launch a more affordable midsize electric pickup in 2027, priced around $30,000. A laudable goal. And, crucially, they expect it to be profitable. A bold claim, to be sure. But in this age of uncertainty, one must cling to hope, however fragile. Furthermore, Ford has taken a rather drastic measure – a $19.5 billion charge – to shift its strategy away from full-electric vehicles. A pragmatic decision, one might say. A recognition that hybrids, those strange, transitional creatures, may offer a more immediate path to profitability. They are, after all, the camels of the automotive world, perfectly adapted to navigate the treacherous sands of the market.

The Peculiar Sum of It All

Ford, then, is a curious investment. A solid balance sheet, a lucrative dividend, the distant promise of AI and driverless vehicles… all very appealing. But one must also consider the current realities: the costly recalls, the heavy electric losses. As Ford addresses these challenges, as it tames the mechanical imps and navigates the electric mirage, it may yet prove to be a sound, long-term investment. But be warned: investing in Ford is not merely a financial transaction. It is an act of faith. A gamble on the resilience of a behemoth, lumbering through the age of progress, perpetually surprised by the very notion of change.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2026-02-01 19:53