1997 marked the establishment of Netflix (NFLX), a company aimed at revolutionizing the video rental industry. By offering DVD delivery services, Netflix eliminated the need for customers to visit brick-and-mortar stores. Unfortunately, Blockbuster, which controlled America’s largest movie rental chain at the time, missed out on the potential of Netflix, as they declined an offer to acquire the up-and-coming startup for a mere $50 million in 2000.

In 2007, Netflix transitioned its services primarily to streaming, effectively phasing out the use of discs and related hardware. This move had profound consequences for video rental chains such as Blockbuster, which are now largely forgotten by consumers. For those who invested in Netflix at the time of its initial public offering (IPO) and remained loyal, their patience has been rewarded with an astounding 112,700% return on investment.

Speaking of the current market value of the company, which surpasses $500 billion, it’s hard not to ponder what might have been for Blockbuster. Yet, the question remains: Can the streaming service continue to generate positive returns for investors who decide to invest in it now?

Advertising and live events are key to Netflix’s future growth

Netflix boasts over 300 million paid subscribers, a figure that surpasses the estimated 200 million users on Amazon Prime and doubles the 126 million subscribers of Disney’s Disney+. As Netflix continues to expand, it becomes increasingly challenging to drive growth. To stay ahead in the industry, the company is leveraging its massive scale by outspending competitors significantly in an attempt to maintain its allure as the premier platform.

This year, the company is planning to invest an impressive $18 billion on developing and licensing content. Additionally, live events are gaining more attention as they serve as effective magnets for drawing new subscribers. In fact, Netflix aired both Christmas NFL games last year, each of which drew over 30 million viewers, making them the most-watched matches in the sport’s history. As a result, these games will be broadcasted again in 2025.

Additionally, after the highly successful Mike Tyson vs. Jake Paul boxing event last November, Netflix decided to invest further in boxing this year. They live-streamed the Katie Taylor vs. Amanda Serrano fight on July 11th, and they are also planning to broadcast the Canelo Alvarez vs. Terence Crawford match in September.

Alongside drawing in new users, live events also catch the attention of advertisers. Currently, Netflix provides three different subscription plans: Premium ($24.99 per month), Standard ($17.99 per month), and a Standard plan with ads priced at $7.99 per month. Subscribers on the ad-tier plan grow increasingly valuable as they not only pay a monthly subscription fee but also generate revenue for Netflix through advertisements. As this user base expands, Netflix can demand higher prices from businesses for advertising slots.

In 2024, Netflix saw its advertising revenue nearly double, and company leaders anticipate another doubling in 2025. At this moment (the fourth quarter of 2024), the ad-supported tier is responsible for approximately half of all new subscribers in countries where it’s offered, suggesting a significant potential for Netflix to attract advertisers to its platform.

Netflix’s revenue growth is reaccelerating

Netflix saw a significant rise in total earnings during the second quarter of 2025, amounting to approximately $11.1 billion. This figure marked a 15.9% increase compared to the same period in the previous year, with this growth rate picking up pace from the 12.5% expansion observed in the first quarter. The company’s leadership anticipates an even faster growth of 17.3% in the coming third quarter (ending September 30). This consistent upward trend underscores Netflix’s ongoing success, a significant part of which can be attributed to its thriving advertising division.

I can’t help but feel thrilled about the incredible financial success Netflix experienced during the second quarter! We raked in an impressive $3.1 billion in net income, which represents a staggering 45% surge compared to the same time last year. That’s equivalent to $7.19 per share, not only meeting but surpassing Wall Street’s projected earnings of $7.08 per share – simply amazing!

Netflix stands out as one of the rare streaming services that consistently generates profits. This financial success is crucial because it enables the company to invest heavily in content production, which attracts more subscribers and maintains the momentum of its growth cycle. If Netflix didn’t earn billions of dollars each quarter, it would likely need to scale back its content production, potentially losing market share.

Netflix stock isn’t cheap right now, but long-term investors can still do well

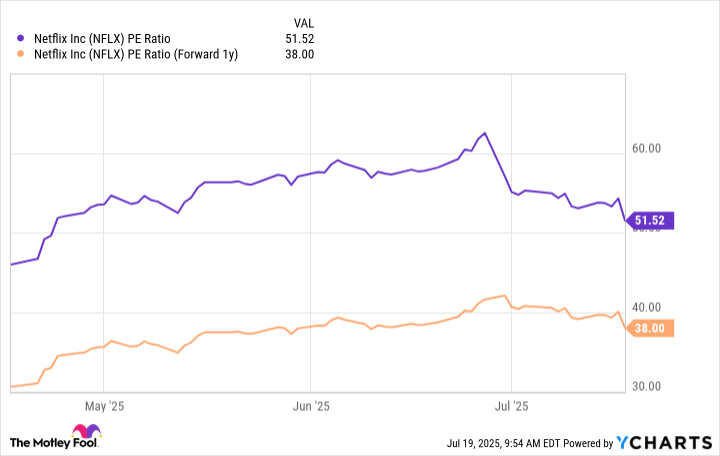

Given that Netflix stock has skyrocketed by an astounding 112,700% since its initial public offering, one might wonder if you’re missing out if you don’t already own it. However, it’s important to note that its current price-to-earnings (P/E) ratio of 51.5 is double the cost of the S&P 500 (24.7), implying Netflix is significantly pricier than the general market.

A more affordable perspective for the stock could be gained if we consider its future projected earnings potential. According to the collective forecast by Wall Street (as indicated by Yahoo! Finance), Netflix is expected to yield $30.87 in Earnings Per Share (EPS) by 2026, which would result in a forward Price-to-Earnings ratio of approximately 38.

From where I stand, those considering purchasing Netflix shares must embrace the idea of shelling out a high price tag. The question of substantial profits down the line might hinge on an investor’s perspective regarding timeframe. For instance, someone seeking swift returns within the next year may feel let down due to Netflix’s valuation, but one ready to hold onto it for half a decade could potentially reap substantial rewards if the company’s earnings keep expanding.

Over a span of five years, Netflix’s advertising sector is expected to grow significantly, potentially boosting its stock value. In fact, as per their own projections, the company aims to double its 2024 revenue of $39 billion by 2030, with approximately $9 billion generated through ad sales. Should these goals be achieved, the next five years are likely to bring substantial returns for shareholders.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

2025-07-23 11:55