Analysts, those ever-vigilant sentinels of the market, have noted the steady decline of FLOKI’s value, as the coin continues its relentless journey downward. Lower highs, languishing momentum, and a rather pessimistic sell-side dominance characterize the scene for November 2025. Now, all eyes are on whether this beleaguered token can somehow stop its perpetual fall and regain the trend-defining levels it once flirted with in a more hopeful era.

The Lower-High Saga: A Never-Ending Story of Selling Pressure

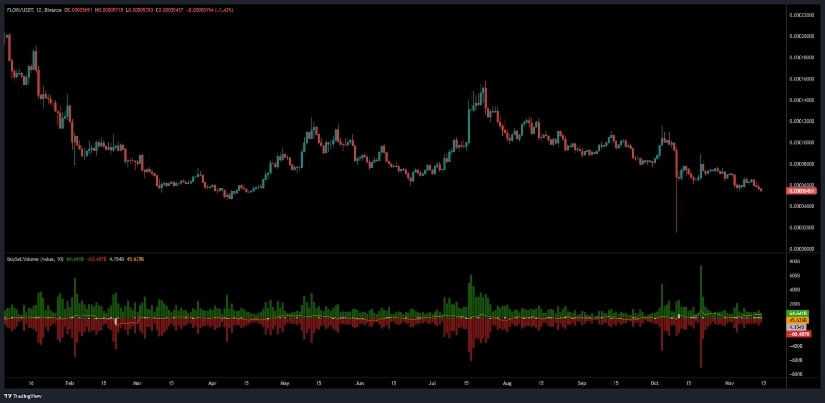

In the most recent analysis, which can only be described as a gripping tale of financial misfortune, FLOKI’s price continues to form lower highs and lows. This sequence, which began its tragic unfolding earlier in the year, illustrates a broader, undeniable downtrend. The daily chart stands as a testament to repeated, yet futile attempts at recovery. Mid-May, mid-July, and late October all witnessed the same pattern: a rally, a flicker of hope, followed by the crushing weight of sell pressure pushing the price back into its depressive spiral.

The open interest metrics, like the cold, heartless truth, only deepen the despair. They reveal that during upward movements, there was little to no buildup, while during declines, the market positioning grew ever stronger. In fact, recent price behavior reflects a similar story-a coin languishing near the lower boundary of its multi-month range, while candles grow ever smaller and momentum fades into oblivion. The utter lack of long positioning suggests buyers are reluctant, hanging back in trepidation, while the market remains locked in a defensive, reactive stance rather than one of bold accumulation.

The Lackluster Metrics: Weak Demand or Just Indifference?

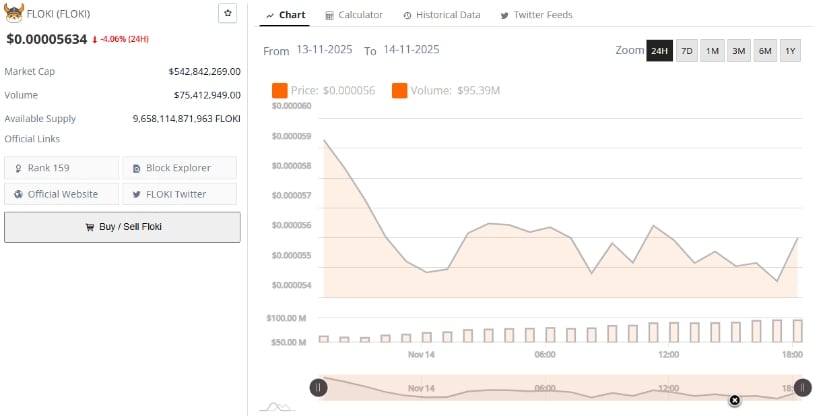

According to BraveNewCoin’s most recent update from November 14, 2025, FLOKI trades at a humble $0.00005634, marking a 4.06% decline in the past 24 hours-hardly a positive sign for the faint-hearted. Its market capitalization, a meager $542,842,269, is supported by a 24-hour trading volume of $75,412,949. The coin is floating in the middle of the meme-asset ocean, ranked #159. Alas, it occupies the mid-cap sector, where dreams of grandeur are perhaps better left unspoken.

The volume profile, a cruel reminder of the overwhelming sell-side activity, underscores the bleak reality. Even during those brief, short-lived rallies in July and late October, any semblance of buying pressure was so fleeting that it was insufficient to shift the market’s direction. The imbalance between buy and sell orders continues to haunt the asset, reflecting a market paralyzed by hesitation and an almost tragic lack of confidence. For any semblance of hope to emerge, observers suggest that a trend reversal would require sustained increases in buyer participation and, most importantly, a clean break above the recent lower-high resistance levels.

Bearish Momentum: The Technical Indicators Speak Truth to Power

TradingView’s latest data from November 14, 2025, paints a rather bleak picture. FLOKI/USDT lingers near $0.00005458, still under the crushing weight of the Bollinger Band at $0.00006451. Price movement is confined to the lower half of the bands, with support testing around $0.00005227, indicating that the selling pressure is far from relinquishing its hold. The narrowing bandwidth is a silent scream of reduced volatility, consistent with the dying breath of a downtrend.

Momentum indicators are unrelentingly negative. The MACD line, at a pathetic -0.00000483, and the signal line at -0.00000453, are both deep beneath the zero threshold, while the histogram shows an equally unimpressive -0.00000030. There’s no sign of life, no reversal on the horizon. The gradual narrowing of the histogram bars speaks of a market too weary to rally, resigned to its low-energy state, with no hope of a breakout anytime soon. It is as though the coin is content to hover in the void, accepting its fate.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-11-15 00:54