On a Friday wrinkled with indecision and rainclouds, the price of Chainlink, like an obstinate urban pigeon, meandered sideways with all the energy of a bureaucrat eyeing the clock before tea time. The oracles and technicals, who are usually wrong but always convinced, buzzed about an imminent “rebound.” Whether this means LINK will soar or just fall down drunk at the next crypto party is, as ever, a mystery fit for Dostoyevsky.

There it sat—$14.20. Not exactly peasantry, but far from nobility. Still, a respectable 45% rise since its shabbiest lows this year. Legends say even Chekhov’s short stories haven’t rebounded that well since publication.

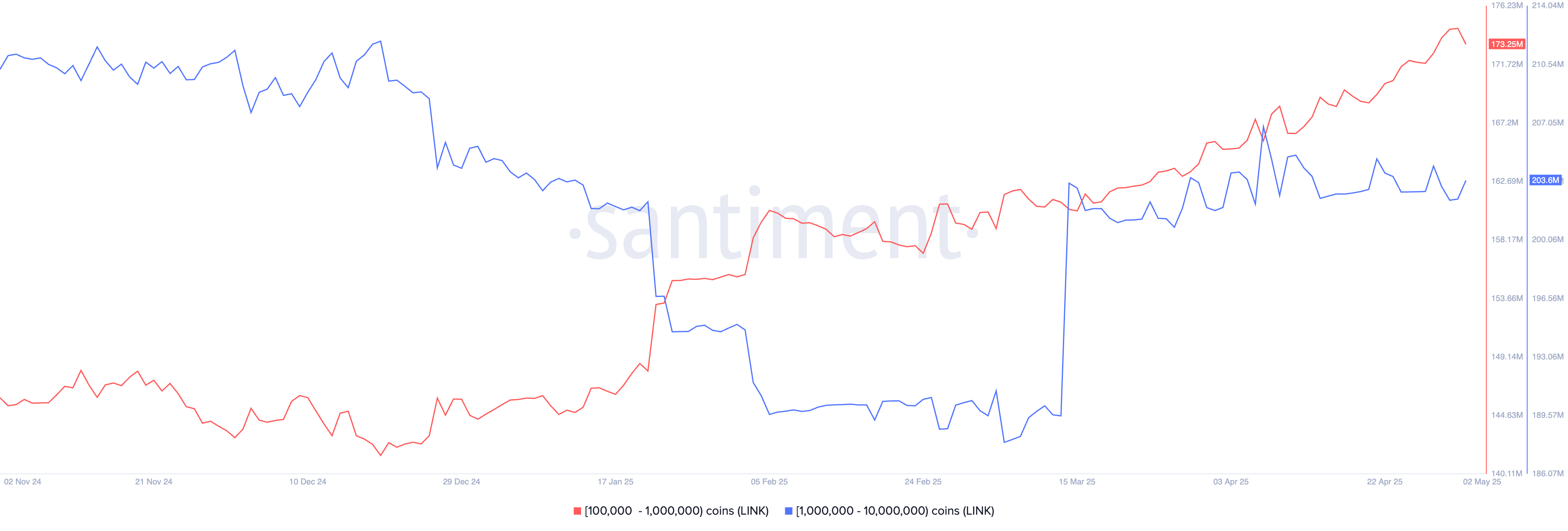

The whales, those silent, rotund lords of the blockchain, are at it again—accumulating LINK with the same fervor as provincial aunts hoarding jam for winter. According to the all-seeing Santiment, investors clutching between 100,000 and 1 million coins now embrace a monumental 173 million LINK, up from the 143 million they sullenly nursed last November before remembering that hope occasionally pays off. In three words: Whales got fatter. Current gain: 30 million coins, roughly $420 million—or as an oligarch might put it, lunch money.

As for the true behemoths, those with pockets deep enough for 1-10 million coins, they’ve padded their wallets to 203 million LINK, up from 183 million coins in February. Someone’s been reading Tolstoy—always room for another chapter, and apparently another LINK.

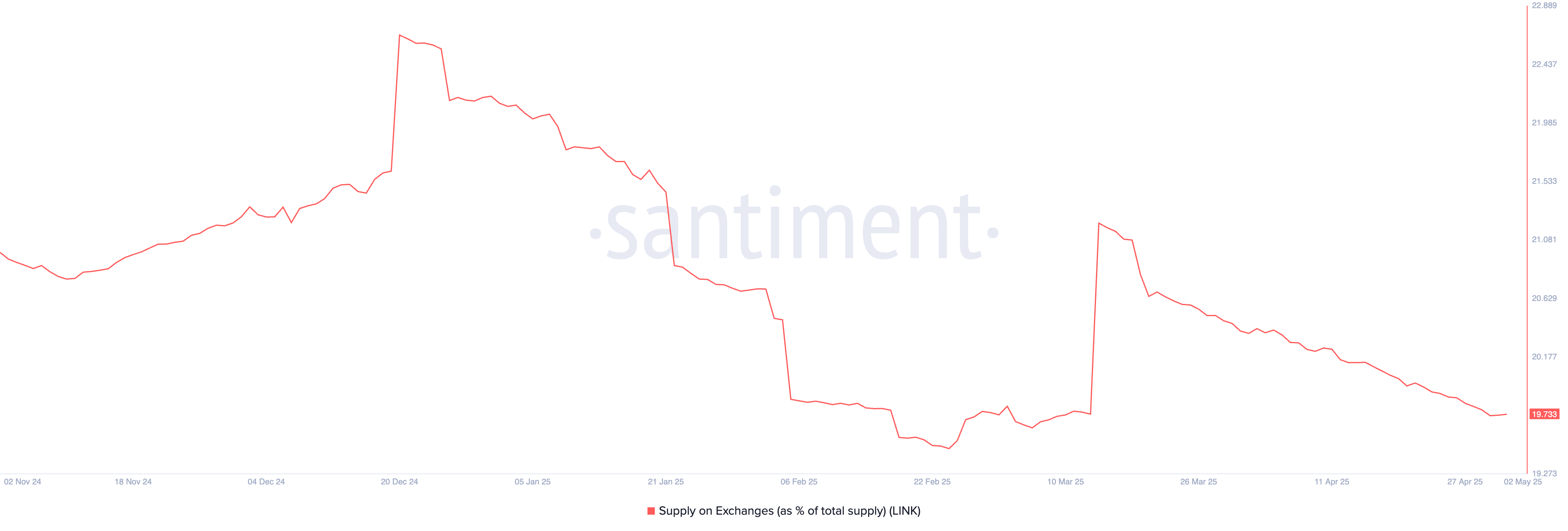

Elsewhere, in a twist worthy of a village gossip, LINK tokens quietly trickle out of exchanges. The percentage has dropped from 21% in March to just 19% now, their lowest since March 13—tokens fleeing public view like lovers at dawn. What does this mean? Holders clutch their coins closer, less inclined to sell—unless, of course, a bear sneezes and the whole market panics.

For the initiated, supply on exchanges only climbs when the masses prepare their tokens for liquidation. If life’s a drama, this is just the actors exiting stage left, making room for a new act.

Will Chainlink see its day in the sun? Perhaps, say the optimists. The ever-so-grand partnerships with institutions such as Swift and the Depository Trust & Clearing Corporation (DTCC) hang in the air like half-baked promises at a provincial wedding. DTCC, custodian of some $3.7 quadrillion (a number so large it should come with its own samovar), is entertaining thoughts of using Chainlink’s Cross-Chain Interoperability Protocol to modernize the tedious business of mutual fund data. Meanwhile, Swift, a giant that flicks $150 trillion around the globe as if it were pepper across borscht, muses on moving tokenized assets using Chainlink’s magic as well. Will this change the world? At least the PowerPoint slides will look fancier.

Chainlink price technical analysis

The 12-hour chart—beloved by technical analysts and ignored by everyone else—paints LINK as a plucky protagonist recently risen from the slough of $9.9720 to the more optimistic heights of $14. Above the 50-period moving average now, it flirts with technical indicators like an indecisive suitor at a provincial ball.

There’s talk of a “falling wedge pattern,” considered by some to be a bullish sign and by cynics to be just another pattern given a fancy name to sound impressive at bourgeois gatherings. Even the “inverse head and shoulders” makes a cameo. If the universe is feeling generous, LINK could rise to $20—about 30% above current levels—or perhaps it will just wander the market for a while, lost in thought, as Russians do best. 🤔🐳

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-05-02 20:51