It is a peculiar sensation, this momentary dip in the valuations of those entities we have collectively deemed…significant. A brief respite, perhaps, before the inevitable return to inflated self-regard. To speak of a “buying opportunity” feels almost…vulgar, as if one might actually benefit from the anxieties of others. Yet, here we are, forced to acknowledge the fleeting possibility of acquiring a fragment of the modern idol – at a slightly diminished price. Two such idols currently offer a semblance of…accessibility: Microsoft and Nvidia. Whether this accessibility represents genuine value, or merely a temporary delusion, remains to be seen. The market, after all, is rarely driven by reason, but by a far more capricious and unsettling force.

1. Microsoft

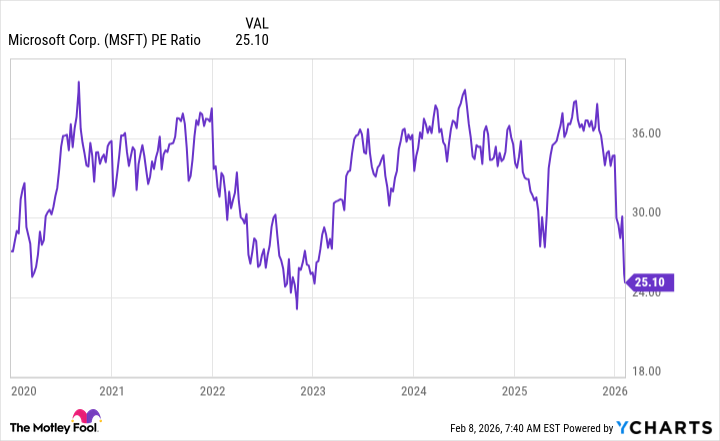

Microsoft. A name synonymous with ubiquity, with the quiet, pervasive control that comes from being embedded in the very fabric of modern existence. They are not innovators, not truly. They are…consolidators. They absorb, adapt, and ultimately, dominate. Their current flirtation with generative AI is less a leap of faith, and more a calculated maneuver to secure their existing dominion. They will not be disrupted; they will simply…incorporate the disruptors into their ever-expanding empire. It is a chillingly efficient process, and one that should give pause to any romantic notions of technological revolution. Their Azure platform, this cloud-borne behemoth, is not a tool for liberation, but a mechanism for control. It offers access, yes, but at a price – the price of dependence. The reported 39% revenue growth in Q2 FY 2026 is not a sign of vitality, but of insatiable appetite. The 17% revenue growth and 23% net income growth, obscured by the complexities of OpenAI investment, are merely symptoms of a larger, more unsettling phenomenon – the relentless pursuit of profit, regardless of consequence.

The market’s reaction – this sudden, irrational outburst of selling – is, of course, absurd. To punish a company for demonstrating competence is a testament to the profound illogicality of collective behavior. Yet, it presents a fleeting opportunity – a chance to acquire a piece of this sprawling, soulless entity at a slightly reduced cost. The valuation, returning to levels not seen since the 2023 sell-off, is still…optimistic, to say the least. But in a world devoid of genuine value, perhaps optimism is the most valuable commodity of all.

2. Nvidia

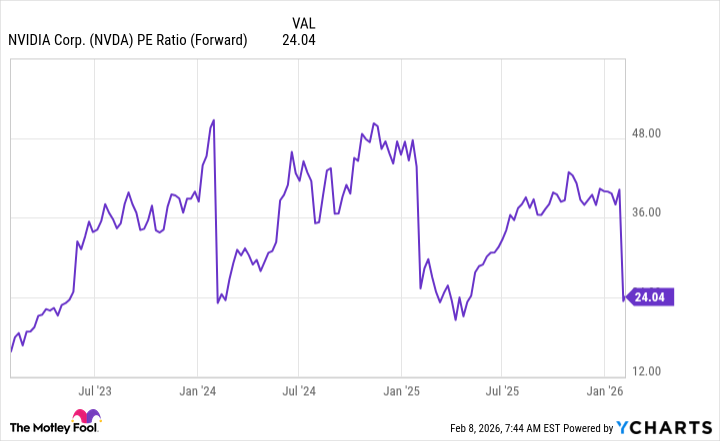

Nvidia. The purveyor of illusions. They do not create reality; they merely render it. Their graphics processing units, these shimmering engines of artificiality, are the tools with which we construct our digital fantasies. And now, these same tools are being harnessed for the creation of something…more. The hype surrounding AI, this feverish obsession with replicating intelligence, has bestowed upon Nvidia a position of unprecedented power. They are not merely a technology company; they are the architects of our future delusions. The 53% revenue growth expected for the next year is not a sign of innovation, but of addiction. We are not investing in technology; we are feeding a habit. The leadership position in this technological revolution is not a cause for celebration, but for profound unease. What happens when the illusions become indistinguishable from reality? What happens when we can no longer tell the difference between the genuine and the artificial?

The valuation – a mere 24 times forward earnings, slightly below the S&P 500 – is a cruel irony. To demand a premium for a company that is shaping the very fabric of our existence is, apparently, too much to ask. The market prefers mediocrity. It rewards conformity. It punishes those who dare to dream. But this small premium, this fleeting opportunity to acquire a piece of the illusion at a reasonable price, is not to be dismissed. If AI spending continues to rise, as so many predict, Nvidia will undoubtedly benefit. But at what cost? And for whose benefit?

The market rarely offers such opportunities. A chance to acquire Nvidia and Microsoft at a discount. A brief respite from the relentless pursuit of profit. But do not delude yourselves. This is not a gift. It is a test. A test of our faith in illusions. A test of our willingness to embrace the artificial. And whether we pass or fail, the outcome will be the same. We will be left to wander in a world of shadows, forever searching for a glimmer of truth in a sea of lies.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-12 21:23