For seven years past, the markets of Wall Street have known a season of plenty, a rising tide lifting most vessels. The Standard & Poor’s 500, that broad measure of American enterprise, has yielded returns of no less than sixteen percent in each of the three years recently concluded, and six in seven – a spectacle not wholly unfamiliar in the annals of commerce, yet one that breeds a certain complacency, a forgetting of the inevitable winter that follows summer. But such widespread prosperity obscures the fortunes of individual endeavors, and it is to one such – Fiverr International – that we turn our attention, a company whose recent history is a cautionary tale, a descent from favor marked by a ninety-five percent diminution of its share price since the high-water mark of February 2021.

The year 2026 dawns upon a market richly valued, perhaps excessively so, according to the Shiller Price-to-Earnings Ratio, which places it among the most expensive epochs in a history stretching back a century and a half. In such times, the discerning investor must adopt a posture of restraint, seeking out those enterprises overlooked or unjustly punished by the prevailing sentiment. I, myself, have lately found more occasion to relinquish holdings than to acquire them, a practice born not of pessimism, but of a sober assessment of value.

Yet, even amidst such caution, certain opportunities present themselves. Fiverr International, it seems to me, has reached a point where the potential reward outweighs the inherent risk, a confluence of circumstances that compels a re-evaluation, even in a market inclined to extravagance. To understand this, however, one must delve into the reasons for its decline, tracing the arc of its misfortune with a dispassionate eye.

The Winds of Fortune and the Shifting Sands of Labor

The pandemic, that great upheaval, served initially to benefit Fiverr. As the world retreated into isolation, the demand for remote labor swelled, and Fiverr, as a marketplace connecting those who sought work with those who offered it, flourished. But such prosperity was, in truth, a temporary aberration, a distortion of the natural order. As the immediate threat of the pandemic receded, a yearning for normalcy returned, and many companies, abandoning the experiment of remote work, summoned their employees back to the physical office. This, of course, diminished the opportunities available to freelancers on Fiverr’s platform.

Indeed, a decline in annual active buyers has become apparent. From a peak of 4.2 million in September 2022, the number has fallen to 3.3 million in the comparable quarter three years hence. This is not merely a statistical observation; it is a reflection of a deeper truth: that human nature is often resistant to change, and that the allure of the familiar – the shared office, the daily commute – remains strong, even in an age of technological innovation.

Furthermore, the specter of artificial intelligence looms large. The advent of generative AI and large language models threatens to automate tasks previously performed by freelancers, potentially eroding the demand for human labor. Fiverr’s recent decision to reduce its workforce by thirty percent, ostensibly to focus on AI integration, is a recognition of this existential threat, a desperate attempt to adapt to a rapidly changing landscape. One wonders, however, whether such measures are sufficient to counteract the forces at play, or merely a palliative to a deeper malaise.

Lastly, the company’s valuation, once exorbitant, has tempered. The triple-digit forward P/E ratio of the past is no longer present, yet the slowing rate of sales growth – from a range of 42% to 77% between 2018 and 2021 to a high-single-digit or low-double-digit percentage from 2022 through 2025 – raises questions about its long-term prospects. Is this a temporary lull, a consequence of broader economic headwinds, or a harbinger of a more fundamental decline?

A Bargain in a Time of Excess

Despite these challenges, I believe that the time to consider Fiverr International is now. The world has changed, and while some businesses are indeed summoning their employees back to the office, a decisive shift towards remote work has occurred. Prior to the pandemic, a mere seven percent of paid workdays were completed remotely. By 2025, that figure had quadrupled to twenty-eight percent. While down from the peak of 2020, this represents a permanent alteration in the fabric of work, a recognition that productivity is not necessarily tied to physical presence. Fiverr, therefore, is ideally positioned to capitalize on this new norm.

The company’s key performance indicators suggest a resilience that is not reflected in its share price. While the number of active buyers has declined by twenty-one percent over the last three years, annual spend per buyer has increased by twenty-six percent to $330. This indicates that the remaining businesses are more engaged, more committed to the platform. A smaller, more dedicated clientele is, in many ways, preferable to a large, fickle one.

Perhaps the most compelling aspect of Fiverr’s operating model is its marketplace take rate – the percentage of each transaction it retains. At 27.6% in the September-ended quarter, it consistently surpasses its competitors, commanding a sustained GAAP gross margin of over 80%. This is a testament to its ability to extract value from its platform, a reflection of its negotiating power.

Furthermore, Fiverr’s balance sheet is remarkably strong. It closed the third quarter with $712.5 million in cash, cash equivalents, and marketable securities, compared to $459.8 million in convertible debt. This $252.7 million net cash position represents nearly 44% of its market capitalization. A company with such a robust financial foundation is well-equipped to weather any storm.

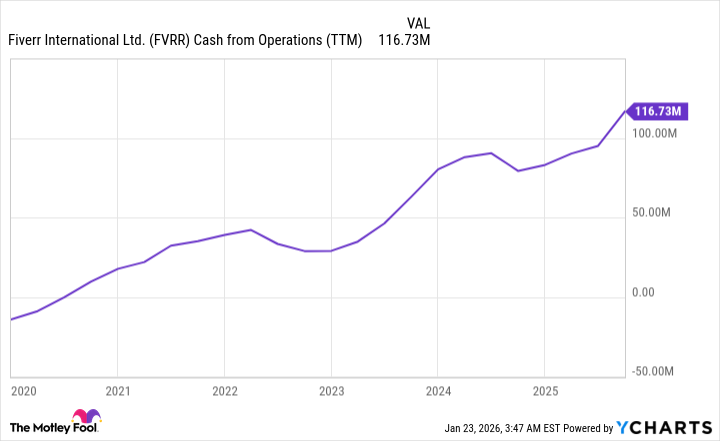

Its cash flow has also been climbing steadily for years. It is capable of generating $100 million or more in net cash from operations annually. If this continues, Fiverr could have more net cash on its balance sheet than its current market cap by early 2029. Such a scenario would be unprecedented, a testament to its financial discipline.

Finally, its valuation is historically cheap. Based on adjusted earnings per share, it can be acquired for a forward P/E of just 5.5. Even using GAAP EPS, its forward P/E of 13.5 is low. If its net cash is factored in, the effective P/E falls to less than 8 times. This is a rare opportunity, a chance to acquire a recurringly profitable company at a bargain price.

Fiverr International may never be this cheap again. It is a company facing challenges, to be sure, but also one with significant potential. It is a bargain in a time of excess, a beacon of value in a market prone to speculation. And it is, therefore, worthy of consideration.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Best Video Games Based On Tabletop Games

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

2026-01-26 13:12