The currents shift, as they always do. One observes the steady drift of capital, the slow yielding of old forms to the new. Fintech, no longer a nascent thing, has become a quiet bloom in the landscape of finance, a subtle unfolding rather than a sudden burst. It is not merely the technology itself, but the way it has woven itself into the fabric of our daily lives, a silent partner in the exchange of value. One sees the potential, a vastness that is often obscured by the immediate clamor of the market.

SoFi Technologies

The habit of banking, once a pilgrimage to marbled halls, has retreated within the walls of the hand. It is a curious thing, this intimacy we now share with our accounts. One remembers a time when a loan officer knew your face, your story. Now, it is algorithms and interfaces. And yet, the comfort, the convenience… it is undeniable. The American Banker’s Association speaks of percentages, of mobile apps and dwindling branch visits. But behind those numbers lies a deeper truth: a surrender to the digital tide. SoFi, born into this current, has not so much ridden the wave as become the wave, an institution sculpted by the very forces it seeks to serve. From a humble beginning, refining student debt, it has grown, a slow accretion of users – from a mere 704,000 to over 12.6 million. A quiet expansion, mirroring the slow growth of a forest. Still, a fraction of the potential, a seed in a vast field. Most customers, clinging to the familiar, maintain only a single thread to this digital bank.

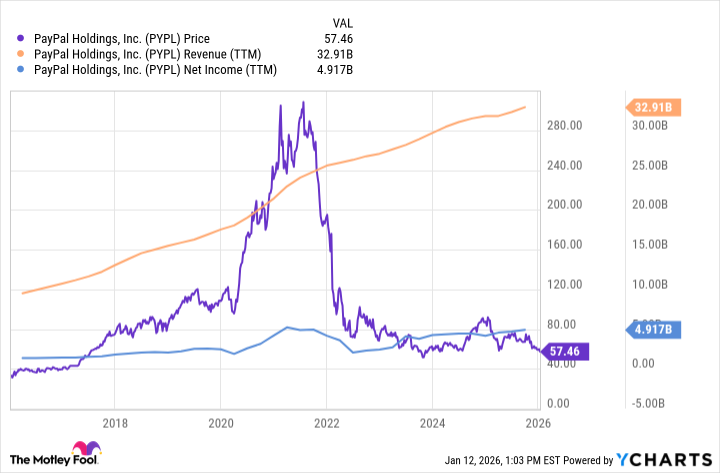

PayPal

PayPal. A name that once evoked the promise of frictionless commerce. The market, that fickle judge, has been…unsettled. It sees shadows where none exist, or perhaps, anticipates storms that never break. The stock’s performance, a troubled trajectory since 2021, tells a story of doubt, of a pandemic-fueled boom receding. But the numbers whisper a different tale. Revenue continues to climb, approaching record levels. Profit, though momentarily obscured, is on the verge of resurgence. It is as if the market, captivated by its own anxieties, fails to see the forest for the trees. Cryptocurrencies, the rise of competitors like Block and Stripe, the pressure from traditional banks… these are merely the surface disturbances of a deeper current. PayPal remains a dominant force, holding nearly half of the global online payment sphere. The analyst community, those seers of the financial world, predict years of unbroken growth, a steady ascent toward $41 billion in revenue by 2028. A slow unfolding, a gradual revealing of potential. The shares, currently undervalued, offer a glimpse of the bounty to come, a promise whispered on the wind.

Upstart

Upstart. A name less familiar, yet no less significant. It operates in the shadows, refining the very mechanism of credit. The old guard – Equifax, TransUnion – have long held sway, relying on established methods. But Upstart approaches the problem anew, employing the tools of artificial intelligence. It is not merely an improvement, but a reimagining. A platform that approves 43% more loans without increasing risk. A system that automates the process, reducing costs and increasing efficiency. More than 100 banks and credit unions have embraced this new approach, recognizing its potential. The stock’s journey has been turbulent, a reflection of the inherent uncertainty of the market. It soared during the pandemic, then tumbled as economic headwinds gathered. But this volatility is not a flaw, but a feature. The algorithm, sensing the changing currents, adjusted its approach, protecting lenders from potential losses. It is a system designed to adapt, to endure. Through the first three quarters of last year, the number of loans processed doubled, while conversion rates improved. A quiet revolution, unfolding beneath the surface. The market, slow to recognize the shift, will eventually catch up, and the true value of Upstart will be revealed.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-01-15 14:55