At the end of July, the Guild of Alchemists and Venture Capitalists (better known as Figma) cast a spell of 41% revenue growth, a feat that would make even the most seasoned scribe of the Unseen University of Coders raise an eyebrow. Yet, the stock, which had been soaring like a dragon on a caffeine rush, plummeted 15% after its first quarterly report. A curious turn of events, one might say, akin to a wizard’s wand misfiring during a critical incantation.

Investors, ever the fickle lot, have fled the scene, their pockets lighter than a beggar’s satchel. The reason? A slowdown in Figma’s growth rate, a phenomenon as alarming as a goblin discovering it’s been eating the same meal for a week.

In Q2 2025, Figma reported revenue of $250 million, a 41% leap that would make the Guild of Alchemists proud. Yet, for all its gilded promises, the company also turned a profit of $28 million-a rarity in the realm of cash-burning software ventures. A refreshing sight, if you’ll pardon the pun.

But the stock’s descent is a tale of two numbers: the 41% growth, and the 33% projected for Q3. A drop so steep, it could make a mountain look like a molehill. Investors, ever the cautious sorts, are now whispering tales of woe, their faith in Figma’s magic waning like a candle in a storm.

Why the Slowdown Stings

Figma’s software, a tool for crafting digital realms, is used by giants like Netflix and Duolingo. Yet, the specter of generative AI looms like a shadow, threatening to render Figma’s spells obsolete. After all, why pay for a wizard’s services when a mere algorithm can conjure the same results for a fraction of the cost?

Despite fears of competition, Figma’s growth remained as steadfast as a troll in a fortress. In 2024, revenue surged 48%, and in Q1 2025, 46%. These figures are the stuff of legend, yet the current 41% growth feels like a fading echo of past glories.

The management’s guidance for Q3-33% growth-has investors clutching their pearls. And if the full-year forecast is to be believed, Q4’s growth may dip to a mere 30%. A decline so steep, it could make a dragon’s tail feel the chill of winter.

The cause of this slowdown remains as enigmatic as a riddle posed by a sphinx. Competitive pressures? Market fatigue? Or perhaps the Guild of Alchemists simply ran out of spells? Whatever the case, investors, already nervous as a cat in a room full of rocking chairs, have taken the smallest nudge to flee.

The Kicker for Figma Stock

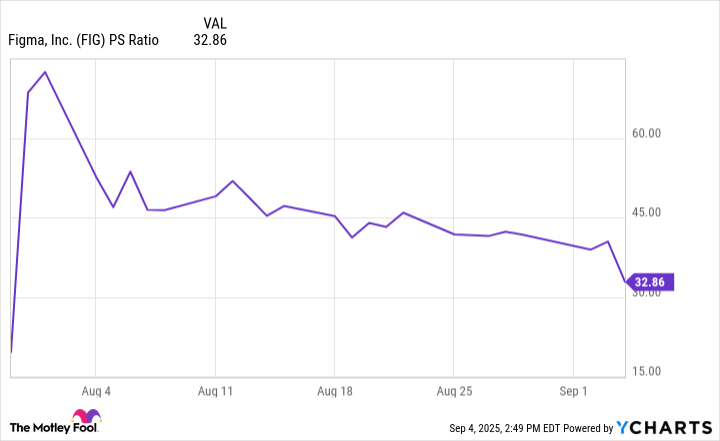

At the time of this writing, Figma’s stock has fallen over 50% from its peak, yet it still trades at a valuation of 30 times sales. A price so lofty, it could make a sky pirate weep. The chart below, a map of the company’s fortunes, shows a path as winding as a goblin’s trail.

Even if valued based on 2025 projections, Figma’s stock still commands 27 times sales. A figure that would make the Guild of Alchemists blush, given that software stocks typically trade between 10 and 20 times sales. Yet, Figma’s growth is slowing, leaving investors to ponder how long this deceleration will persist-and whether the valuation is a mirage or a genuine treasure.

Some may wonder why Figma’s valuation reached such heights. The answer lies in the IPO’s imbalance: 487 million shares outstanding, yet only 37 million available for purchase. A scarcity so profound, it could rival the rarity of a unicorn’s smile.

After years of dry IPO markets, investors, like thirsty travelers in a desert, seized any opportunity. Figma’s stock, once priced at $33, now stands 60% higher. A lesson, perhaps, in the folly of chasing the next big thing.

Seasoned investors, ever the cautious sorts, know to wait. IPOs, like enchanted potions, can be volatile. A lesson in patience, if nothing else.

What Now for Figma Shareholders?

One hopes that Figma’s shareholders are long-term visionaries, their eyes set on the horizon. Even the mightiest of companies face periods of stagnation. Stocks, like rivers, can swell and recede before finding their course.

Figma’s management vows to create value through “big swings,” a phrase that could mean anything from acquisitions to investments in cryptocurrency. A future as uncertain as a wizard’s spell, yet one that demands patience. After all, the Guild of Alchemists has only been public for a month-time enough to cast a few spells, but not enough to see their full power.

Personally, I’d rather invest in a growing market than a company’s vague promises. Figma, for all its magic, didn’t quite fit the bill. But then again, the market is a fickle beast, and its whims are as unpredictable as a goblin’s grin.

While concerns linger, it’s premature to write off Figma. After all, even the most brilliant wizards face setbacks. And who knows? Perhaps the next spell will be the one that turns lead into gold.

🪄

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-05 14:56