Behold the tempest of modern finance, where the embers of innovation flicker against the abyss of doubt. Figma, that ephemeral alchemist of digital design, has drawn the gaze of countless seekers, each yearning to transmute their meager coins into gold. Yet, as the sun sets on its IPO, the shadows stretch long, whispering of both promise and peril.

What is this Figma, you ask? A mere tool, some might say-a digital quill for the hands of the uninitiated. But in its simplicity lies a paradox: a platform that transforms the abstract into the tangible, the chaotic into the ordered. Yet, like all things born of human ingenuity, it is both a marvel and a mirage, a testament to our ceaseless hunger for connection and control.

And yet, the market, that fickle mistress, has turned her face away. The stock, once a beacon, now flickers like a candle in a storm. The quarterly reports, though robust, have failed to soothe the restless spirits of investors. What is this but a reflection of our own mortal condition-our yearning for permanence in a world of flux?

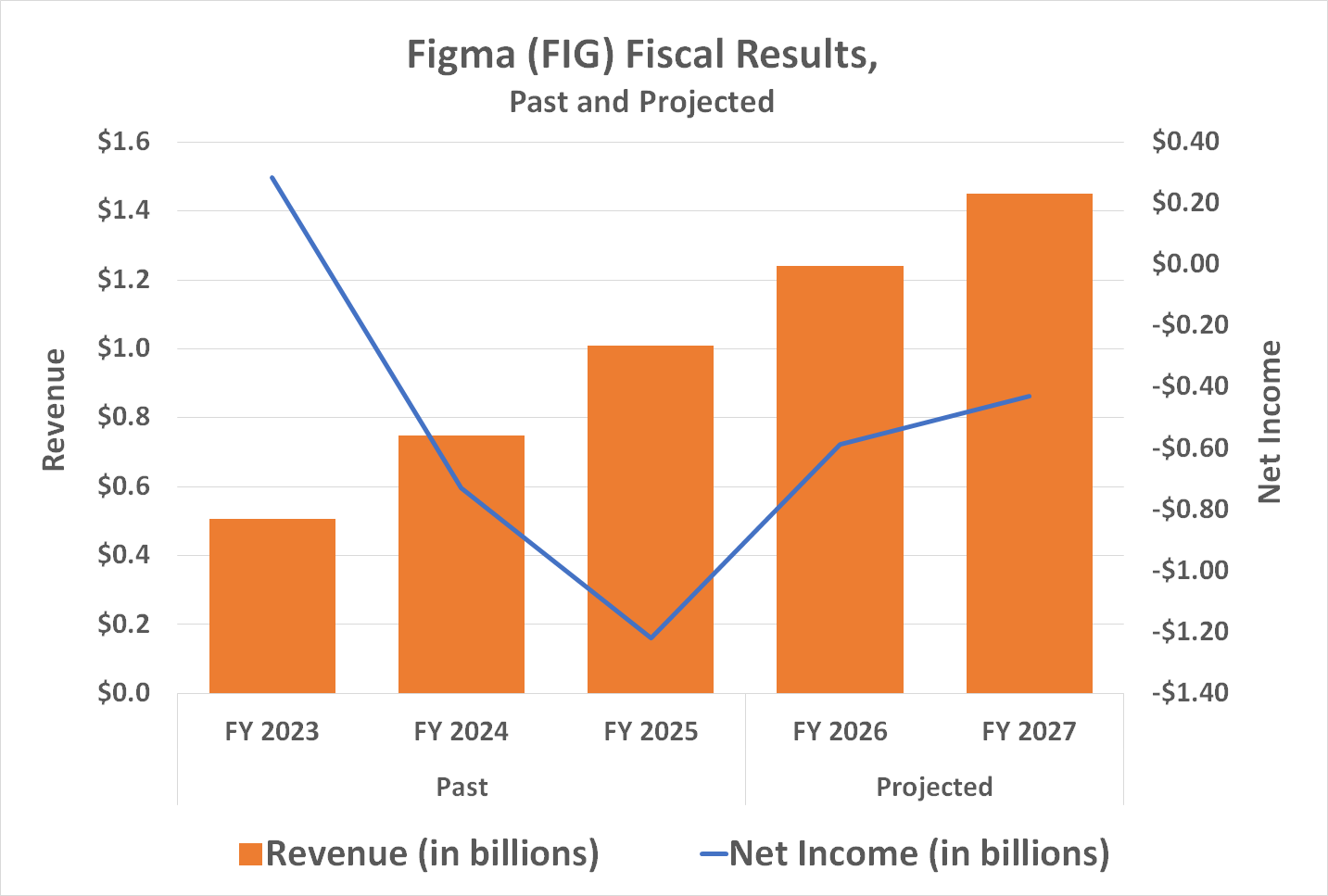

Let us not mistake this for mere folly. The numbers are there: a 41% surge in revenue, a testament to the growing hunger for digital collaboration. Yet, as the sage of Yalta once mused, “The more things change, the more they remain the same.” The same forces that once toppled giants now loom over this fledgling titan. For every investor who sees a future of boundless growth, another perceives the specter of obsolescence.

Consider the tale of Meta, once the darling of the digital age, now a shadow of its former self. Or Snap, that once-bright star now lost in the void. These are not mere anecdotes but parables, etched into the annals of financial history. Figma, too, may find itself ensnared in this cycle, its fate hanging by a thread of perception.

But what of the true danger? Not the stock’s valuation, nor the whispers of competitors, but the absence of a moat-a fortress to guard against the encroaching tide. In a world where ideas are as fleeting as the wind, Figma’s greatest vulnerability is its very simplicity. A single stroke of a rival’s brush could render its masterpiece obsolete.

And so, the question lingers: Can a mere $10,000, that paltry sum in the grand tapestry of wealth, become a million? Perhaps. But let us not be deceived by the siren song of easy riches. The path is fraught with peril, a labyrinth where hope and despair dance in equal measure.

In the end, the investor must ask not only what Figma is, but what it represents. A symbol of progress? A cautionary tale? Or merely a fleeting moment in the eternal dance of capital and ambition? The answer, like the market itself, remains elusive.

Yet, as the old adage warns, “He who hesitates is lost.” The choice, as ever, lies with the investor-whether to chase the mirage or seek the substance. And in that choice, we glimpse the eternal struggle of mankind: to grasp the infinite with finite hands.

But let us not forget the lesson of history: even the mightiest empires crumble, and the humblest seeds may yet grow into forests. Whether Figma’s tale is one of triumph or tragedy remains to be seen. One thing is certain-the market, like life itself, is a tale of both wonder and woe.

And so, the investor stands at the crossroads, a solitary figure in the vast expanse of uncertainty. With a final glance at the horizon, they take their step, driven by the eternal promise of fortune-or the quiet resignation of failure.

🧠

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-09 05:22