Conventional investment wisdom often bypasses the automotive sector, citing cyclicality, capital intensity, and margin compression. While generally sound, this dismissal overlooks a niche within the industry exhibiting characteristics diverging from the norm. Ferrari N.V. (RACE) presents a case study in brand resilience and pricing power, warranting a reassessment of established automotive investment theses.

Disproportionate Margin Profile

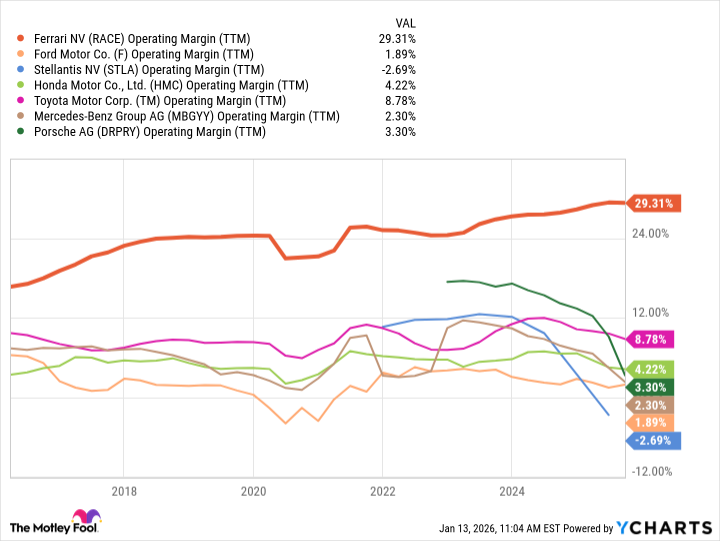

Ferrari’s operating margins consistently exceed those of its peers, a phenomenon attributable not merely to brand prestige, but to deliberate supply management. The company actively restricts production, maintaining an imbalance between demand and available units. This strategy, while seemingly counterintuitive, reinforces exclusivity and mitigates the need for price discounting—a common affliction within the broader automotive landscape. The introduction of technologically advanced features, often originating from Formula 1 development, further justifies premium pricing. This is not simply a matter of marketing; it is a function of demonstrable product differentiation.

The graphical representation confirms a sustained divergence in profitability. While industry averages fluctuate in response to macroeconomic pressures and competitive dynamics, Ferrari’s margins exhibit a persistent upward trajectory, suggesting a durable competitive advantage. The company’s ability to effectively monetize its brand equity remains a key determinant of future performance.

The forthcoming F80 model, priced at approximately $4 million, is already fully allocated, demonstrating the strength of demand and the efficacy of the company’s pricing strategy. This level of pre-sale commitment reduces execution risk and provides a degree of earnings visibility uncommon in the capital-intensive automotive sector.

Navigating the Electric Vehicle Transition

The automotive industry is undergoing a structural shift towards electrification, demanding significant capital allocation and posing challenges to established manufacturers. Ferrari, however, benefits from a degree of flexibility not afforded to volume producers. The company is not compelled to rapidly transition its entire product line to electric powertrains, allowing it to carefully assess market demand and technological advancements.

Current sales data indicates a measured approach to electrification, with hybrid models comprising 43% of shipments in the most recent quarter. This pragmatic strategy contrasts with the aggressive, and increasingly costly, pursuit of full electrification undertaken by some competitors. The recent $19.5 billion charge incurred by Ford Motor Company serves as a cautionary tale, highlighting the financial risks associated with premature technological adoption.

While a fully electric Ferrari remains under development, the company’s initial focus on hybrid technology allows it to refine its engineering expertise and gauge consumer acceptance without incurring the substantial capital expenditures associated with a complete powertrain overhaul. This phased approach mitigates risk and positions Ferrari to capitalize on emerging opportunities in the electric vehicle market.

In conclusion, Ferrari presents a unique investment proposition within the automotive sector. The company’s deliberate supply management, sustained margin profile, and measured approach to electrification differentiate it from its peers. While valuation multiples remain elevated, the company’s durable competitive advantages and earnings visibility warrant consideration by investors seeking exposure to the luxury goods market.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2026-01-18 07:42